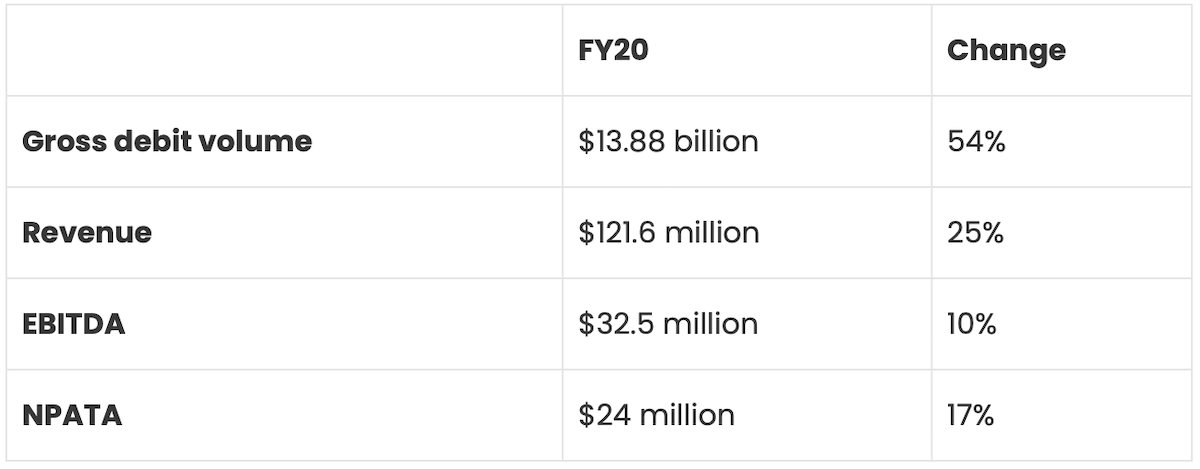

The EML Payments Ltd (ASX: EML) share price is on the move today after the company released its full-year FY20 results.

Key points from EML’s FY20 report

On the bottom line, EML swung to a statutory loss after tax of $5.8 million, weighed down by acquisition due diligence expenses of $15.8 million primarily relating to the acquisition of Prepaid Financial Services.

EML operates across three primary business segments: gift and incentive (G&I), general purpose reloadable (GPR) and virtual account numbers (VANs). Let’s take a look at how each of these segments performed.

Gift & Incentive

G&I involves the provision of single-load gift cards for reward programs and shopping malls. This segment clearly took a hit from COVID-19, however, it still grew GDV by 11% to $1.17 billion.

Unsurprisingly, EML said it experienced two different sets of trading conditions during FY20. Seasonal volumes in the back end of 2019 were up 17% on the prior corresponding period (pcp) and GDV increased 26% up until the end of February. However, the outbreak of COVID-19 and subsequent closure of malls saw gift card volumes fall by more than 90% in April.

Despite this impact, growth in EML’s incentive programs ensured that it managed to grow GDV for the G&I segment, with almost an equal GDV split between mall gift card programs and incentive card programs.

G&I achieved revenue growth, increasing 3% to $68.2 million – representing 56% of group revenue.

General purpose reloadable

The company’s GPR segment operates across two key verticals: gaming and salary packaging. EML provides reloadable cards to major betting companies like Sportsbet and Pointsbet Holdings Ltd (ASX: PBH). It also works with salary packaging companies such as Smartgroup Corporation Ltd (ASX: SIQ) to provide payment and technology solutions.

GDV from the GPR segment jumped 54.3% to $4.2 billion, driven by strong organic growth from salary packaging programs, resiliency in gaming and disbursement programs, and the acquisition of Prepaid Financial Services (PFS).

The PFS acquisition was completed in April 2020 on renegotiated terms and contributed $1.25 billion of GDV in the last quarter.

The GPR segment contributed $41.9 million of revenue, up 75% compared to FY19. This included a $15.6 million contribution from PFS.

Virtual account numbers

Virtual account numbers are single-use, randomly-generated card numbers that can be used to make payments.

In EML’s VANs segment in North America, GDV increased by 62% to $8.47 billion, driven by organic growth in existing customers. The company noted that volumes were negatively impacted in the last quarter of FY21 as social distancing and lockdown measures reduced spending in health industry clients.

The VANs segment increased revenue relatively in line with GDV, up 66% to $10.7 million.

Strategy update

Along with its financial results, EML announced a new strategy to drive organic growth in the next 3 years: Project Accelerator. EML has long had a strategy of diversification and an intent to transition towards a company that generates the majority of its revenues from GPR products. Project Accelerator is designed to turbocharge these initiatives.

EML said the strategy is centred around a new vision statement of “offering our customers a feature rich, fully embedded payment solution via a simple, single touchpoint” and a purpose statement of “inspiring transformative digital change for our customers and communities”.

Some of the key components of Project Accelerator will include investments in technology, working with product partners to integrate their solutions into an expanded EML product offering, and investments in other technology companies.

Outlook

EML previously suspended guidance back in March due to the uncertain impact of COVID-19. The company remains cautious in the current environment, particularly in regard to how the pandemic will impact G&I volumes in the lead up to Christmas.

EML noted that the G&I segment averages $6 million of revenue and $4.8 million of gross profit per $100 million of GDV. Seasonal sales in November and December typically account for 43-46% of annual volumes for the G&I segment, so a lot is riding on the performance during these two months.

As a result, EML expects to resume guidance in February 2021 once this uncertainty is resolved.

In positive news, the company said that June and July trading has been encouraging. It has seen improved trading conditions in the G&I segment, driven by non-mall programs, while Australian GPR is performing strongly on the back of salary packaging volumes.

Summary

Investors initially reacted positively to EML’s report, sending shares more than 8% higher to an intra-day high of $3.57. However, shares have since pulled back to sit at $3.27, in line with yesterday’s closing price.

On the whole, I think EML delivered a strong result against a backdrop of uncertainty and the future looks bright for this innovative payments business. For another growth share I like the look of right now, grab a copy of the free report below.