The Flight Centre Travel Group (ASX: FLT) share price edged lower on Thursday after the company handed in its full-year results.

The travel company had already revealed its profit expectations (or lack thereof) earlier in the month, so investors had a fair idea of what to expect.

Here’s how the Flight Centre share price has performed over the last 12 months:

What did Flight Centre report?

Flight Centre reported an underlying loss before tax of $510 million, towards the upper end of the company’s guidance range of $475 million to $525 million.

The company’s statutory loss before tax came in at $849 million, around the middle of the guidance range of $825 million to $875 million. This statutory loss included $339 million in one-off items, including a $103 million COVID-19 impact and business impairment charges of $140 million.

This is a big swing from the $343.5 million profit before tax reported in FY19, such has been the significant impact of the pandemic on the travel industry.

Looking at the higher-level financials, Flight Centre delivered total transaction value (TTV) of $15.3 billion, down 36% on FY19.

The company noted that prior to COVID restrictions, it had actually achieved a $150 million underlying profit for the eight months to 29 February 2020 from record TTV. As you’d expect, Flight Centre recorded minimal sales from March onwards and most of the company’s forward leisure bookings were cancelled and the transactions reversed.

The decline in revenue was relatively consistent with that seen in TTV, down 36% to $1.9 billion.

Flight Centre received $98 million in government subsidies during FY20 and expects to receive a net benefit of around $10 million per month from the JobKeeper subsidy through to September. It then anticipates a net benefit of between $40 million and $50 million from October to March 2021.

At the end of the period, the company had $1.9 billion cash on its balance sheet, bolstered by a $700 million capital raising announced in April, and $463 million of debt.

Corporate travel

Flight Centre’s global corporate business encompasses the FCM and Corporate Traveller brands and operates across 23 countries.

The corporate business managed to turn a profit for the year, generating a $74 million underlying profit before tax from $7 billion in TTV.

“The FCM businesses in the key Americas and Europe, the Middle East and Africa (EMEA) markets both won accounts with projected annual spends of more than $US500million during the year, as FLT consolidated its position as a top-five global travel management company and increased its share of what was a $US1.5trillion market pre-COVID,” the company said.

Leisure travel

As announced previously, Flight Centre’s global leisure business recorded a $20 million profit to 29 February, before incurring significant losses during the four months to 30 June.

All up, the leisure business reported an underlying profit before tax of $527 million from $7.4 billion in TTV.

The company noted that to date, it has processed more than $600 million of full or partial refunds in Australia, its largest leisure market, passing on returned money from airlines and other suppliers back to customers.

In leisure e-commerce, the company generated nearly $1.2 billion in TTV during FY20, primarily through the Flight Centre brand websites, the Jetmax businesses (BYOjet and Aunt Betty) and StudentUniverse.

Flight Centre said StudentUniverse is among the businesses leading the company’s leisure recovery to date, with TTV now tracking at around 30-40% of prior year levels.

Trading update

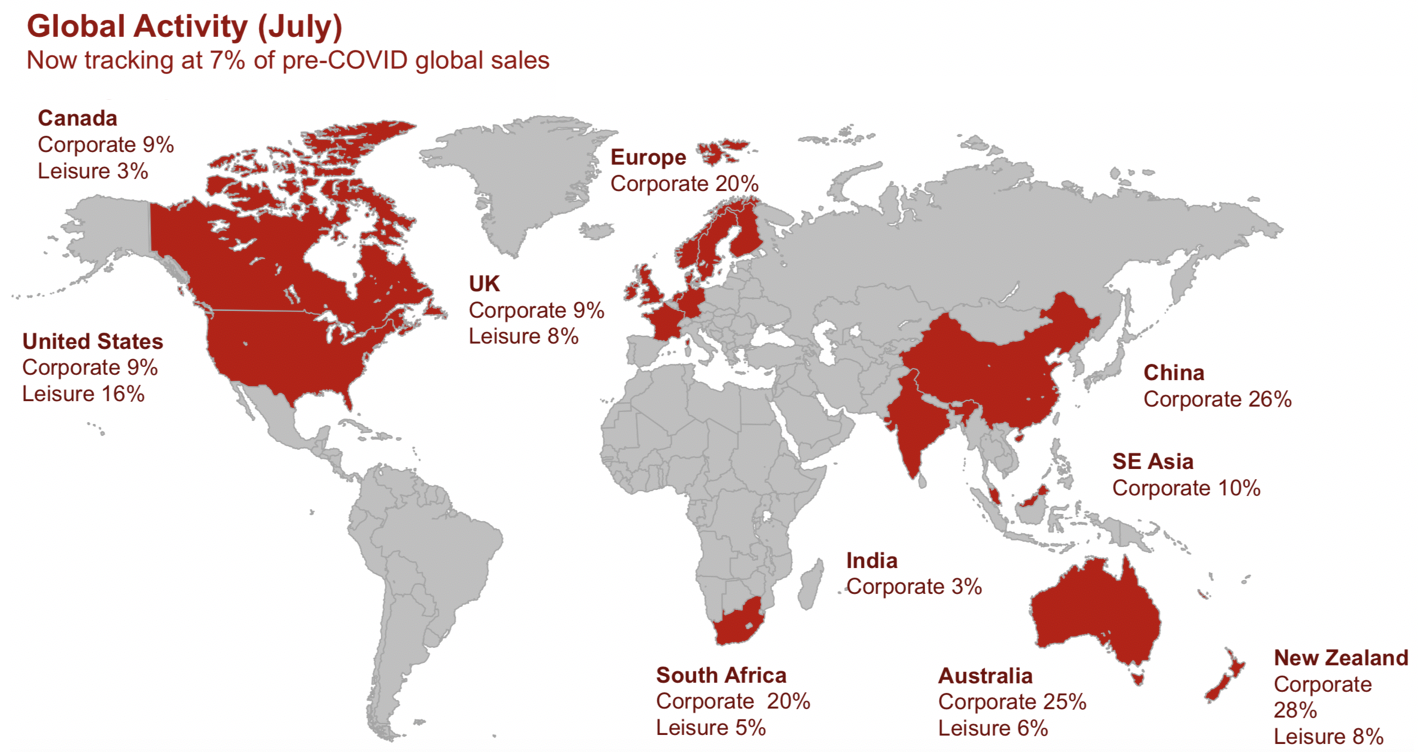

Flight Centre revealed that July revenue (excluding refunds) reached $17 million, around 7% of the prior year level.

Through a range of cost initiatives, the company comfortably exceeded its short-term target of $65 million net operating cash outflow by 31 July. In reality, it recorded $53 million net operating cash outflow in July. Including the net benefit from the JobKeeper subsidy, the outflow decreased to $43 million.

Flight Centre believes its current cost base can service 40% of normal TTV, which is likely to represent a break-even position.

“Travel is starting to gradually recover in locations like North America, Europe and South Africa, where domestic borders are now open, although we are also seeing heightened restrictions in Australia and New Zealand, after earlier relaxations,” said CEO Graham Turner.

The chart below shows how Flight Centre’s global sales were tracking in July:

Outlook

“While FLT has seen a consistent uplift in demand since April, widespread and ongoing travel restrictions – including key domestic border closures in Australia – continue to hamper a more meaningful industry-wide recovery,” the company said.

Given the limited visibility around the timeframes for travel restrictions to be lifted, Flight Centre declined to provide guidance.

The company also said that it believes demand for international travel, which is the leisure business’ primary revenue source, will not fully recover before FY23 or FY24 in the absence of an effective vaccine.

However, it expects gradual sales growth throughout FY21 as travel bubbles and corridors open between countries, and businesses and governments work together to develop broader re-opening strategies.

Flight Centre’s ASX travel peers Webjet Ltd (ASX: WEB) and Corporate Travel Management Ltd (ASX: CTD) have already delivered their full-year results.

Webjet reported a net loss of $144 million, while Corporate Travel delivered a net loss of $8 million.

For a run-down on the ASX shares that have reported this month, check out Rask Media’s ASX reporting season calendar – you’ll find links to our daily coverage in the calendar.