Earlier in the week, payments giant PayPal Holdings Inc (NASDAQ: PYPL) announced its arrival on the buy now, pay later (BNPL) scene, causing a stir on the ASX.

The Afterpay Ltd (ASX: APT) share price has fallen nearly 10% since Monday’s close, while Zip Co Ltd (ASX: Z1P) shares have tumbled 23%.

So how is PayPal shaking up the BNPL sector and what does this mean for the likes of Afterpay and Zip?

Pay in 4

As early as next month, PayPal is set to roll out its ‘Pay in 4’ solution across the US. As it says on the tin, Pay in 4 allows customers to spread out payments into four, equal, interest-free instalments for purchases between $30 and $600. Customers won’t incur interest or origination fees, only a late fee if they fail to pay on time.

Sound familiar? It’s essentially the same model that Afterpay rose to fame with, and one that Sezzle Inc (ASX: SZL) also adopts. Zip differs in that it charges customers monthly fees, while Splitit Ltd (ASX: SPT) is different again as it tacks on purchases to a customer’s existing credit card.

Where PayPal’s Pay in 4 solution stands out from the crowd is merchant fees, or the lack thereof. Pay in 4 will be embedded into PayPal’s existing pricing structure, so merchants will be able to offer the instalment solution to its customers at no additional cost. PayPal’s standard ~2.9% transaction fee will apply as usual.

In contrast, Afterpay typically charges merchants 4-5% in the US, while Zip’s recently-acquired QuadPay business charges around 4-6%. In the most recent half, Sezzle’s merchant fees as a percentage of underlying sales were 5.7%. So from a merchant perspective, PayPal makes a very compelling case.

PayPal doubles down

As a PayPal shareholder, it would be remiss of me not to mention that the payments giant is no stranger to the BNPL sector. In fact, in its press release earlier in the week, PayPal referred to itself as the “originator in the buy now, pay later space”.

While Pay in 4 is its first fully-fledged offering that will directly compete with the likes of Afterpay, PayPal Credit (formerly Bill Me Later) and Pay After Delivery are solutions that have been around for many years now. PayPal also has localised instalment offerings in France and Germany, but these incur interest.

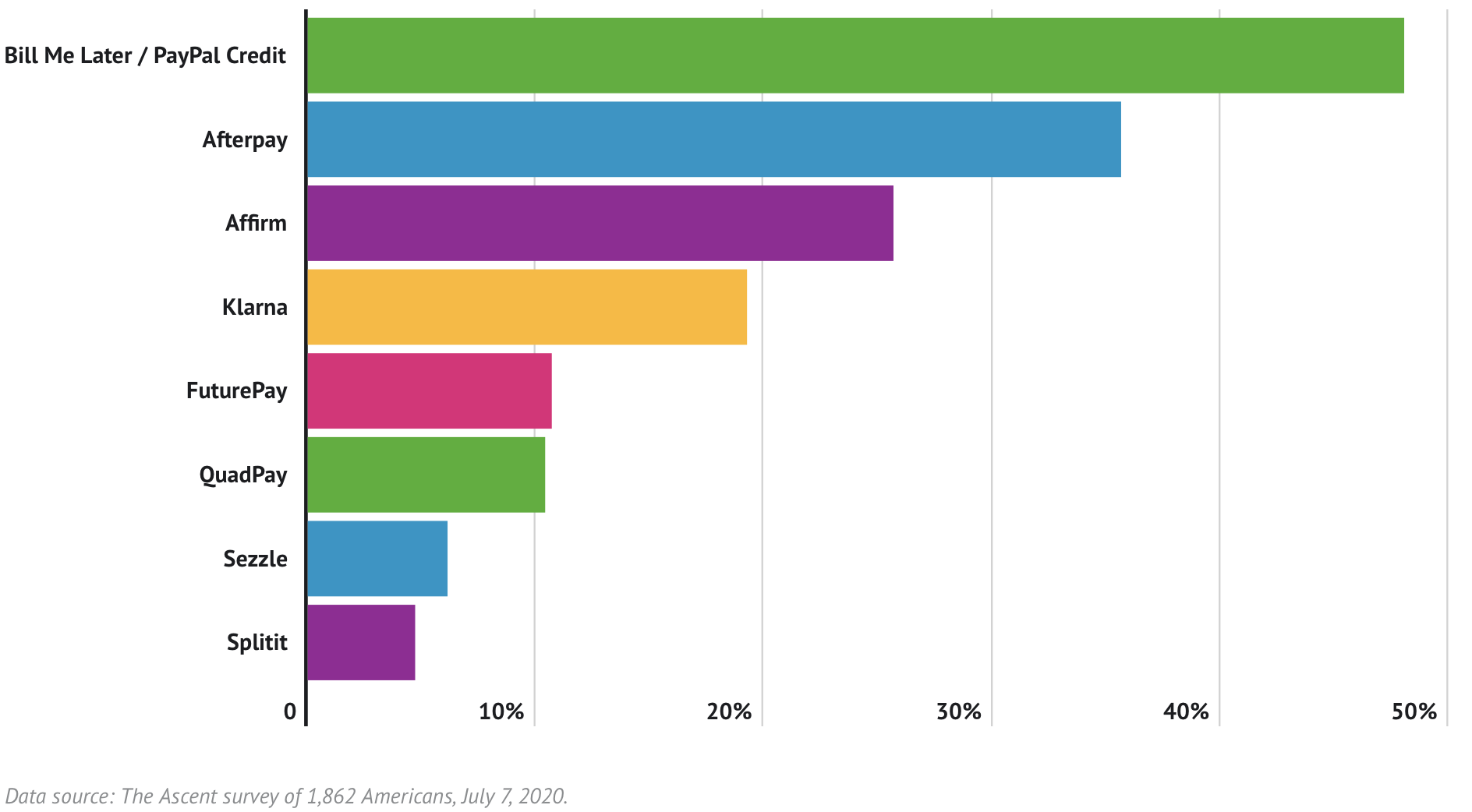

You might not be familiar with PayPal Credit, likely because it’s a US product, but a recent survey by The Ascent found that PayPal Credit was the most commonly used BNPL service in the US among the near-2,000 respondents. When asked which BNPL service they had used, these were the results:

What does Pay in 4 mean for Afterpay & co?

PayPal will likely lead the charge from a merchant perspective but the BNPL sector isn’t all about merchant fees. Although Afterpay generates the majority of its revenue from merchants (86% to be exact in FY20), its business lies first and foremost with the consumer. Merchants are willing to pay such high fees to BNPL companies because of the value proposition to their business. As many BNPL companies have been touting for some time now, adopting an instalment solution typically translates into incremental growth for merchants through higher conversion rates and larger carts.

For example, in its recent FY20 results presentation, Afterpay cited retail survey data that found 83% of retailers using Afterpay see improving conversion and fewer cart abandons, while 72% of retailers see expanding average order values and basket sizes.

As long as Afterpay, Zip, etc. can continue to deliver this incremental growth for merchants, retailers will likely be willing to fork out the extra fees. And as we’ve seen, there’s room for more than one player in the BNPL sector, with retailers often offering a whole host of payment options at the checkout.

That said, fee-conscious merchants will likely gravitate towards Pay in 4, especially those that already offer PayPal as a payment option. It’s worth noting that PayPal reported 26 million active merchants at the end of June – in contrast, Afterpay had 55,400 merchants, while Swedish fintech Klarna had around 200,000.

At the end of the day, I think it’ll boil down to which BNPL products resonate with consumers. Afterpay has a proven product, a cult-like following, an early-mover advantage in the US and recently launched a loyalty program, which should bolster customer retention rates. On the flip side, Pay in 4 hasn’t rolled out yet, so we’re yet to see what the usability and customer experience will be like, and how strong the take-up will be.

Now what?

Competition, low barriers to entry and margin compression have long been part of the bear case for Afterpay, so PayPal hasn’t exactly turned the game on its head. It’s simply thrown its hat in the ring into what was already a highly competitive space.

For long-term investors, the big question is whether Afterpay (or any other BNPL company) has a defensible economic moat, or a sustainable competitive advantage.

It certainly has a growing network effect – as more retailers come on board, the value of the product only increases for its customers and vice versa. And you could also argue that Afterpay has a strong brand. But it remains to be seen whether this will be enough to withstand competition once the BNPL sector matures.

Be sure to bookmark our ASX growth shares page, using your web browser, for daily stock ideas and insights from the team at Rask Media. Or get our in-depth and free investment report below.