The Marley Spoon AG (ASX: MMM) share price will be on watch on Friday after the company announced its half-year results for the six months ending 30 June 2020.

For those unfamiliar, Marley Spoon is a subscription-based meal kit business that delivers fresh ingredients and recipes to your door. The company was founded in Germany in 2014 and completed its IPO on the ASX in mid-2018. Marley Spoon is a global business, operating across Australia, the US and Europe.

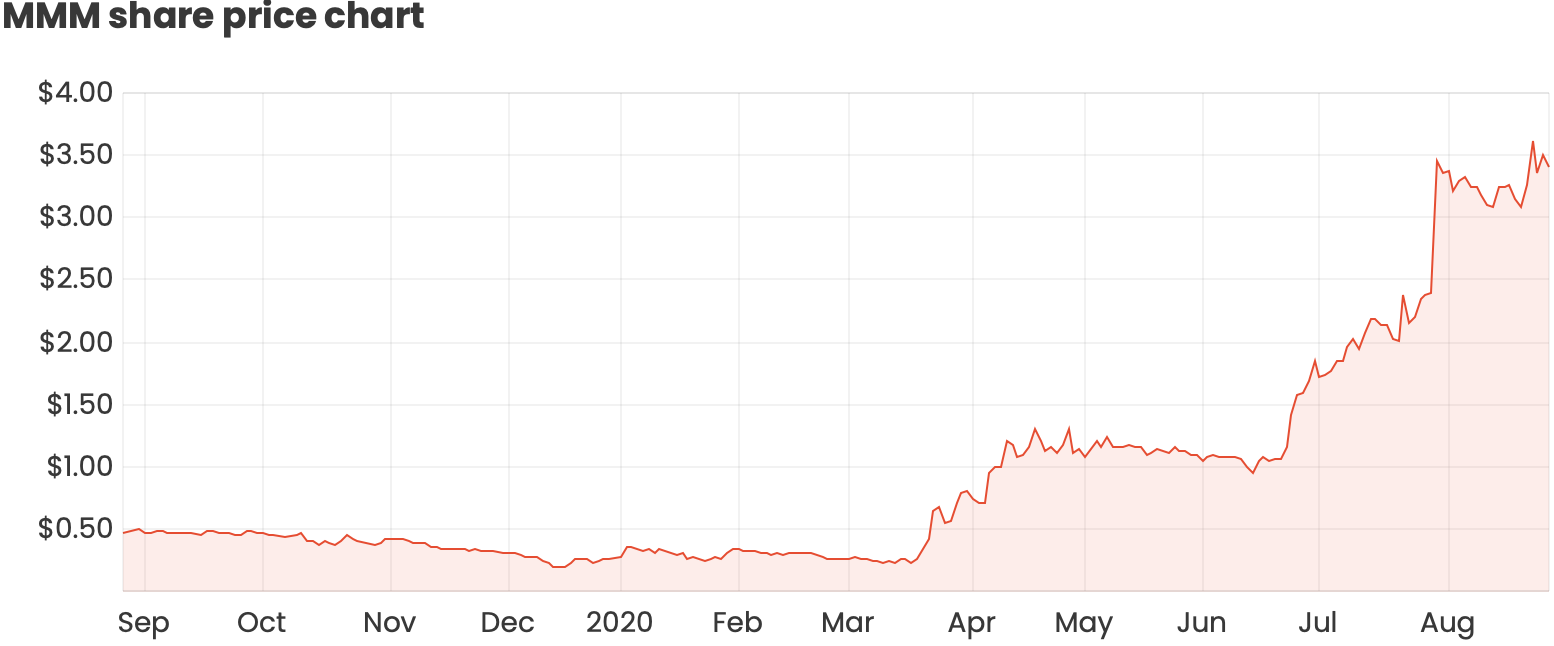

As you can see in the chart below, Marley Spoon shares have experienced a meteoric rise this year on the back of COVID-related surges in demand.

Unpacking Marley Spoon’s HY20 results

As the market is now well-aware of, COVID-19 fast-tracked the adoption of online grocery shopping, leading to accelerated growth of Marley Spoon’s global business.

As a result, Marley Spoon reported revenue of €116.2 million in the first half, up 89% on the prior corresponding period (pcp). The second quarter saw especially strong growth, with revenue up 129% to €73.3 million.

Existing customers increased their order frequency during the first half, with larger average order sizes at the end of Q1. This trend started to normalise in mid to late Q2, but the company noted that customer acquisition remained strong at an attractive cost per acquisition throughout Q2.

Importantly, Marley Spoon said customers acquired since the start of the pandemic have shown equally strong or better than normal retention rates. This allowed the company to continue to build up its back book of recurring revenue, which again accounted for 91% of revenue in the first half of the year.

“Since we last reported to the market at the end of July, the impact of the COVID-19 pandemic continues to create a favourable market environment for us. We still see an accelerated adoption of online shopping for all kinds of goods, including groceries. The resulting surge in demand for our brands has led to strong growth, a record margin and a positive operating cashflow for the half year as well as a profitable second quarter,” said chief executive Fabian Siegel.

Margins & earnings

Marley Spoon’s contribution margin, which represents the income it receives after accounting for cost of goods sold and fulfilment expenses, came in 137% higher at $35 million. As a percentage of revenue, the contribution margin sat at a record 30% in 1H20, an improvement of 6 percentage points on the pcp.

Together with slower increases in marketing and general & administrative expenses, this led to a notable improvement in EBITDA from a loss of €17.2 million in 1H19 to a loss of €2 million in the first half of FY20.

As previously announced, Marley Spoon posted a global operating EBITDA profit of €4.5 million in Q2. This marked the company’s first operating EBITDA profit on a group level – the Australian business has been operating EBITDA positive since the second quarter of FY19.

Operating metrics

Marley Spoon ended 1H20 with 350,000 active customers, up 104% on the pcp. On average, customers ordered 4.4 times in Q2, up from 4.2 orders per customer in the year-ago period.

Additionally, on average, 1H20 net order value increased to €45.90, representing a rise of 7% on the pcp.

Marley Spoon delivered 2.52 million orders in the first half, up 76% on the pcp, and provided a total of 20.9 million meals, up 98%.

Outlook & guidance

“While we prepared for a sizeable drop in quarter on quarter revenue for Q3, reflecting uncertainty of customer behaviour during the COVID-19 pandemic, this has to date not materialized. We are continuing to experience significantly reduced customer acquisition costs and strong demand for our brands in all regions,” Mr Siegel said.

Given the continued strong market environment and an overall acceleration in e-commerce, Marley Spoon has upgraded its revenue guidance to between 80% and 100% growth for FY20. This is up from guidance of 70% revenue growth announced in July.

Are Marley Spoon shares a buy?

Marley Spoon isn’t a company I’m overly familiar with but these results have certainly caught my attention. It’s worth noting though that Marley Spoon released a detailed market update at the end of July to discuss its first-half performance so a lot of these results have already been priced in. In fact, the Marley Spoon share price closed 44% higher on the day of the announcement in July, such was the strength of the update.

A few things I like about the company include the improving unit economics (e.g. lowering customer acquisition costs and expanding margins), the large degree of customer loyalty (demonstrated by the high proportion of repeat orders), and, of course, industry tailwinds.

These factors are certainly no secret though, as evidenced by how far shares have run this year.

Until I can get a handle on valuation, I’ll be watching on from the sidelines. For a growth share I’d be happy to buy right now, check out the company in the free report below.