The Domain Holdings Australia Ltd (ASX: DHG) share price underperformed the market today as investors digested the company’s full-year result.

While the S&P/ASX 200 (ASX: XJO) dropped 0.8%, Domain shares fell nearly 2% to $3.56.

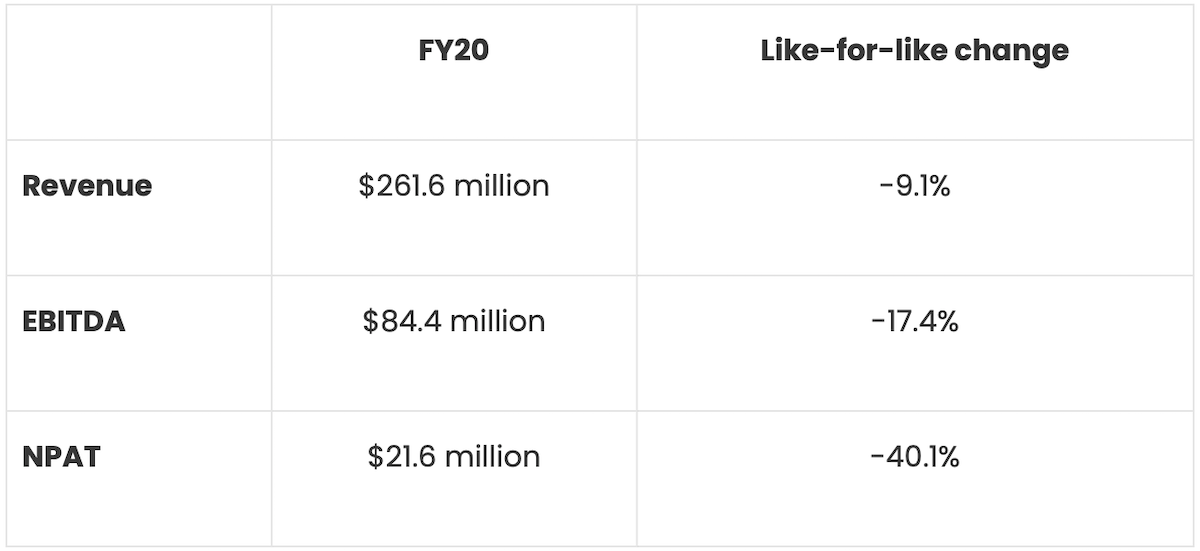

Key points from Domain’s FY20 report

Although Domain managed to pare back its operating expenses, its bottom line was hit by a $256 million impairment charge relating to Domain Digital.

Residential performance

The residential segment made up 62% of Domain’s total revenue, falling 6.7% to $161.6 million.

Residential generates revenue through ‘for sale’ and rental listings across Domain’s desktop, mobile and social platforms.

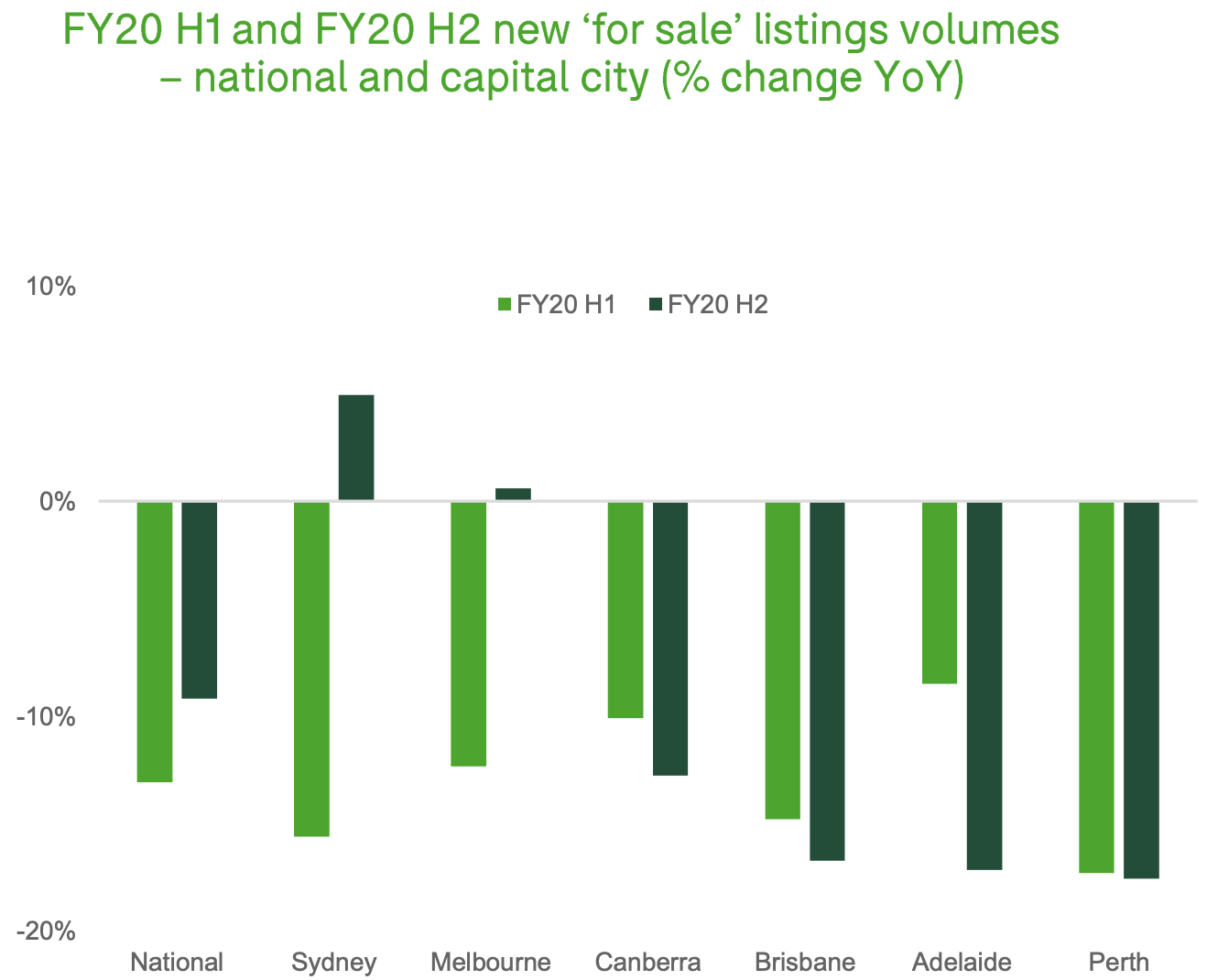

Total market listing volumes were down 11% on a like-for-like basis, while subscription revenue was impacted by customer support initiatives, declining 15%.

As you can see in the chart below, ’for sale’ listing volumes varied across capital cities. While Sydney and Melbourne managed to grow year-over-year, each of Canberra, Brisbane, Adelaide and Perth took a backwards step.

What about JobKeeper?

Domain became eligible to participate in the JobKeeper scheme from 30 March. As a result, $5.4 million of JobKeeper grants have been included in the company’s FY20 result, with JobKeeper contributing $4.7 million to EBITDA.

Domain’s dividend

Unfortunately for income investors, Domain did not declare a final dividend, citing the continued uncertainty of COVID-19.

The company paid a 2 cents per share dividend back in March, which compares to full-year dividends of 8 cents per share declared in FY19.

Now what?

Looking ahead, Domain said that July 2020 trading reflected strong year-over-year listings growth in Sydney and Melbourne, with greater than usual market activity in a seasonally low period

But despite strong July trading, Domain acknowledged that the outlook for the broader market remains uncertain.

“FY21 H1 will be subject to the health and economic consequences of COVID-19, and in particular the return of more typical seasonality patterns for the Spring selling season. Melbourne’s performance will reflect the duration of the COVID-related lockdown,” the company said.

Concluding its commentary on outlook, Domain said it will remain disciplined in managing its cost base in FY21, while continuing to invest in growth initiatives.

In other news today, Wesfarmers Ltd (ASX: WES) reported a profit of $2 billion, while Qantas Airways Limited (ASX: QAN) announced a $2 billion net loss.