The Zip Co Ltd (ASX: Z1P) share price has risen again today. It was up almost 6% in earlier trading.

Zip share price keeps going higher

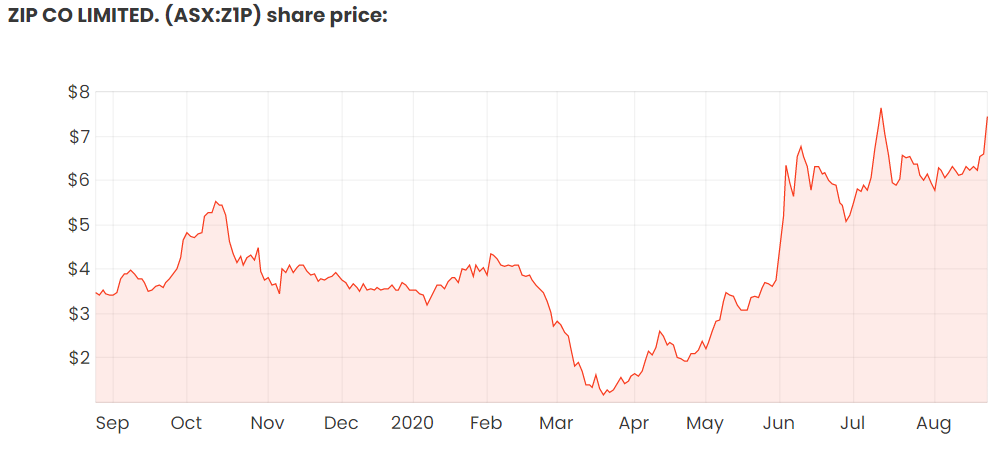

After yesterday’s large rise, Zip has continued to climb. It has been a very volatile last 12 months for Zip:

The cause of the latest surge for the Zip share price was yesterday’s update from its acquisition target QuadPay.

Zip said that QuadPay achieved record monthly transaction volume of more than US$70 million in July, representing a 30% increase in the June quarter average and a 600% increase year on year.

During July alone it added 133,000 customers and surpassed the 2 million customer milestone in August.

Management said that the enterprise sales pipeline going into the holiday period continues to remain strong.

QuadPay has established a strategic partnership with Fiserv (a global provider of payments and fintech services) to offer buy now, pay later services across its US based merchant base, launching with Fanatics.

In terms of profitability, QuadPay has net transaction margins (NTM) of more than 2%.

A few thoughts

Zip and its investments are clearly doing well. Buy now, pay later has shot up in popularity over the past few years, particularly since COVID-19 with consumers looking for ways to fund their purchasing.

However, the hard part is coming up with a fair price. When are these BNPL businesses going to turn profitable? Or is the share price just largely riding the momentum of positive news? I really don’t know. It makes it hard to calculate a good price to buy. It’s also harder to decide when you’d sell. How much competition can the sector sustain? I’d rather go for other ASX growth shares like donation payment business Pushpay Holdings Ltd (ASX: PPH).