The Lovisa Holdings Ltd (ASX: LOV) share price is tumbling today after the fast-fashion jewellery retailer delivered its full-year results.

In late morning trade, Lovisa shares have fallen more than 6% to $7.05, meaning shares are down around 43% year to date.

Unpacking Lovisa’s FY20 report

Lovisa reported $242.2 million revenue for the full-year, down 3.2% compared to FY19 due to disruptions in the second half related to COVID-19. As you’d expect, online sales soared during the year, up 311% for the full-year with 382% growth during Q4.

The retailer achieved strong growth in the first half of FY20, with total sales increasing 22.2% from the increased store network and comparable store sales growth of 2.1%.

However, Lovisa began to see the impact of the pandemic through Q3, initially in its Asian markets which then escalated to full store closures by the end of March.

Lovisa also experienced disruption to its supply chain, first with factory and warehouse closures in China, followed by freight disruption and bottlenecks.

These factors made for a difficult second half, with total sales in H2 down 32.2% on the prior year and comparable store sales finishing the year down 5.5%.

Gross margin also took a hit, falling from 80.5% in FY19 to 77.3%, largely due to a weaker Australian dollar for most of the year as well as the re-opening of stores post-lockdown.

Cost of doing business (CODB) increased to 59% of sales, slightly higher than 56% in FY19. Lovisa managed to achieve CODB of 50% in 1H20 but this was pushed up in the second half due to store network closures.

Despite the disruption in Q4, Lovisa achieved operating cash conversion of 115% as a result of tight working capital management during the height of the pandemic period and rent payment deferral.

The company also benefited from government support, reporting $11.8 million of wage subsidy grants during the year.

It wasn’t so pretty on the bottom line, with statutory net profit after tax (NPAT) tumbling 69.7% to $11.2 million. Excluding the impact of the new lease accounting standard AASB 16 and impairment charges related to the exit from the Spanish market, underlying NPAT was $19.3 million, down 47.8%. Along with lower sales and higher CODB, NPAT was weighed down by a significant step up in depreciation and amortisation expenses in FY20.

Store growth & regional performance

During the year, Lovisa continued its global rollout strategy and opened 66 new stores, primarily in the USA and France. There were also 21 store closures during the year, including all nine stores in Spain.

The Australia and New Zealand region delivered strong sales growth prior to COVID-19 and has recovered faster than other markets since stores reopened. The ANZ region saw a 9.9% decline in sales to $124.1 million in FY20 and is still far and away the company’s biggest revenue driver.

Europe and the US increased sales during the year, up 14.7% and 223.5% respectively, reflecting continued new store growth.

Sales in Asia were impacted the earliest by COVID-19 and have been slower to recover, down 26% for the year, while South Africa sales fell by 15.1%.

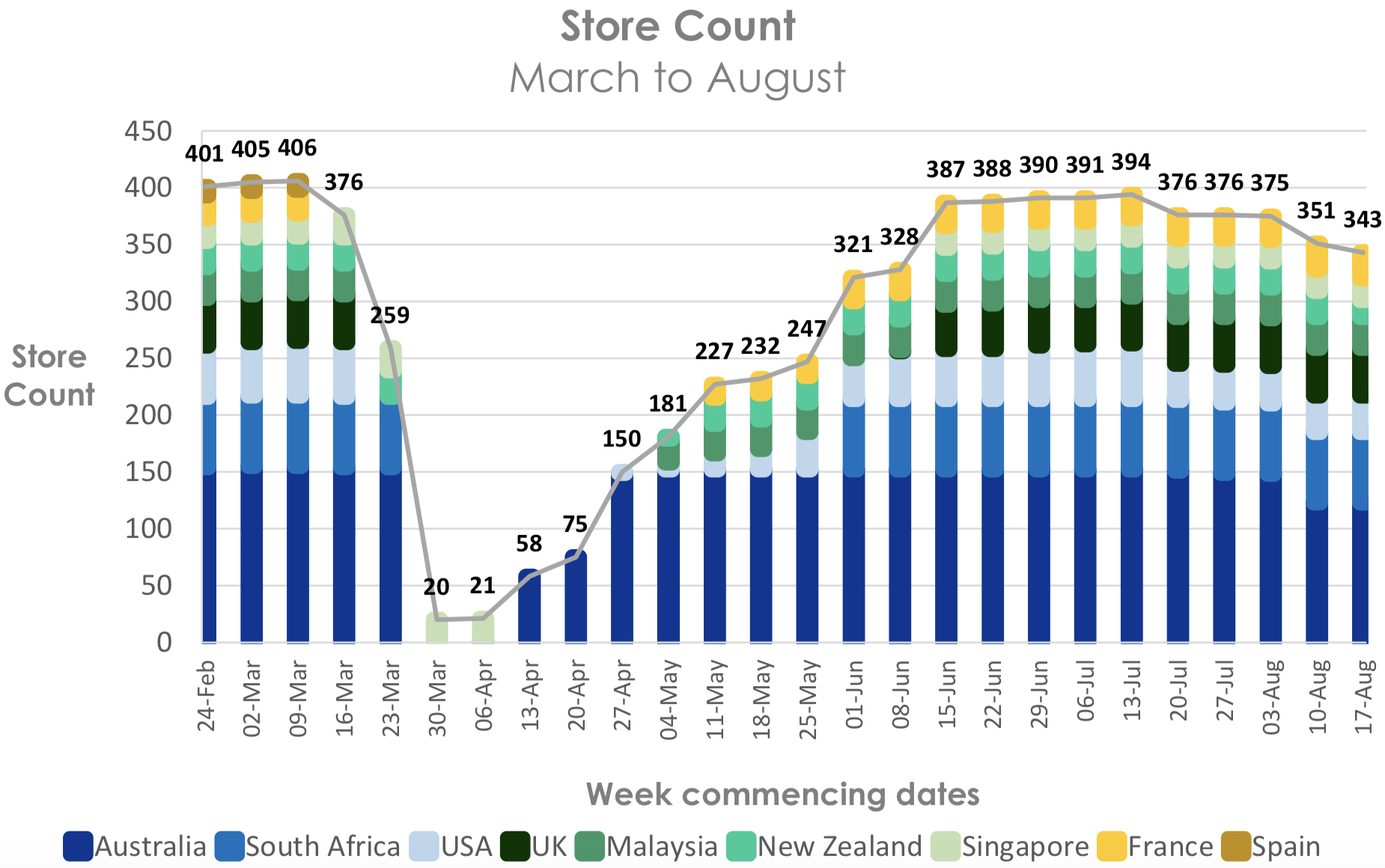

The following chart shows the progressive impact of COVID-19 on Lovisa’s store network. As you can see, there have been further store closures since the end of FY20 due to lockdowns in Victoria, California and New Zealand.

Lovisa dividend

Lovisa confirmed it intends to pay its deferred 15 cent interim dividend on 30 September as planned. The interim dividend was originally fully franked but due to lower tax paid in FY20, the franking percentage has been reduced to 50%.

Additionally, Lovisa decided not to declare a final dividend due to the ongoing uncertainty in the global market.

Commenting on future dividend prospects, the company said: “The Board will continue to assess dividend levels each half year and determine the appropriate level of dividend based on profitability, cash flows, and future growth capex requirements in the context of prevailing economic conditions.”

Now what?

Lovisa said trading for the first eight weeks of FY21 has been challenging as most markets continue to experience economic disruption. Comparable store sales for this period were down 19%, an improvement from comparable store sales in Q4 of -32.5%.

The company will continue to focus on opportunities to expand its store network in the coming year and has opened eight new stores so far in FY21, taking the total store network to 443.

As expected, Lovisa declined to provide guidance due to the current uncertain environment.

Summary

Overall, I thought this was a decent result considering the prevailing conditions. There’s a lot to like about Lovisa, including its founder-led management team, small store footprint and vertically-integrated business model, which translates to strong margins.

However, due to the cyclicality of the retail sector and the as yet unknown impact of JobKeeper payments, I’d rather hold shares in the growth company mentioned in the free report below.