The Laybuy Holdings Ltd (ASX: LBY) share price closed at $2.05 on Monday, recording a 45% jump on debut.

Laybuy considers itself as the pre-eminent buy now, pay later (BNPL) provider in New Zealand, where it was established in May 2017. It also has a growing presence in Australia and the United Kingdom, where it has been operating since May 2018 and February 2019, respectively.

As a result, Laybuy competes with both Afterpay Ltd (ASX: APT) and Openpay Group Ltd (ASX: OPY) in all three regions. Given that Afterpay and Openpay expanded into the UK in mid-2019, Laybuy had a head start.

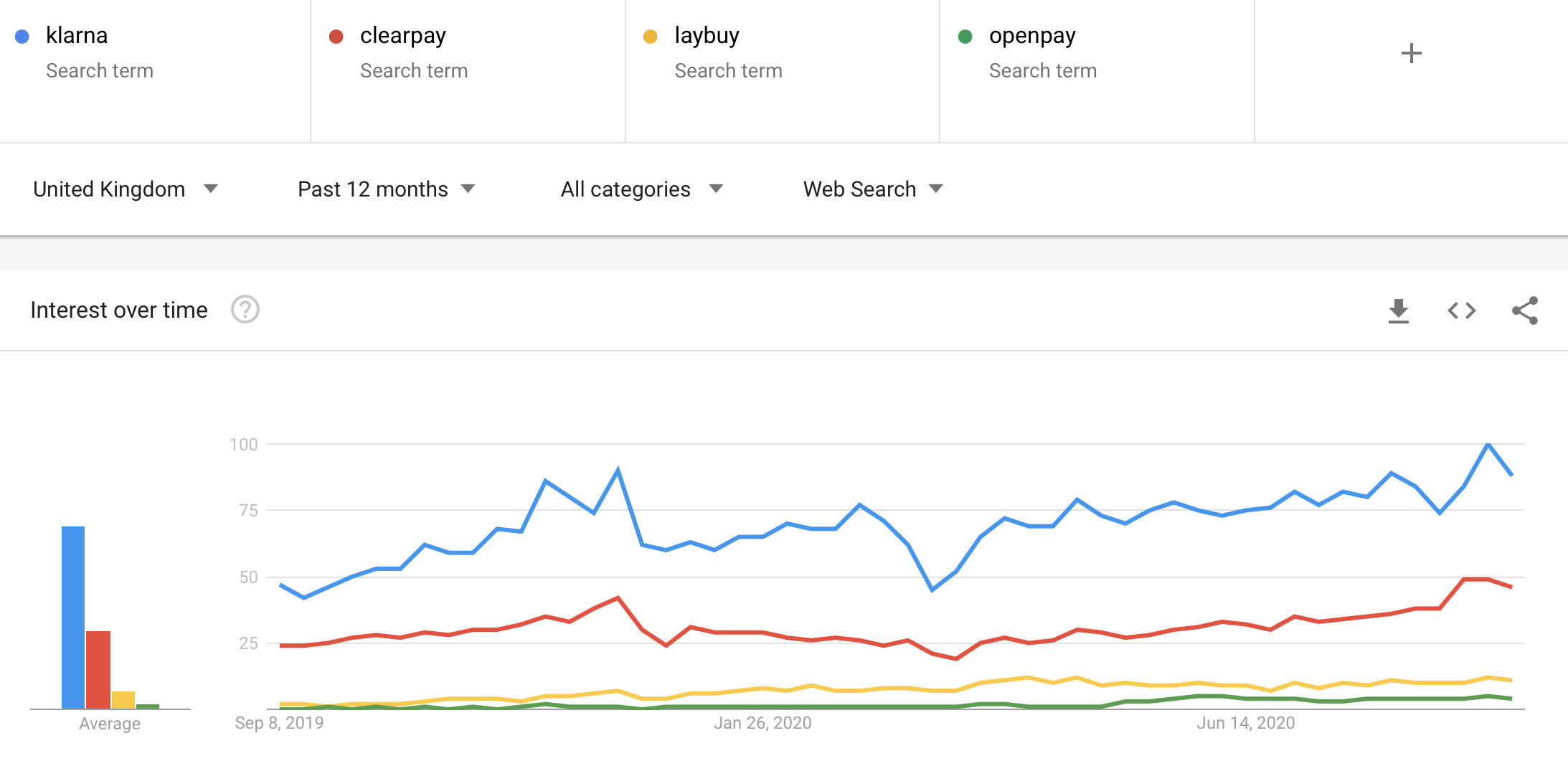

Google Trends data sheds some light on the BNPL landscape in the UK:

It’s no surprise that Laybuy decided to list in Australia instead of its home country. The ASX is home to six (now seven) popular BNPL companies, whose share prices have gone through the roof in recent months. As Laybuy founder and managing director Gary Rohloff put it, “the ASX is the most sophisticated buy now pay later market in the world … and it makes sense to be part of it.”

How does Laybuy work?

Laybuy operates a similar business model to Afterpay in that there are no sign-up or interest fees for customers, only a $10 late fee for missed payments.

However, the two companies differ in that Laybuy runs credit checks on prospective customers by using third-parties like Centrix and Experian. In contrast, Afterpay simply “reserves the right” to perform credit checks.

Additionally, Laybuy provides a weekly repayment schedule. Purchases are split into six equal instalments, the first of which is paid at the point of sale, and repayments are made on a weekly basis. Before entering the UK market, Laybuy commissioned a survey of over 1,000 UK residents to find out how they preferred to manage their finances (daily, weekly, fortnightly, monthly, etc.). Laybuy said that the most preferred option across those surveyed was weekly budgeting.

Additional features

The company offers something it calls Laybuy Boost, which allows customers to make purchases outside of their transaction limit by covering the shortfall at the point of sale. For example, if a customer’s limit was $500 but they want to use Laybuy on a $600 purchase, they can pay the excess $100 as their first payment at the point of sale. This is similar to Afterpay’s variable payment upfront feature.

Another distinct offering is Laybuy Global, which allows customers to purchase products online in their local currency with a merchant in a different country (given that Laybuy operates across Australia, New Zealand and the UK). As long as the merchant ships to that particular country, Laybuy will facilitate the transaction by taking care of the currency conversion and paying the merchant in their local currency.

Mastercard partnership

Laybuy recently signed a partnership with payments giant Mastercard which will enable it to issue digital cards to Laybuy customers in New Zealand. This will provide customers with an option to ‘tap and go’ at stores that accept both contactless payments and Laybuy.

Along with enhancing the in-store experience for both customers and merchants, Laybuy expects the partnership to broaden its revenue streams and deepen customer loyalty.

In its prospectus, Laybuy also noted it has engaged with a “major payments technology specialist” to bring a digital card to market in Australia and the UK. This company is EML Payments Ltd (ASX: EML), who will help Laybuy roll out a smartphone-enabled digital card in Australia in the second quarter of FY21, with further plans for the UK. Customers will be able to use the card to make both in-store and online purchases.

Headline metrics

At the end of June, Laybuy had more than 5,600 merchants and 470,000 active customers on its platform. This represents an increase of around 50% and 110%, respectively, compared to the prior year.

In terms of the UK market, which is currently Laybuy’s key focus, the company had more than 200,000 active customers and 400 active merchants at the end of July.

For the sake of comparison, Openpay reported around 109,000 active customers in the UK at the end of June from 25 active merchants, while Afterpay had one million active customers and 1,100 active merchants.

Leading merchants currently offering Laybuy at the checkout include JD Sports, Cotton On, The Hut Group and boohoo. Laybuy also has relationships in the English Premier League – it’s the official BNPL partner of Manchester United and Manchester City, and also provides BNPL services for Arsenal’s online store.

Turning to gross merchandise value (GMV), also known as underlying sales or total transaction volume, Laybuy processed NZ$86.7 million of sales through its platform in July and August 2020. This equates to roughly NZ$520 million on an annualised basis.

Laybuy’s financials

Like most Kiwi companies, Laybuy has a financial year ending 31 March.

In FY20, Laybuy reported merchant revenue of NZ$7.1 million (up 63%) and generated NZ$6.6 million from late fees (up 137%). It’s worth noting that Laybuy expects late fees to reduce as a percentage of income in each market as that market matures.

This is because the company prevents customers with overdue payments from making further transactions on its platform. Therefore, as a market matures over time, the customer base remaining on the platform should increasingly comprise customers who are up to date on their payments (and thus, do not incur late fees).

Notably, the company recognised receivables impairment expenses (i.e. bad debts) of NZ$9.2 million in FY20, up from NZ$1.7 million in the prior year.

This represents 4.1% of GMV and completely wiped out the company’s full-year gross profit. Laybuy attributed the increase to its growing customer base and entry into new markets, which brings initial risk and cost until the customer base begins to mature. The company noted that receivables impairment expenses dropped to 3.1% of GMV in the first quarter of FY21 (i.e. the June quarter).

After accounting for NZ$16.2 million of operating expenses, Laybuy posted a statutory net loss after tax of NZ$16.1 million for the full year.

Now what?

Many investors are describing the ASX BNPL sector as a bubble that’s ready to burst. As it stands, Afterpay shares are up 160% year to date, while Zip and Openpay have jumped 95% and 168%, respectively.

With a current market cap of $357.7 million and pro forma net cash of $46.1 million, Laybuy’s enterprise value currently sits at around $311.6 million. This means that shares are trading on an enterprise value/revenue metric of approximately 19.7x for the 12 months to 30 June 2020.

According to Yahoo Finance, Afterpay is trading on enterprise value/revenue of 48.3x, Zip 22.7x, and Openpay 19.0x.

With low barriers to entry, the BNPL sector is getting extremely crowded, very quickly. While there is certainly room for multiple players in the BNPL sector, it remains to be seen whether all of these companies will be viable businesses in the long-run when the market matures.

For an ASX growth share that is arguably up against less stiff competition, grab a copy of the free investment report below.