The Openpay Group Ltd (ASX: OPY) share price tumbled 8% today as investors digested the buy now, pay later (BNPL) provider’s full-year results.

Unlike rivals Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P), who are worth a combined $29.5 billion, Openpay sits on the smaller end of the ASX with a market capitalisation of $465 million.

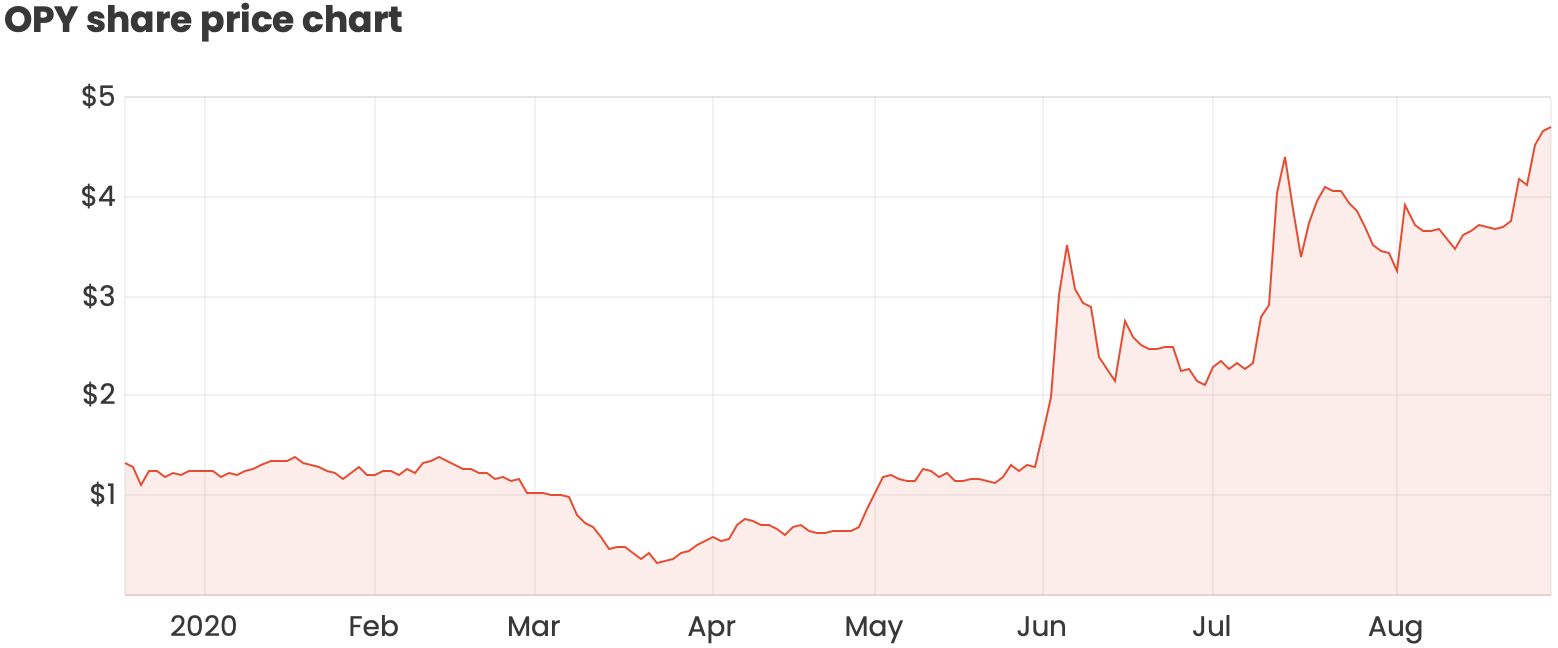

The smaller (and inherently riskier) nature of the business has helped Openpay achieve superior share price gains to those of Afterpay and Zip this year, with shares currently up 245% year to date.

However, Sezzle Inc (ASX: SZL) is still far and away the leader in the ASX BNPL space, currently sitting on a year-to-date share price rise of 390%.

What did Openpay report?

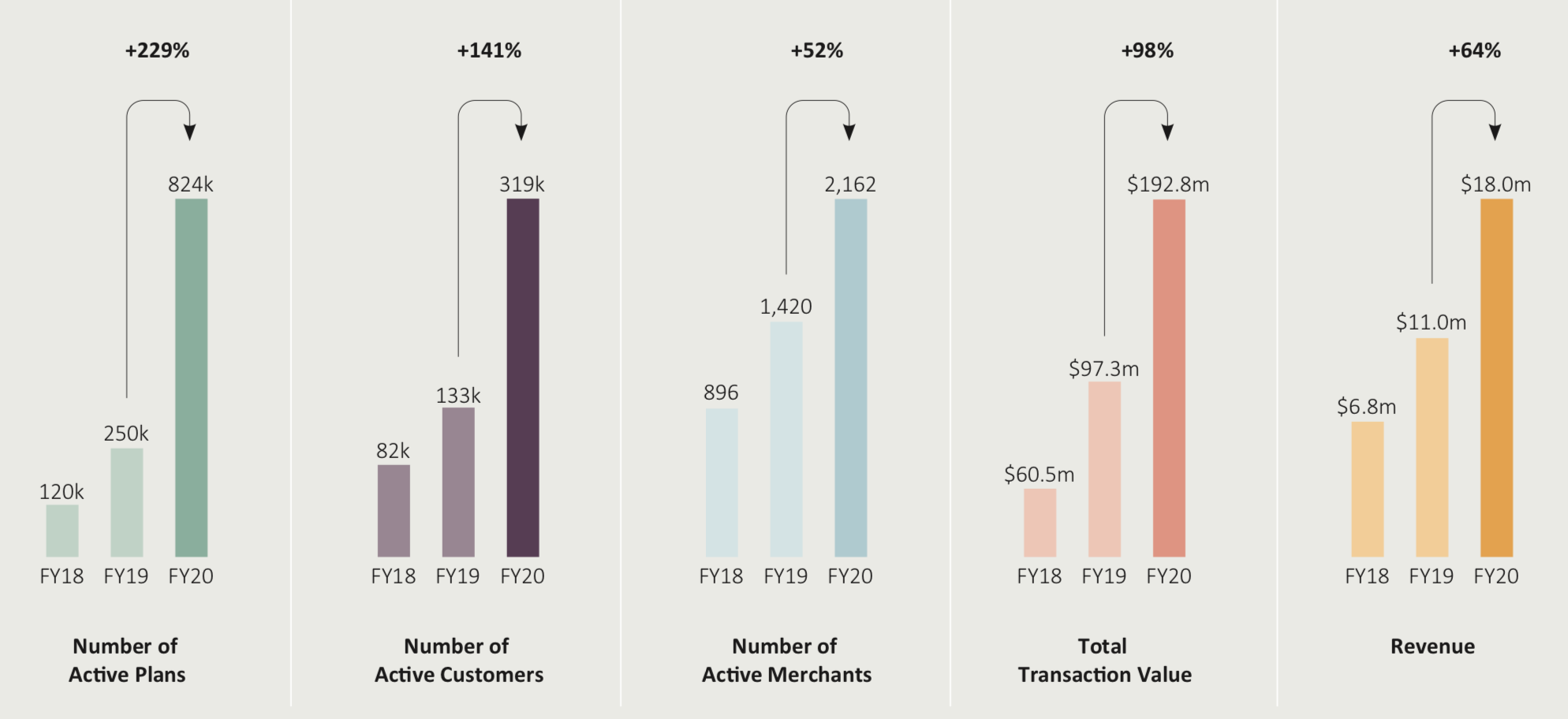

Here are Openpay’s headline results, courtesy of the company’s FY20 results presentation:

These results translated to an EBITDA loss before significant items of $30.1 million, expanding from a loss of $11.5 million in FY19 but landing in line with management’s expectations.

Operating expenses jumped 115% to $48.4 million, reflecting significant investments across personnel, processes and technical platforms to support future growth.

Openpay’s receivables impairment (i.e. bad debts) expense also increased to $7.9 million or 4.1% of TTV, driven by heightened credit provisioning policies in response to COVID-19.

On the bottom line, Openpay reported a statutory net loss after tax of $35.4 million, which compares to a net loss of $14.7 million in FY19.

The company finished the year with cash and cash equivalents of $70.1 million and $37.2 million of debt.

Operational performance

Openpay noted particularly strong growth in the automotive and healthcare verticals, where the company is typically either the sole BNPL provider or one of only two.

The automotive vertical recorded 92% growth in active plans and a 65% lift in active merchants, while healthcare saw a 127% jump in active plans and 42% growth in active merchants.

Unsurprisingly, the retail vertical enjoyed the strongest growth, particularly in the second half of FY20. Active plans increased by 160% over the prior year, while the number of active customers jumped 175%.

In the second half of FY20, Openpay also conducted a soft launch into two new verticals: education and memberships. The company noted this launch has been “promising”, with a number of active merchants established in each new vertical.

For example, Openpay recently announced a revenue-sharing merchant agreement with MSL Solutions. The deal will see Openpay integrate its BNPL offering with MSL’s golf and membership products.

Openpay is planning a hard launch for these new verticals in the first half of FY21.

UK business’ inaugural year

Openpay’s UK business, which was established in June 2019, has gotten off to a strong start. There are now 109,000 active customers in the UK, up 223% over the first half (off a low base), who took out 187,000 active plans in FY20.

The UK business only operates in the online retail vertical for now and its headline merchant is JD Sports.

Just last week, Openpay also announced a new merchant partnership with global e-commerce retailer The Hut Group, which operates some 200 websites primarily across the health and beauty sectors.

Now what?

Openpay already delivered a July trading update earlier in the month, revealing that its strong growth has continued into the new financial year.

Looking ahead, the company is focusing on three core strategic pillars:

- A strong local market

- A global vision; and

- Platform enrichment.

This includes driving platform utilisation and repeat customers growth, entering strategic partnerships to scale, exploring other markets to complement growth, and continuing to invest in core platform innovations, customer experience and advanced analytics.

In related news, ASX BNPL peers Sezzle and Splitit also reported today. Sezzle shares fell more than 9% on the back of its half-year report, while Splitit shares climbed nearly 2% after delivering record results.