The Nanosonics Ltd (ASX: NAN) share price got whacked on Tuesday morning, falling 12% at the open before recovering slightly. If you ask me, if the NAN share price keeps falling it could be a great opportunity for savvy long-term investors.

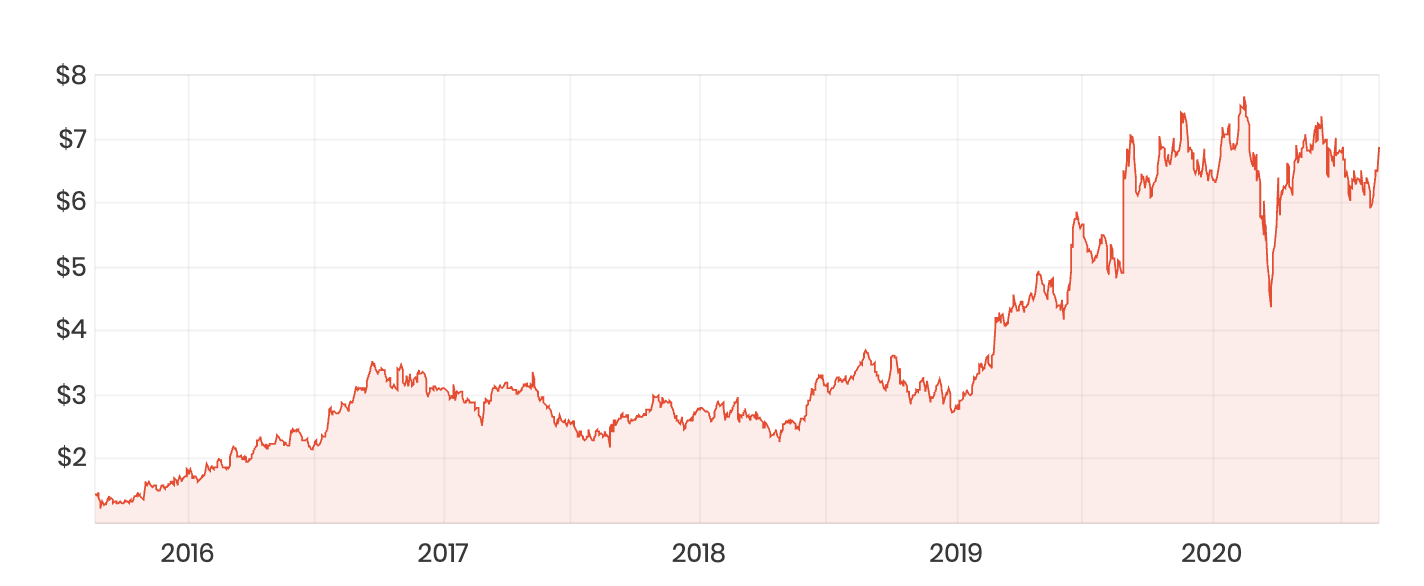

NAN share price

Nanosonics is a medical technology company with its flagship product being the trophon EPR system. The trophon system disinfects ultrasound probes with rapid efficiency. Ultrasound probes are vitally important to hospitals and medical clinics because they are the things that radiographers and doctors use to see what’s going on inside the patient’s body. Nanosonics claims to reduce error and increase efficiency — saving clinics time and making them money.

Summary of Nanosonics report

- The installed base of trophon systems rose 13% to 23,720 units

- Revenue up 19% to $100.1 million (a company record)

- Consumables and service revenue up 36% to $70.1 million

- Capital revenue (i.e. sale of units) fell 9% to $30 million

- EBIT (earnings before interest and tax) of $12.6 million, down from $16.8 million

“The 2020 financial year has been another year of significant achievement and progress with many important milestones achieved against our strategic growth agenda,” CEO Michael Kavanagh said.

Even under the worst COVID conditions, and while the number of new installed Trophon units fell 46%, revenue in the fourth quarter rose 1% over the prior year’s corresponding period. To me, this highlights the importance of getting the disinfecting ultrasound units installed, but more so the importance of Nanosonics’ recurring revenue from the sales of consumable items for each procedure.

“As expected, the implications of the COVID-19 pandemic impacted the momentum primarily in Q4 which saw the planned adoption of trophon being delayed in hospitals as their focus turned to the management of COVID-19,” Kavanagh added. Noting, “With healthcare procedures being postponed due to lock down restrictions, some implications on consumables sales were also experienced in this period but commenced recovering towards Q1 to Q3 levels in June.”

Nanosonics continues to see the opportunity in front of it, with the company spending another $15.6 million in Research and Development (R&D) during the year. This is a sign that management believes in the organic growth potential and is keen to fulfil customers’ needs and gaps in the marketplace.

Nanosonics estimates it has over 50% of the market in North America, with 20,990 units installed. In Europe and the Middle East the company has 1,120 units installed. In the Asia Pacific region, the number stands at 1,610, up 9% year over year.

While capital sales were down during the year, Nanosonics said this came as a result of two things: the launch of the trophon2 system increased last year’s figures, and COVID-19 caused sales interruptions.

Turning to the all-important cash flow of the business, the company reported free cash flow of $21 million. Cash in the bank rose to $91.8 million, up from $72.2 million, with minimal debt.

I think this is a very strong financial position and allows Nanosonics to, as it says, take advantage of new opportunities via organic growth — or maybe even acquisitions.

Going forward the company will keep investing in new technologies and support initiatives to drive awareness of its products through the world.

Kavanagh said that, “despite the ongoing uncertainties associated with the current COVID-19 pandemic, the fundamentals for the underlying business remain strong as demonstrated again in FY20. While we continue to be faced with the current issues associated with the COVID-19 pandemic, we remain optimistic about the future.”

As expected, Nanosonics declined to provide FY21 revenue guidance, which is reasonable to me. However, it did say that it expects trophon unit sales (i.e. ‘capital sales revenue’) to be impacted by limited hospital access. Unfortunately, the pandemic will likely have a two-pronged impact on sales.

The company said a drop in the number of ultrasound procedures will also likely result in a decline to consumables revenue in FY21. That said, in the month of June consumables sales were around 80% of the level in the first three-quarters of FY20. That’s reassuring.

Operating expenses are tipped to be between $75 million and $78 million.

Is this an opportunity to buy NAN shares?

I’ve followed Nanosonics for years and really like the business. Based on my current expectations, I’d be happy to hold shares for the next five years.

Based on current share prices, Nanosonics is trading at around $1.92 billion in market capitalisation, or $1.83 billion in enterprise value (market cap less net cash). With free cash flow of $20 million, that’s an enterprise value to free cash flow (EV/FCF) multiple of 91x.

In my opinion, Nanosonics is one of the best mid-cap technology companies on the ASX. However, as Charlie Munger would say, even wonderful businesses are not worth an infinite amount.

At 91x FCF, for our Rask Invest membership service, Nanosonics is still too expensive to buy. However, due to its quality and growth potential, I’ll definitely have it on a watchlist and look to buy shares if it falls into a much more compelling valuation range (which I know is unlikely).

If you’re like me and interested in Nanosonics but not sure about the valuation, rest-assured the team here at Rask Media is writing about ASX growth shares daily. Bookmark our pages to come back regularly.

If you’re eager to sink your teeth into growth shares right now, two other ASX growth companies you might want to study now include Pushpay Holdings Ltd (ASX: PPH) or even Audinate Group Ltd (ASX: AD8).