VanEck’s Russel Chesler explains why Australian ETFs have remained popular, despite ongoing share market volatility.

After a strong start to the year with a record January, things quickly took a turn for the worse in what will be remembered as one of the most volatile six month periods in history.

However, the Australian ETF industry remained resilient as investors turned to exchange-traded products (ETPs) to end the first half of 2020 with record inflows.

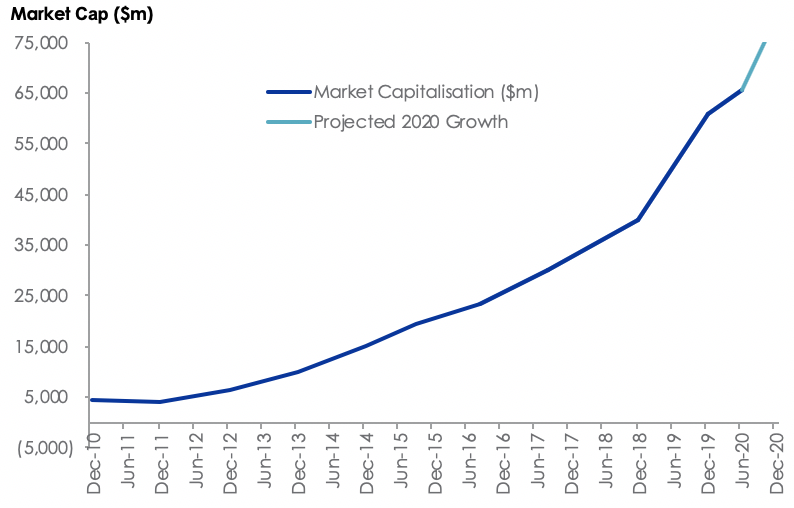

Industry size

Despite record numbers, the ETP industry grew at a relatively subdued rate of ~6% due to decline in asset values, ending the half-year at $65.6 billion, slightly below the all-time high $66 billion achieved at the end of January. In absolute terms, the industry grew ~$4 billion, which can be entirely attributed to net inflows.

The industry saw net new money of $8.2 billion to the end of June, which is an increase of 90% compared to pcp and an increase of 300% compared to the first half of 2018.

Product launches

After a relatively quiet first quarter with only three new product launches, the half-year ended with nine product launches in total.

Notably, there were two ETF issuers that exited the market as UBS converted six of their products in May and Pinnacle liquidated their two aShares products in June. There are now 212 ETPs listed across 23 issuers in an increasingly competitive industry.

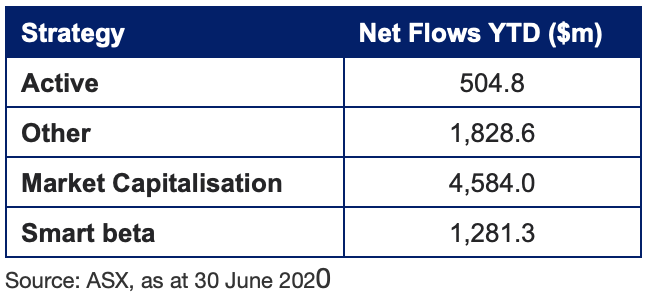

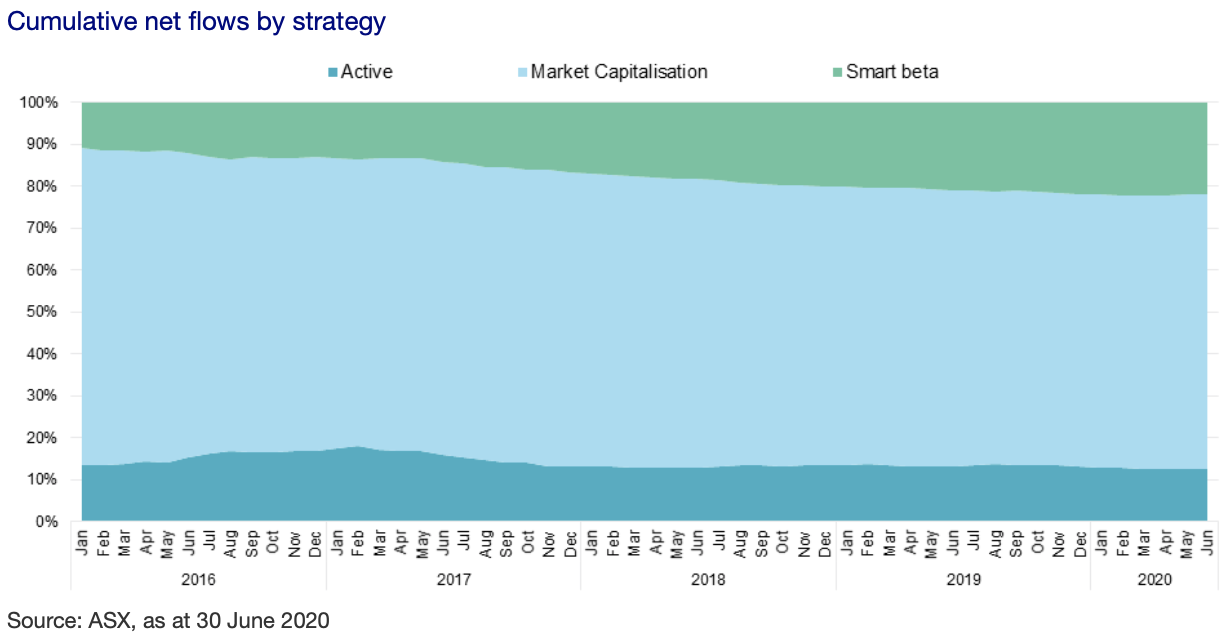

Flows by strategy type

Market capitalisation products continue to take the lion’s share of flows, making up 56% of net flows for the first half as smart beta products and gold/leverage and inverse products received 16% and 22% of industry flows respectively.

Smart beta products continue to be the fastest-growing strategy type in the Australian ETP industry, growing their market share by 32%, 42% and 48% over one, two and three years respectively.

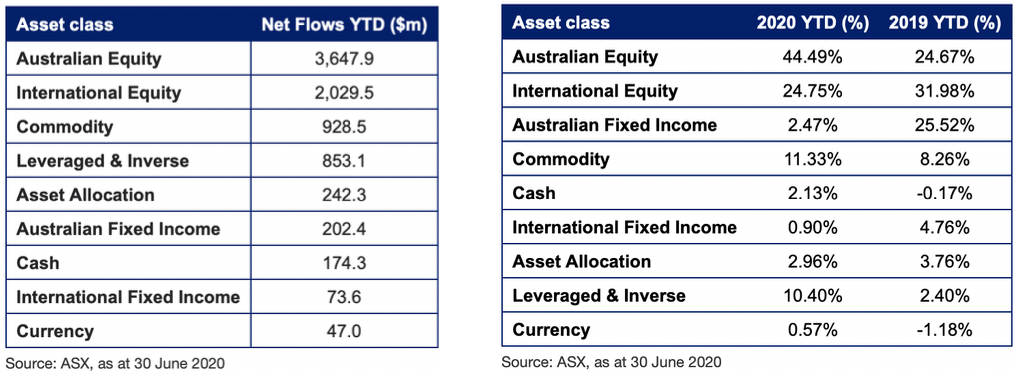

Flows by asset class

The first half of the year saw a complete overhaul of the asset class flows composition compared to 2019.

Some notable observations from the above charts include:

- Equity made up almost 70% of the total net flows, with Australian equity in particular more than doubling its market share and over 1.5x the flows of the next largest asset class, international equities.

- Conversely, fixed-income saw a sharp decline from 30% of the market share in 2019 to 3% after recording net outflows from February to June.

- There was also significantly more flows going into leveraged & inverse and gold bullion products, increasing by 660% and 141% respectively.

This report was written by Russel Chesler, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.