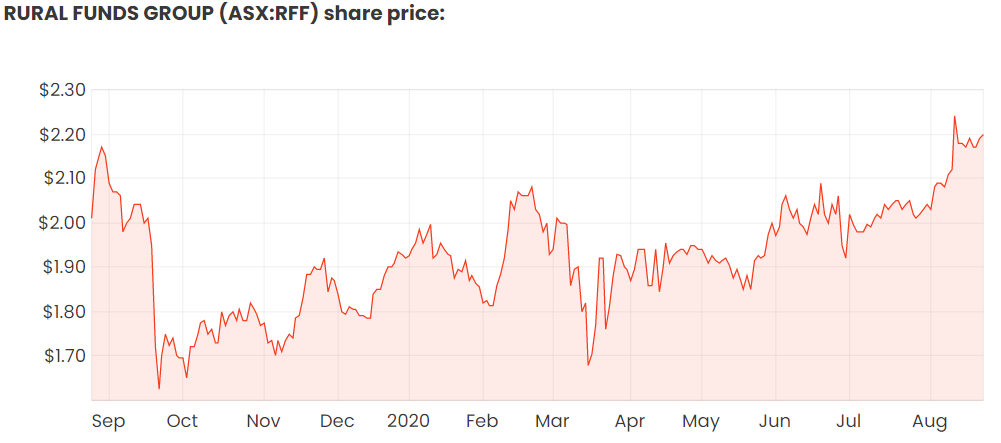

Rural Funds Group (ASX: RFF) has announced its FY20 result and released some guidance for FY21. The Rural Funds share price has risen to $2.25.

Rural Funds is a real estate investment trust (REIT) which owns and leases out farms.

It has recovered well since the short attack last year, as you can see on the share price graph below.

FY20 report

The farm landlord announced that its property revenue rose by 8% to $72 million. Net property income rose by 6.9% to $67.9 million.

No COVID-19 lessee rent relief was required.

Rural Funds’ EBITDA (click here to learn what EBITDA means) went up by 6.7% to $57.25 million. That helped adjusted funds from operations (AFFO), which is essentially the net cash rental profit, go up 5% to $45.4 million.

On a per unit basis, AFFO increased by 1.5% to 13.5 cents. This is the important measure that helps fund the distribution.

Earnings per unit rose by 82% to 18.4 cents. This measure includes property revaluations. Rural Funds reported there were positive independent valuations for its almond orchards, macadamia orchards, cattle properties and water entitlements.

The distribution was increased by 4% in FY20 to 10.85 cents.

Balance sheet and portfolio changes

During the year Rural Funds decided to recycle capital out of poultry and almond assets to fund acquisitions and developments.

The Mooral almond orchard sale for $98 million, which is subject to various adjustments and inclusions, is conditional on completion of due diligence within 45 days but subject to possible extensions and FIRB approval. The sale is forecast to settle in December 2020.

Rural Funds has acquired, or has contracts to acquire, additional cattle and cropping properties suitable for conversion into 5,000 hectares of macadamia orchards. These developments are expected to provide ongoing earnings growth in future years.

The REIT reported that its adjusted net asset value (NAV) increased by 8% to $1.94. It’s ‘adjusted’ to include the market value of the water entitlements that it owns.

Rural Funds said that its weighted average lease expiry (WALE) was 10.9 years at the end of FY20.

FY21 guidance

In FY21 Rural Funds is expecting to grow the distribution by another 4% to 11.28 cents as per its long term goal.

However, AFFO is expected to drop by 13.4% to 11.7 cents in FY21. That means the payout ratio will be 96.4%. Rural Funds said that the AFFO decrease is due to the macadamia orchard developments which are expected to produce higher income when leased.

Maryborough macadamia plantings are expected to commence in late FY21. It will take several years to fully develop Maryborough and Rockhampton. In the meantime, Maryborough farms will be leased as cropping operations, primarily as sugar cane with a two-year cane off-take agreement.

The current Rural Funds share price offers a FY21 distribution yield of 5%. That’s not bad, but I think there are better value ASX dividend shares out there such as Brickworks Limited (ASX: BKW). Rural Funds is trading at a material premium to its adjusted NAV now – I’d only want to buy shares at close to (or under) the adjusted NAV value. In other words, at under $2.