Beach Energy Ltd (ASX: BPT) was the best-performing S&P/ASX 200 (ASX: XJO) share today after investors responded to the oil and gas company’s FY20 results.

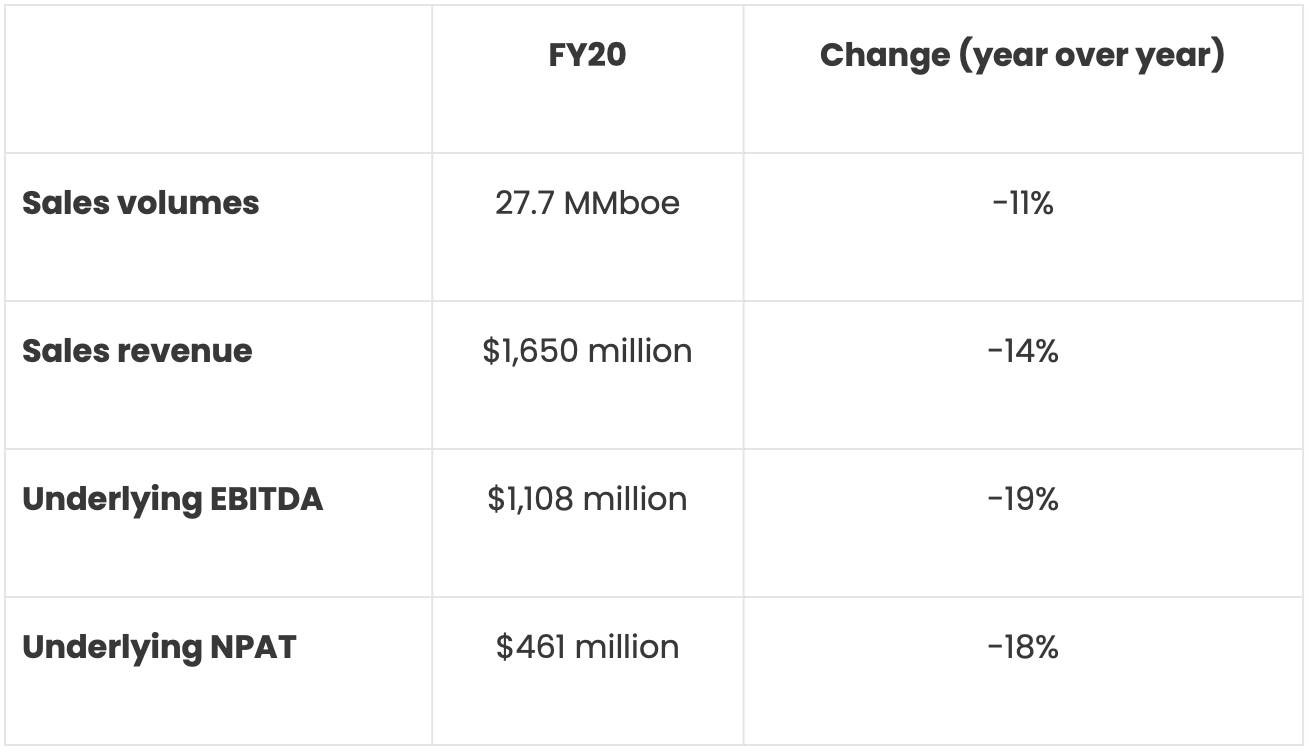

Key points from Beach Energy’s FY20 result

Echoing comments from other ASX companies that have reported this month, Beach said FY20 was a tale of two halves.

Managing Director Matt Kay said FY20 demonstrated the resilience of Beach’s business, pointing to the company’s net cash position, high-margin oil business and stable gas revenues as drivers of the strong full-year result.

“Given our high margin, high returning business, Beach was in an enviable position at the end of the financial year in which we had no material write downs and were able to maintain our final dividend at 1 cent.”

Mr Kay also said the company’s operational performance, with production of 26.7 million barrels of oil equivalent (MMboe), 2% higher than pro forma FY19 production, was a testament to how Beach managed the impacts of COVID-19 across the business.

Beach generated gas and ethane sales revenue of $605 million, which covered all of the company’s stay-in-business costs. A 7% increase in realised gas and ethane prices partially offset a 21% decrease in realised oil price after Brent oil prices infamously tumbled to under US$20 a barrel in April.

Moving forward, Beach highlighted its ‘rock solid’ balance sheet, with $50 million net cash and $500 million liquidity as at 30 June 2020. The company also said its fixed-price gas contracts provide revenue certainty and are expected to cover all operating costs.

Beach Energy’s dividend

Impressively, Beach maintained its final dividend of 1 cent per share, fully franked. This takes full-year dividends to 2 cents per share, flat on FY19.

With the Beach Energy share price closing at $1.58, this puts shares on a trailing dividend yield of 1.27%.

Now what?

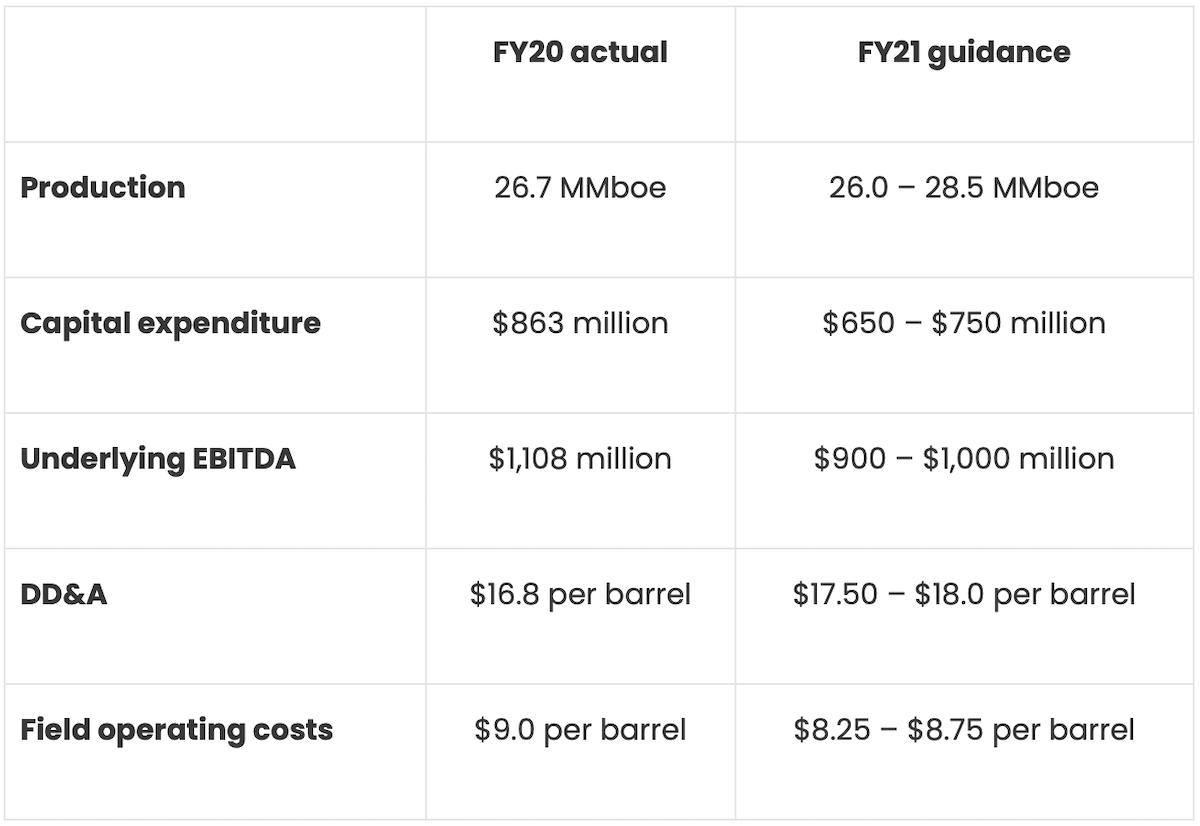

Looking forward, Beach Energy has provided the following guidance:

DD&A stands for depreciation, depletion and amortisation, where depletion refers to the cost of extracting natural resources like oil from the earth.

Commenting on outlook, Mr Kay concluded: “Beach has set itself up to be in a position of strength during this downturn. We expect to invest in our high-margin and diverse portfolio and target creating over $2 billion of free cash flow over the next 5 years”.

“Our current projections have Beach remaining in a net cash position through our peak investment years at around US$40/bbl Brent. This means Beach has the ability to pursue growth despite the current macro challenges.”

In other news in the ASX energy space, Viva Energy Group Ltd (ASX: VEA) delivered its half-year FY20 results today.

To keep up to date on the latest reports, check out our ASX reporting season calendar.