The G8 Education Ltd (ASX: GEM) share price tumbled today as investors reacted to the company’s half-year results.

Despite falling as much as 11.3% in intra-day trade, G8 Education shares clawed back some of these losses to close 4.6% lower for the day at $0.92.

As you can see in the share price chart below, it hasn’t been an easy few years for G8 Education shareholders and the company’s troubles have only compounded in the wake of COVID-19.

G8 Education’s difficult half year

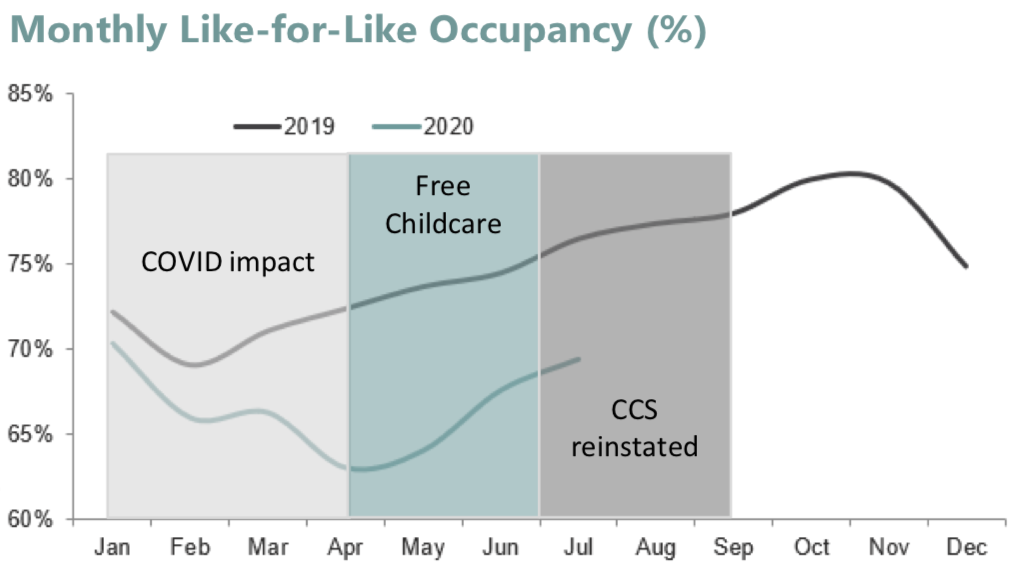

G8 reported a 28% revenue decline to $308 million, while underlying earnings before interest and tax (EBIT) dropped 44% to $29 million. As previously flagged, these results were impacted by COVID-19 restrictions and the capped revenue model under the government’s ‘free’ childcare package, which was in place between 6 April to 12 July.

On the bottom line, G8 recorded a statutory loss after tax of $239 million, driven by a $237 million impairment charge which the company warned the market about in June.

“Our revenue during the first half was impacted by the initial Government support package which capped revenue for providers, irrespective of occupancy figures. Following the immediate hit to occupancy at the start of the pandemic, we saw occupancy levels increase during the period of Government-supported free childcare,” said managing director and chief executive Gary Carroll

.

Balance sheet

G8 Education recently completed a capital raising, generating $301 million of proceeds which reduced net debt to $57 million. The capital raising also significantly reduced the company’s leverage from 2.3x EBITDA in December 2019 to 0.4x in June 2020.

“Having completed the equity raise in April, and successfully achieving the cash preservation and cost savings targets we set for ourselves at that time, we have a robust balance sheet, prudent gearing levels and the financial flexibility to successfully navigate this period,” Mr Carroll said.

G8 Education dividend

G8 Education’s dividend policy remains temporarily suspended in order to preserve cash. However, the company’s deferred FY19 final dividend of 6 cents per share will be paid on 30 October 2020.

G8 hasn’t yet put a line through FY20 dividends, saying a final dividend may be declared subject to financial performance.

Portfolio optimisation

Following the company’s recent strategic review (which led to the $237 impairment charge), G8 is divesting its Singaporean business, which it expects to complete in the second half of the year.

The company said the divestment will enable it to focus its attention on maximising the quality and performance of its Australian portfolio, including ensuring the business emerges strongly from the current COVID-19 operating environment.

G8 also completed its greenfield pipeline in the first half of FY20, with a new approach now being adopted to secure attractive future locations involving high quality partners and lower capital investments.

Trading outlook

G8 revealed that the impact of the ending of the initial childcare package on 12 July and the re-introduction of the Child Care Subsidy on 13 July has been more subdued than expected. As you can see in the chart below, occupancy has continued to grow even after parent co-payments returned.

The company said its current occupancy is 69%, with occupancy growing steadily in all states with the exception of Victoria.

G8 described these occupancy levels as “solid” but given the ongoing uncertainty and market volatility, said it is not in a position to provide guidance on expected occupancy or financial operating performance.

Buy, hold or sell?

G8 Education shares are down more than 50% this year and I’m sure a case can be made for a value play here. However, even looking beyond COVID-19 uncertainty and related government initiatives, G8 has made a name for itself using a ‘roll-up’ strategy, growing primarily through acquisitions. I prefer to invest in companies with strong organic growth, like a2 Milk Company Ltd (ASX: A2M) and the companies profiled in the free report below.