AMP Limited (ASX: AMP) recently announced to the market a complete portfolio review of the group’s assets and business units.

Led by recently appointed Chairwoman Debra Hazelton, the firm has appointed Credit Suisse, Goldman Sachs and King & Wood Mallesons to oversee the review.

Why is this important?

Effectively, AMP is publicly stating the business is for sale.

The announcement confirms previous media reports that AMP has recently received interest from potential buyers, with Macquarie Group Ltd (ASX: MQG) and private equity firm KKR rumoured to be circling.

For shareholders, the sale of a business unit will likely yield an increased special dividend, similar to when AMP spun off its life insurance arm and returned $544 million.

In this case of a takeover, shareholders may receive compensation in the form of shares in the new company. For example, current AMP shareholders may receive shares in Macquarie Group on a pro-rata basis.

How has the AMP share price performed?

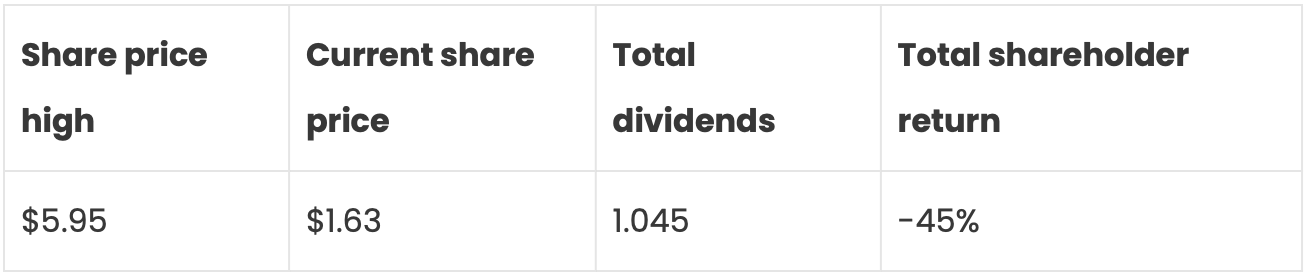

AMP has been a perennial capital killer over the past five years. At the time of writing, AMP’s share price has fallen 72% from the company’s original high of $5.95 in 2015.

While $1.045 in dividends has been paid during the period, this has resulted in an overall shareholder return of -45%.

More recently, the share price is down 16% year to date however is up 49% from its March 23 low of $1.10.

What is AMP truly worth?

With AMP marking its business units are up for sale, a sum-of-the-parts valuation provides investors insight into the true value of the firm.

AMP has four core business units:

- AMP Capital

- AMP Bank

- Australian Wealth Management

- New Zealand Wealth management

AMP recently paid $460 million to repurchase a 15% holding in AMP Capital. Using this transaction as a yardstick, this values AMP Capital at just over $3 billion.

Then taking the most recent half-year report, which states the weighted number of shares at 3.4 billion, and the current share price of $1.63, AMP has a total market capitalisation of $5.5 billion.

In round numbers, the value of the remaining three business units accounts for $2.5 billion of market cap.

Annualising the operating earnings from 1H20 implies full-year earnings of $254 million.

That values the remaining business units at a price-earnings (P/E) ratio of approximately 16.

Given the challenges currently facing the business and sum-of-the-parts valuation, I would wait and see what unfolds regarding potential offers for AMP.