VanEck’s Russel Chesler explains the headwinds facing ASX bank shares and what this means for Aussie investors.

Earlier this month, KPMG issued a report, The new reality for bank profitability, which highlighted the serious profitability and growth challenges Australian banks are facing in the aftermath of COVID-19.

As a result of the record low rates and squeeze on net interest margins (NIMs), banks face pressure to manage costs and increase productivity. With the RBA unlikely to raise rates in the short term, banks will continue to face ongoing structural headwinds.

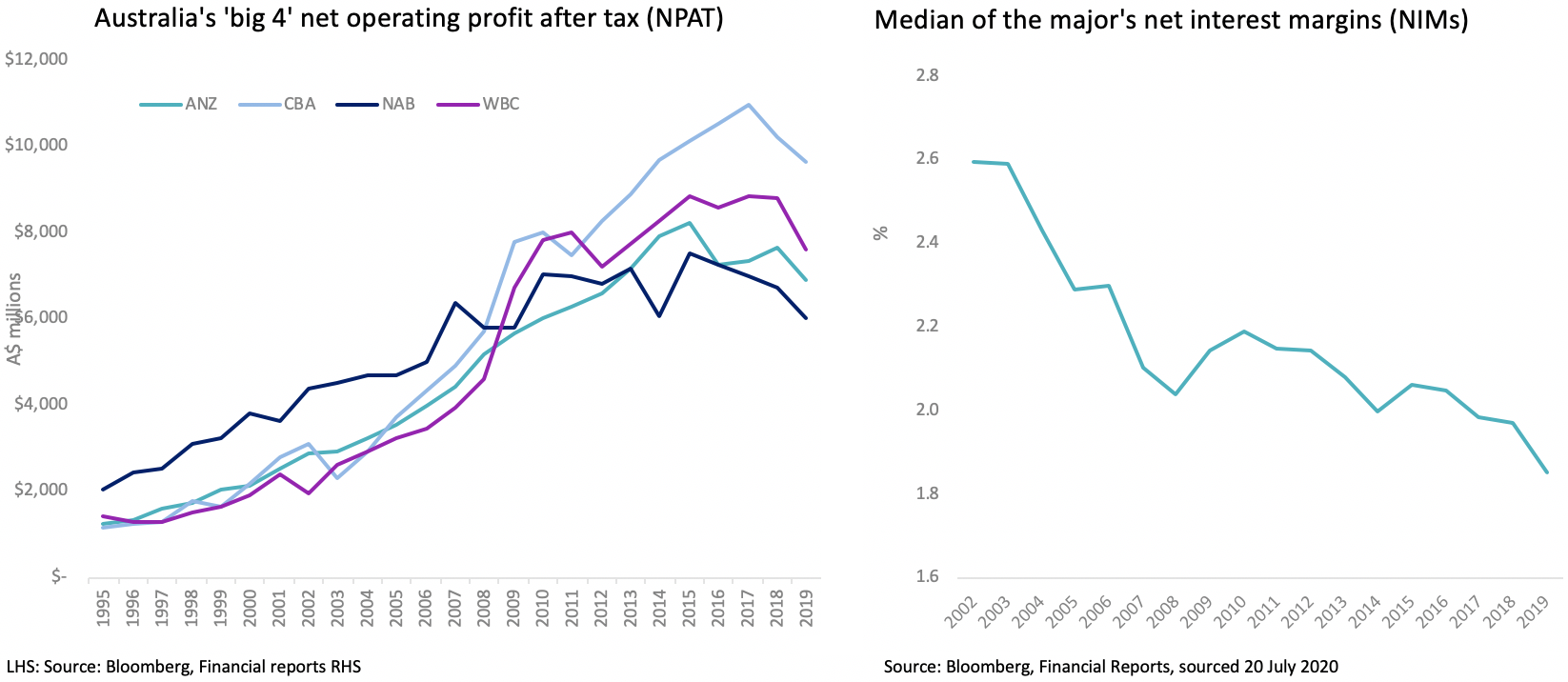

Since Australia’s “recession we had to have” in 1994, Australian banks have benefited from a growing economy in which home loan lending and credit growth thrived. This growth drove the banks’ profits to record levels.

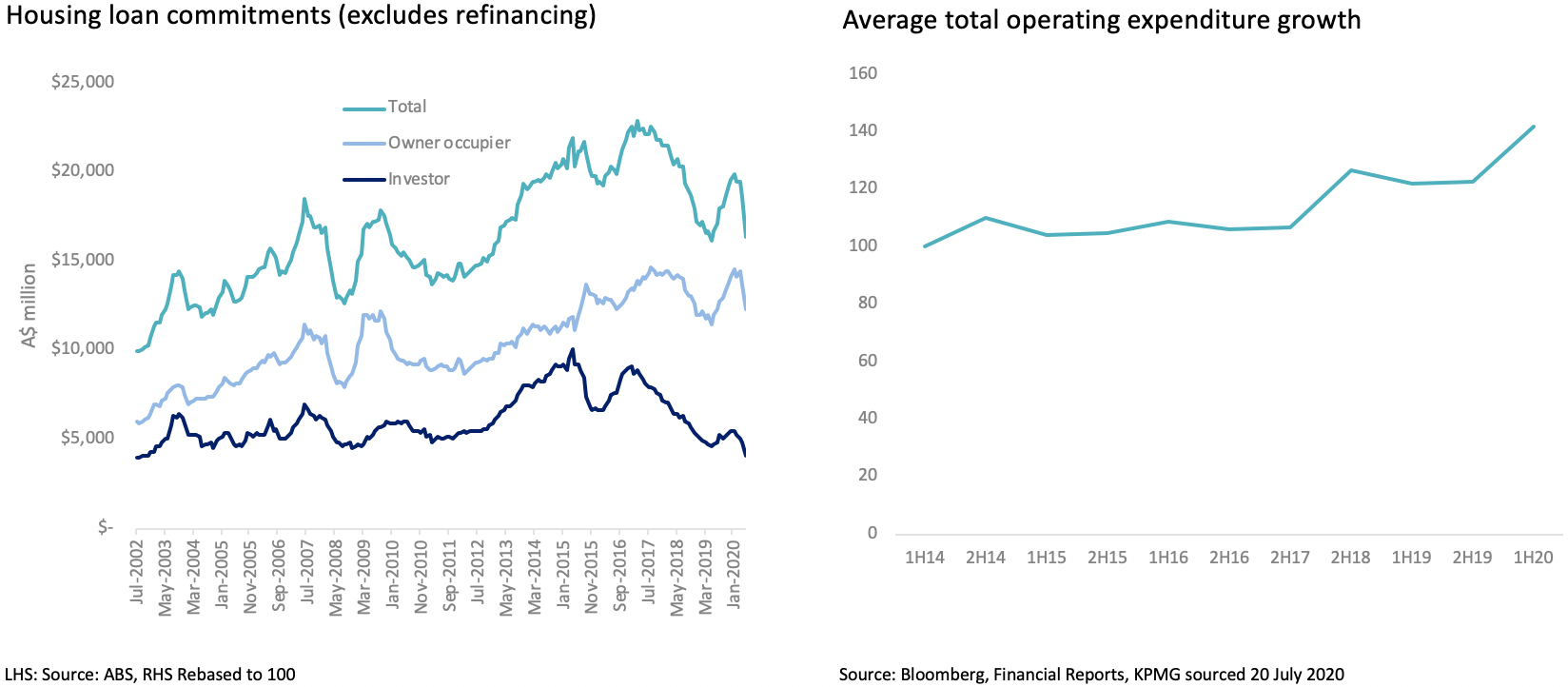

As you can see, banks were already facing headwinds in 2019 as the RBA loosened monetary policy, and we expect profits to fall further in 2020. Banks’ profits are sensitive to the mortgage market and according to KPMG’s report, it is estimated that every 5 basis points reduction in mortgage NIM results in a 1-2% reduction in cash earnings for the major banks. NIMs remain under pressure.

Having previously relied on mortgage growth for their burgeoning profits, Australian banks now have tough challenges as home loan lending slows but costs continue to rise.

What does this mean for ASX investors?

These headwinds are highly problematic for ASX bank shares and for the many Australian investors whose portfolios have significant exposure to the big four banks. They don’t bode well for sustaining current dividend payout ratios.

The four pillars (CBA, Westpac, ANZ and NAB) represent a quarter of the S&P/ASX 200 (INDEXASX: XJO). In other words, if you hold a blue-chip portfolio or are invested in an active or passively managed Australian equity fund that tracks or benchmarks to the S&P/ASX 200, $1 out of every $4 is likely to be invested in banks and therefore, vulnerable to the risks they face.

Conversely, taking an ‘equal weight’ approach to the S&P/ASX 200 can provide true diversification across securities and market sectors, reducing concentration risk to the banks. We’ve written a lot about the importance and benefits of taking an ‘equal weight’ approach, where the same weight, or importance, is given to each stock, reducing concentration risk.

As an example, the VanEck Vectors Australian Equal Weight ETF (ASX: MVW) invests in over 80 of the largest and most liquid ASX-listed companies using an equal weight approach. MVW’s exposure to the big four banks is less than 5%. This dramatically reduces investors’ exposure to the big four, reducing concentration risk and reducing the impact of dividend declines. MVW is close to 2.5 times more diversified than the S&P/ASX 200, as measured by the Herfindahl Index.

Find out more about the MVW ETF by visiting the VanEck website.

This report was written by Russel Chesler, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.