It’s fair to say 2020 has been a bloody tough slog for Aussies everywhere. I hope you and your family are well.

Unfortunately, as much as ScoMo wants us to believe he’s taking care of business and you should take what you can get, I reckon Randy Bachman would prefer me to say, baby, you ain’t seen nothin’ yet.

I reckon, this economic shock, many of us just ain’t gonna forget…

Polar opposites

Over in the stock market, despite the true unemployment rate possibly bubbling high in the double-digits, the market’s returns have been mixed. Some stocks are near all-time highs and others are taking a bath.

That’s why, when I look around, 2020 has so far been a tale of two investors who have had polar opposite outcomes:

1. David Dividend.

He’s an investor in yesterday’s blue chips like Westpac Banking Corp (ASX: WBC), ANZ Banking Group (ASX: ANZ) and Insurance Australia Group Ltd (ASX: IAG).

David’s had a horrendous year with nearly all of his slow-growth dividend stocks “deferring” (cutting) their dividends, reporting materially lower profits… you name it.

I’ve heard stories of wealthy investors going from $150k+ per year in fully franked dividends to under $50k in the space of six months.

2. Gabbie Growth.

Gabbie is a long term investor, so she’s been investing in the ASX’s best growth stocks, trying to find tomorrow’s dividend payers.

She realised years ago that the world was headed towards zero interest rates and the likely place to turn to for growth was shares. She bought shares of innovative companies like Pushpay Holdings Ltd (ASX: PPH), Temple & Webster Group Ltd (ASX: TPW) or even Amazon (NASDAQ: AMZN).

She’s crushed it.

Going South

David isn’t alone. I’d bet tens of thousands of income-seeking shareholders have been left speechless by dividend cuts/deferrals or cancellations from companies such as National Australia Bank Ltd (ASX: NAB), Flight Centre Travel Group Ltd (ASX: FLT), Bank of Queensland (ASX: BOQ), IAG… the list goes on.

Going forward the important questions for David to ask himself now isn’t ‘if’ the dividends will come back (I think they will), but:

- When will the dividends come back, and

- Will the dividend payments be as generous as they were last year?

At Rask, we’re led to believe the bank regulator APRA has told the banks to cut their dividends by 50% for the rest of 2020. So, I wouldn’t expect another decent dividend for at least the next six months.

If you ask me, however, the banks (and most blue chips) have been waiting for the next market crash to put an end to their excessive dividend payments because they’ve been taking too much away from their growth.

Put simply, paying such high dividends, they don’t have enough left in the tank to fuel growth.

Together with the economic shock, that’s why I suspect it’ll take at least a few years for many of the ASX’s ‘usual suspects’ to pay the same level of dividends again. Some might never.

North Star

How about Gabbie, the growth investor? How’s her outlook in 2020?

Pretty darn good.

She bought a combination of growing smaller companies, new-age businesses and, most likely, exchange-traded funds (ETFs) to provide a low-cost dividend income exposure.

Basically, she’s done exactly what we’ve been telling our long-term investors to do for years!

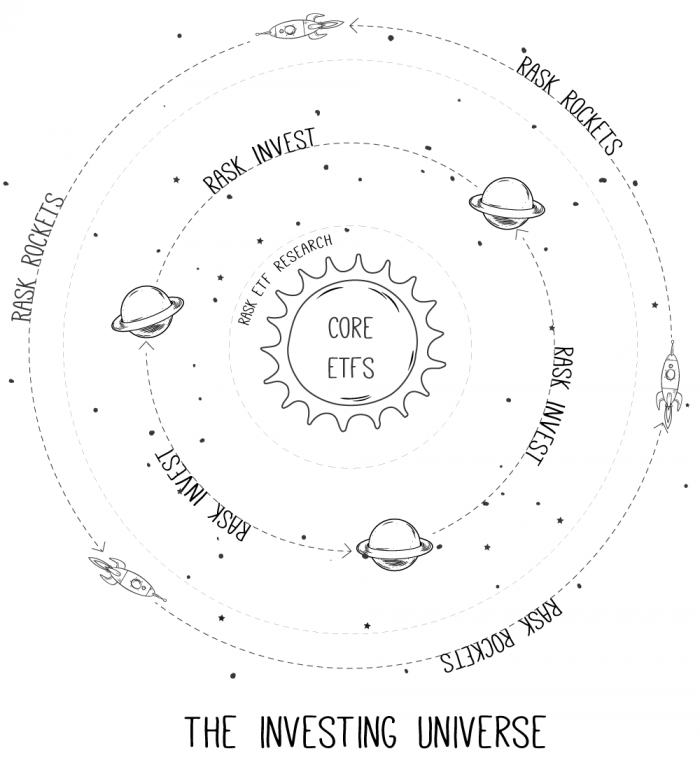

Starting at the centre of the universe.

For longer than I care to admit, we’ve been telling income-seeking investors to avoid picking yesterday’s dividend stocks and instead focus on using diversified ETFs to get your core income exposure to markets (see above).

Why?

Despite the obvious trouble many blue chips are experiencing with their dividend payments, the ASX’s good low-cost and diversified share ETFs will still pay some amount of dividends to investors this year — because they aren’t reliant on one company’s balance sheet.

With just a handful of good ETFs (we’ve identified 9 of our favourite for the Rask ETF service) I believe an investor can then move on to adding individual positions to their portfolio. Positions which could be capable of much more growth.

In my portfolio, these positions are typically fast-growing companies which are very capable of paying dividends but usually choose not to because they are growing so fast.

For example, the return on invested capital (ROIC) and marginal ROIC are probably two of the most important ratios for any long-term investor to understand. The ROIC will help you determine the opportunity available to a company and if management are making good capital allocation decisions. The ROIC measures in percentage terms how much a company makes for every $1 it invests.

All it really boils down to is this:

The reason the stock market works wonders for long-term investors is good companies will achieve an ROIC that is much higher than individuals. Great companies can achieve an ROIC of over 30%, 40% or even 50% per year.

Meaning, a great company can invest $1 today and get 30, 40 or 50 cents back in the first year. Sometimes more.

Don’t believe me?

According to Morningstar data, Lovisa Holdings Ltd (ASX: LOV), one of the ASX’s fastest-growing retail companies on the ASX (pre-COVID), was able to achieve an ROIC over 100% in 2017 as it rolled out new stores that, in some cases, paid themselves back in the first year.

Ask yourself this: where can I potentially achieve returns over just 10% per year?

I think it’s clear that the reason investing in companies — over the long run — works is because good businesses make better returns than a bank account, a bond and property.

The thing is, most people can’t see the potentially fierce compounding clearly because stock prices are not a true reflection of a business in the short run. Yet that’s what everyone focuses on.

Meaning, between you and the high ROIC on offer inside these companies like Lovisa, is a cauldron of investor psychology and uncertainty.

Understanding the difference between noise (stock price) and fundamental performance (valuation) is difficult for most new or inexperienced investors to understand because they can’t see the forest from the trees.

How to unlock the stock market’s true potential in 2020

If I look around, I can see term deposit interest rates near zero, a shaky (and heavily indebted) property market, precarious bond yields (especially when compared to duration) and an uncertain dividend environment for blue-chip stocks.

It’s not pretty.

However, if I look further afield. At least 5 years out. I believe investing in tomorrow’s great companies and entrepreneurs will still work. Therefore, in my opinion, using the share market to get a small, part-ownership of growing businesses will still be the best place to park extra capital.

For the last few months (and years), my focus in Australia has been fixed firmly on growth companies, especially those at the smaller end of the market.

While we’re not yet willing to shout our track record from the rooftops (it hasn’t been long enough), I’m very pleased that our results have begun to speak for themselves. In some cases, many times over.