The oOh!Media Ltd (ASX: OML) share price bounced 17.5% higher on Monday, placing it amongst the Australian share market’s best performer for the day. The OML share price reacted to news of the company’s half-year financial report (HY20).

For context, the Australian share market or S&P/ASX 200 (ASX: XJO) traded up 0.3% today.

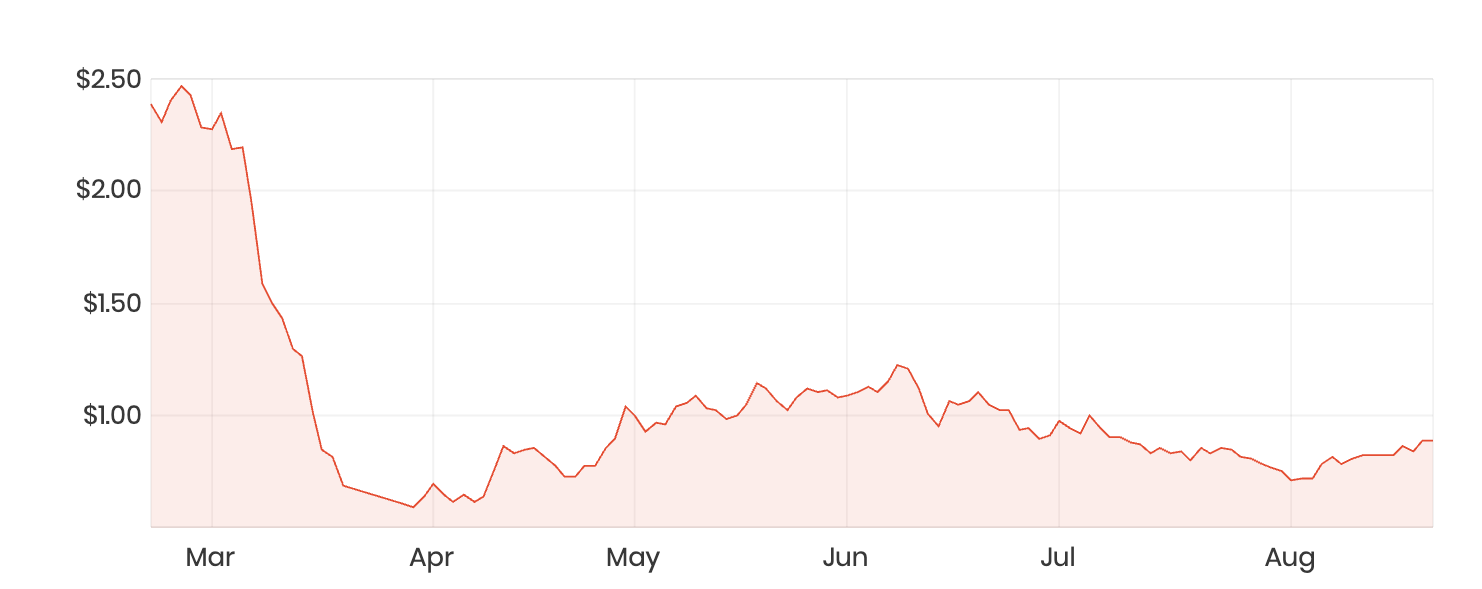

OML share price – 6 months

oOh!Media is an outdoor advertising and media business. Founded in 1989, it has become one of Australia’s largest advertising companies. Across Australia and New Zealand, oOh!media has more than 30,000 advertising billboard locations.

The company makes money by providing advertising space on street furniture (e.g. public seating), trains, billboards and other ‘Out of Home’ ad placement real estate.

Key Results

| This period (HY20) | Change | |

| Revenue | $204.9 million | Down 33% |

| Net profit | Loss of $27.5m | Down from $608,000 |

| Dividends (per share) | None | Down from 3.5 cents |

Source: oOh!Media Ltd announcements; author calculations, AUD millions unless otherwise stated.

“Although we are seeing national audiences starting to bounce back, Out of Home has been impacted disproportionately by the COVID-19 restrictions in people movement compared to other sectors, resulting in the market declining by 36% in Australia and 41% in New Zealand,” oOh!Media CEO Brendon Cook said.

During the year, as the potential implications of COVID-19 restrictions began to take ahold, oOh!Media raised $167 million of capital to shore up its balance sheet and provide some comfort for shareholders. Currently, the company has a gearing ratio, which it defines as net debt/EBITDA, of 1.2 times.

“While revenue and profits predictably declined, our decisive early action to raise additional equity, reduce costs and capital expenditure and manage cash flows has reduced debt by 67 per cent and positioned the company well for the future,” Cook noted.

In New Zealand, where there have been fewer reported cases, the Out of Home advertising market bounced back from its lows. oOh!Media reported a 36% increase in revenue between June and July. While the company’s market or industry has shrunk considerably these past few months, Cook said the company plans to take more share through creative new strategies.

“We continue to lead the industry in creating a new media business and we are uniquely positioned to help drive the Out of Home industry’s share of overall media spend over 7% in 2019 to 10% in the next few years,” he added.

In terms of the recent trading activity for August, oOh!Media said the business was operating around 60% of its August 2019 numbers. While it continues to experience declines at the top line (revenue), it is cutting costs and has reduced debt to try to weather the storm.

For example, the company asked its staff to voluntarily work a four-day week from May to July. This enabled the company to receive $7 million of JobKeeper payments from the Australian Government.

Are OML shares cheap?

oOh!Media is not the type of company I want to own in my portfolio. Typically, I avoid companies with high debt and invest strictly in companies with durable competitive advantages.

oOh!Media has banking facilities of $520 million. About $245 million was drawn, with a maturity of September 2021 (i.e. 13 months away). It had $125 million of cash. With lots of uncertainty in the outdoor ads market, the extra financial uncertainty would be too much for me and my portfolio.

Indeed in my opinion oOh!Media is a company that is at the pointy end of COVID-19 restrictions in the short term and is exposed to the long-term shift towards more digital ad dollars, as more businesses opt for a work-from-home arrangement.

Bottom line: The company could prove to be a bargain but I’m not in a rush to buy shares myself.

If you’re looking for better ideas, use your web browser to bookmark our ASX growth shares for daily ideas. Or use Rask Media’s free ASX share ideas page for the latest stories.