The Downer EDI Limited (ASX: DOW) share price finished nearly 4% higher today after the company released its FY20 results.

Downer is a provider of integrated services in Australia and New Zealand. Its speciality is designing, building and sustaining assets, infrastructure and facilities.

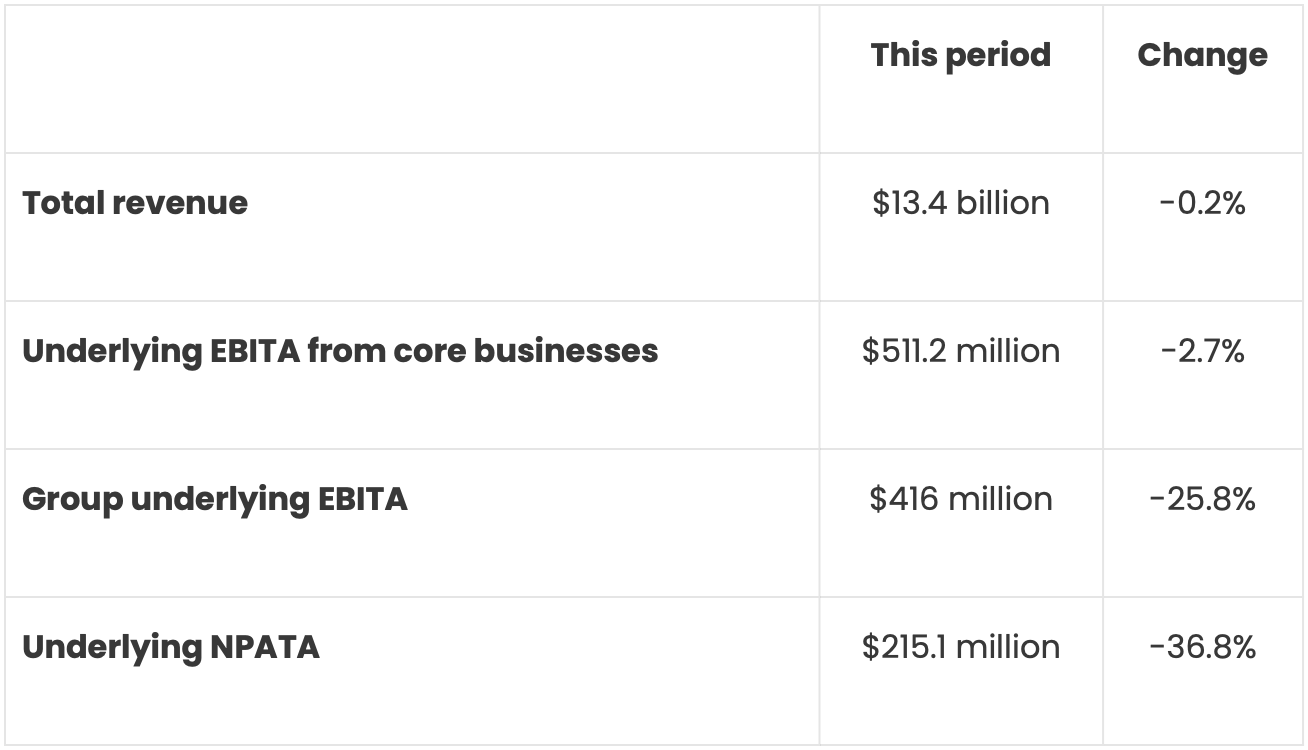

Downer FY20 – key results

Back in July, Downer provided updated guidance for the full-year (along with announcing a $400 million capital raising).

Underlying earnings before interest, tax and amortisation of acquired intangible assets (EBITA) came in within management’s guidance of between $410 million and $420 million. As did net profit after tax before amortisation of acquired intangible assets (NPATA), where management was guiding for $210 million to $220 million.

The video below explains the difference between underlying figures and statutory figures.

Downer’s statutory results paint a bleaker picture, with the company posting a net loss after tax of $150.3 million during FY20. This compares to a net profit after tax of $261.8 million in the prior year.

The main differences between the statutory and underlying figures are due to a $165 million impairment charge related to Spotless and $142.4 million of portfolio restructure and exit costs.

Segment results

Downer managed to increase revenue in its transport and utilities divisions, up 7.9% and 7.2% respectively over FY19, but it wasn’t enough to offset a fall in the EBITA margins for both divisions.

EBITA margin fared the worst in Downer’s facilities division, falling 1.6 percentage points. This led to a 33% drop in EBITA despite only a 2.3% decrease in revenue.

As per the company’s announcement in August 2019, it has been undertaking a review of its portfolio businesses, with mining being an area of focus. The review process for its mining business was suspended in March due to COVID-19 but Downer confirmed today that it continues to explore a potential sale – either in parts or as a whole.

Spotless takeover

Downer’s capital raising last month was launched, in part, to fund its acquisition of the remaining shares in Spotless.

Spotless is the largest integrated facilities services provider throughout Australia and New Zealand. It was listed on the ASX up until mid-2019 under the ticker code SPO. Spotless delisted due to the company’s liquidity and shareholder spread, along with the costs incurred in being listed.

Regarding the former, just two shareholders collectively held 99.4% of the ordinary shares in Spotless – 87.8% belonging to Downer (which it acquired in 2017) and 11.6% held by New York-based hedge fund Coltrane.

Downer announced its intention to acquire the remaining shares in Spotless last month, but formally sent out the takeover booklet today.

Explaining the takeover, Downer said that Spotless is an important part of its Urban Services strategy – driving consistent earnings and reliable cash flow from long term customers in critical sectors.

What now?

Downer said it would not be providing earnings guidance for FY21 in the current environment.

As flagged last month, there will be no final dividend in FY20 due to COVID-19 and the recent capital raising. Downer’s deferred interim dividend of 14 cents per share will be paid on 25 September 2020.

Giving some hope to income investors, the company expects dividends to resume in FY21, depending on business performance.

If income is what you’re after, be sure to bookmark Rask Media’s ASX dividend shares page for the latest in dividend news and analysis.

[ls_content_block id=”14948″ para=”paragraphs”]