The Openpay Group Ltd (ASX: OPY) share price is flying (again) today after the company announced a trading update for the month of July.

At the time of writing, Openpay shares have jumped nearly 9% to $3.78, taking year-to-date share price gains to a lofty 202%.

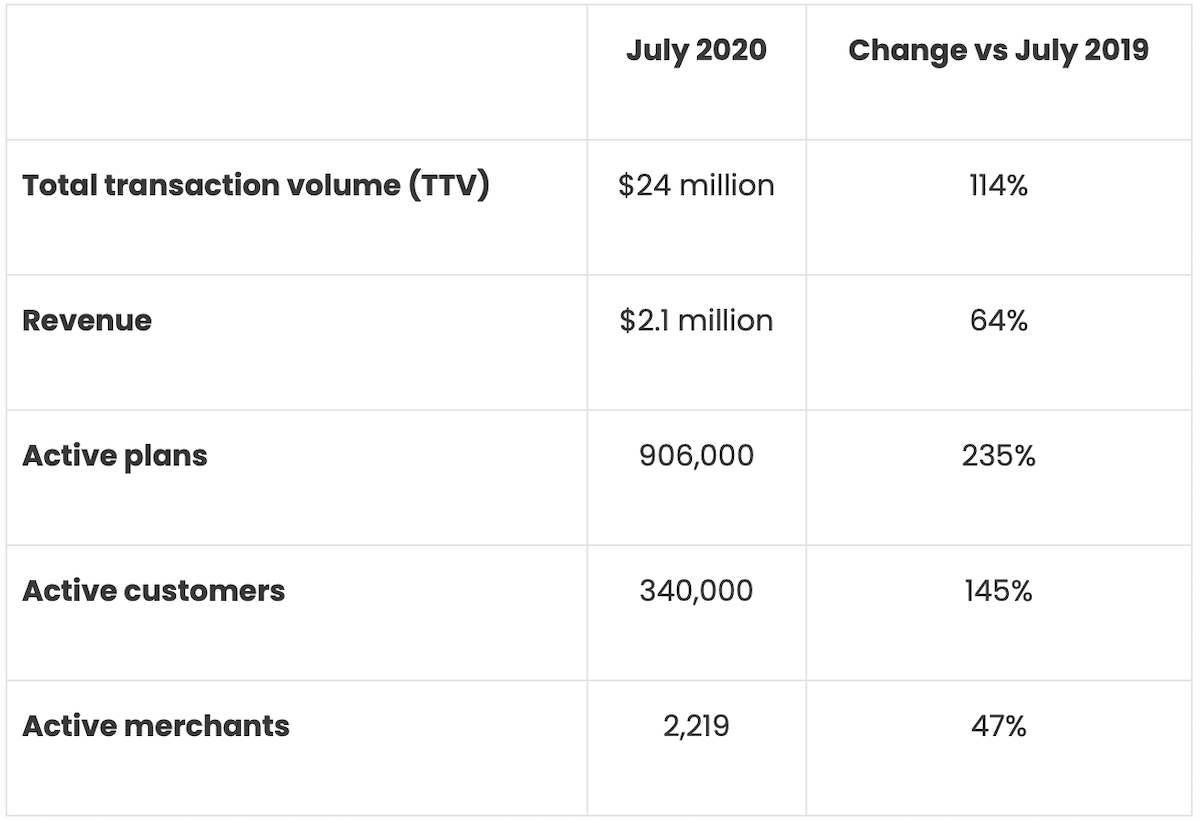

Here are the key figures

Openpay said July was its best month in its history, with TTV beating the previous record set in May 2020. While you’d expect Openpay to be setting records, it’s worth noting that performance in May was driven by the company’s ‘OpenMay’ promotional initiative and launch of UK retailer JD Sports.

The main drivers of July’s result were the accelerated growth in e-commerce in Australia – reflected in the sky-high share prices of ASX BNPL shares – and the continued strong increase in UK trading volumes.

While July was another strong month for e-commerce in retail, Openpay said that trading volumes have increased particularly in the online automotive and healthcare verticals, where businesses are mostly in-store.

The online channel contributed 27% of Australian TTV ($4.7 million) in July, up from $4.1 million in April. In-store accounted for the remaining 73% ($12.5 million), a notable increase from $9 million in April, reflecting easing lockdown restrictions.

Impressively, net bad debts in July as a percentage of TTV continued its downtrend, coming in at 1.54%. This is down from 2.89% in 4Q20 and 4.7% in 3Q20. Openpay attributed this positive trend to improvements it made to its automated risk management system in March.

Openpay is set to release its full-year results on 31 August, together with an update on its growth strategy for FY21.

For an in-depth look at what’s ahead this month, check out Rask Media’s ASX reporting season calendar.