According to the latest data from 13 analysts sourced by Refinitiv, Commonwealth Bank of Australia (ASX: CBA) shares are expected to pay a dividend of $2.72 in 2020 and $2.68 in 2021.

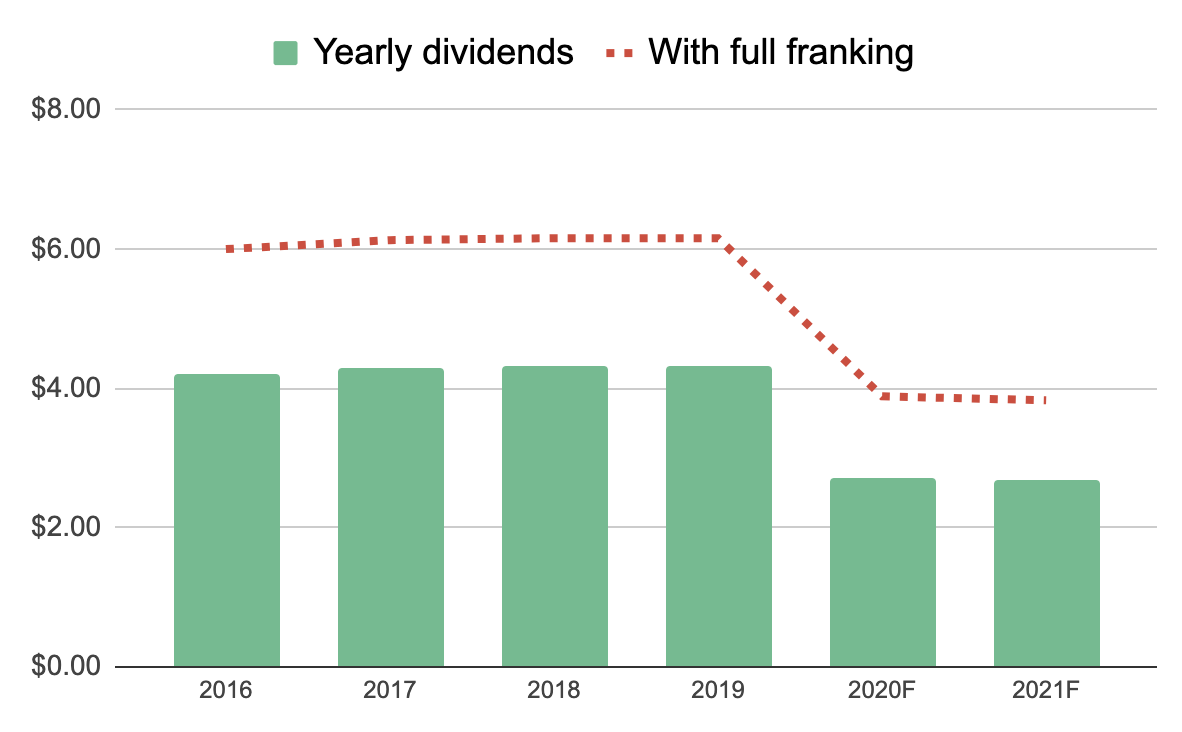

In other words, CBA’s forecast dividends expected to be lower than they were in 2019 ($4.31 per share). This chart shows CBA’s prior year dividends versus what’s expected:

As you can see above, CBA’s yearly dividends are expected to fall considerably — if you believe the analyst forecasts.

Indeed, these forecasts do not mean CBA will definitely cut its dividends. However, at the very least it reminds investors to remain cautious about relying on the historical dividends as a guide to future dividends. Coronavirus is expected to have severe implications on our economy, wages and bank profits.

Based on CBA’s dividends in 2019, its shares currently yield 5.89% fully franked. However, using the forward or forecast dividend payment of $2.72, for its 2020 financial year, the dividend yield drops to 3.72% fully franked.

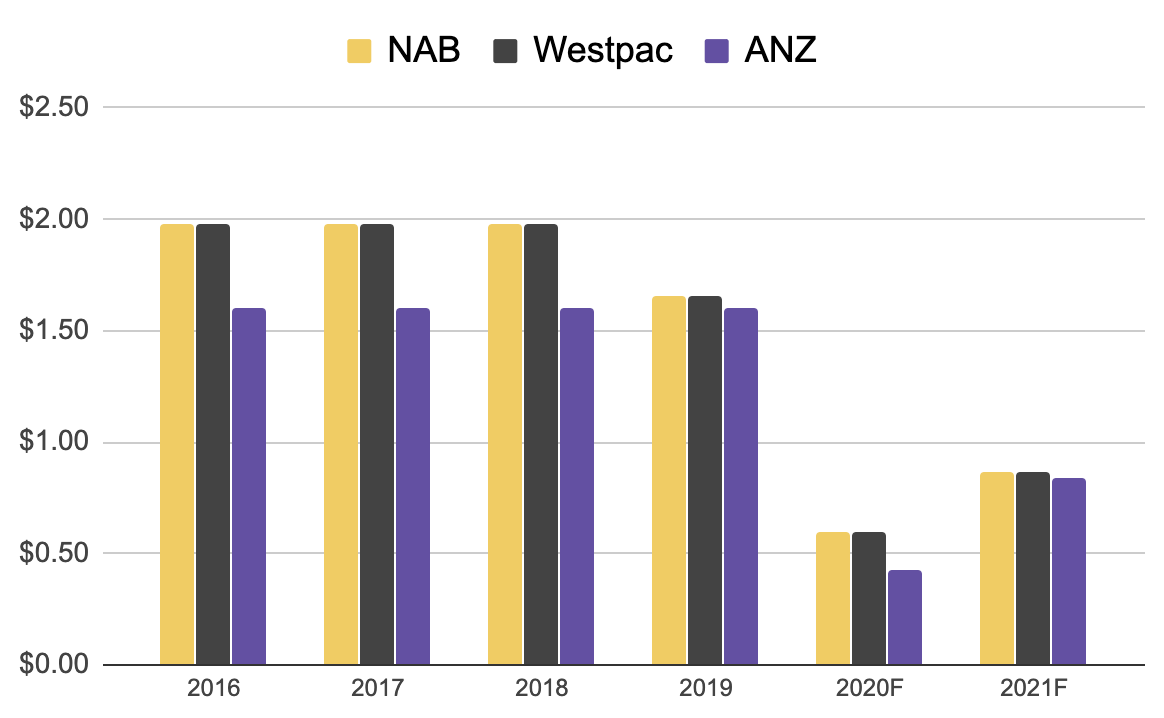

While that’s a pretty tough pill to swallow for existing shareholders, if the analysts are correct in their forecasts it will be a lot better than National Australia Bank Ltd. (ASX: NAB), Westpac Banking Corp (ASX: WBC) and ANZ Banking Group (ASX: ANZ).

As can be seen above, with recent cuts to the dividends from NAB, Westpac and ANZ, CBA shareholders are already sitting pretty, relatively speaking. If that’s any consolation.

Buy, Hold or Sell

When it reports, analysts surveyed by Bloomberg are expecting CBA to reveal an FY20 profit of $8.92 billion, which I guess excludes bad debt charges and other costs (e.g. remediation). The next dividend is expected to be around 67 cents per share.

However, as I’ve said time and again, I would not rely on the forecasts of analysts to make an investment, nor would I buy ASX bank shares for dividend income right now. There are simply better opportunities available on the market, such as Washington. H Soul Pattinson & Co. Ltd (ASX: SOL) or low-cost diversified shares ETFs.

I recently interviewed Washington H. Soul Pattinson Chairman, Rob Millner, and asked why paying dividends are really important to him and his shareholders.

If you’re looking to secure dividend income in 2020 and beyond, be sure to bookmark our ASX dividend shares page for the latest in ASX dividend share ideas (the Rask Media website is entirely free and updated daily).

Alternatively, if you want to know which ASX stocks I’m buying, grab a copy of our free investment report below. If you create a free Rask account you’ll instantly get access to all of our analyst investment reports, courses, podcasts and more.