Since August, the Integrated Research Limited (ASX: IRI) share price has fallen over 25%. Could this represent a good buying opportunity or has something structurally changed within the company?

What does Integrated Research do?

Integrated Research has positioned itself as a global leader in developing enterprise software able to monitor and troubleshoot critical IT infrastructure, payments and communications systems. 95% of its revenue comes from overseas, reaching over 60 countries globally.

Its main customers are large organisations such as banks, credit card companies, stock exchanges and telecommunication carriers. The company’s suite of prognosis products can quickly identify the root-cause of problems, resulting in significant cost savings and avoiding downtime and outages.

Why has the IRI share price been falling recently?

I think Integrated Research shares had been gaining a lot of popularity this year, especially leading up to its FY20 results. The drop in share price was most likely due to the market expecting more in terms of revenue and profit growth.

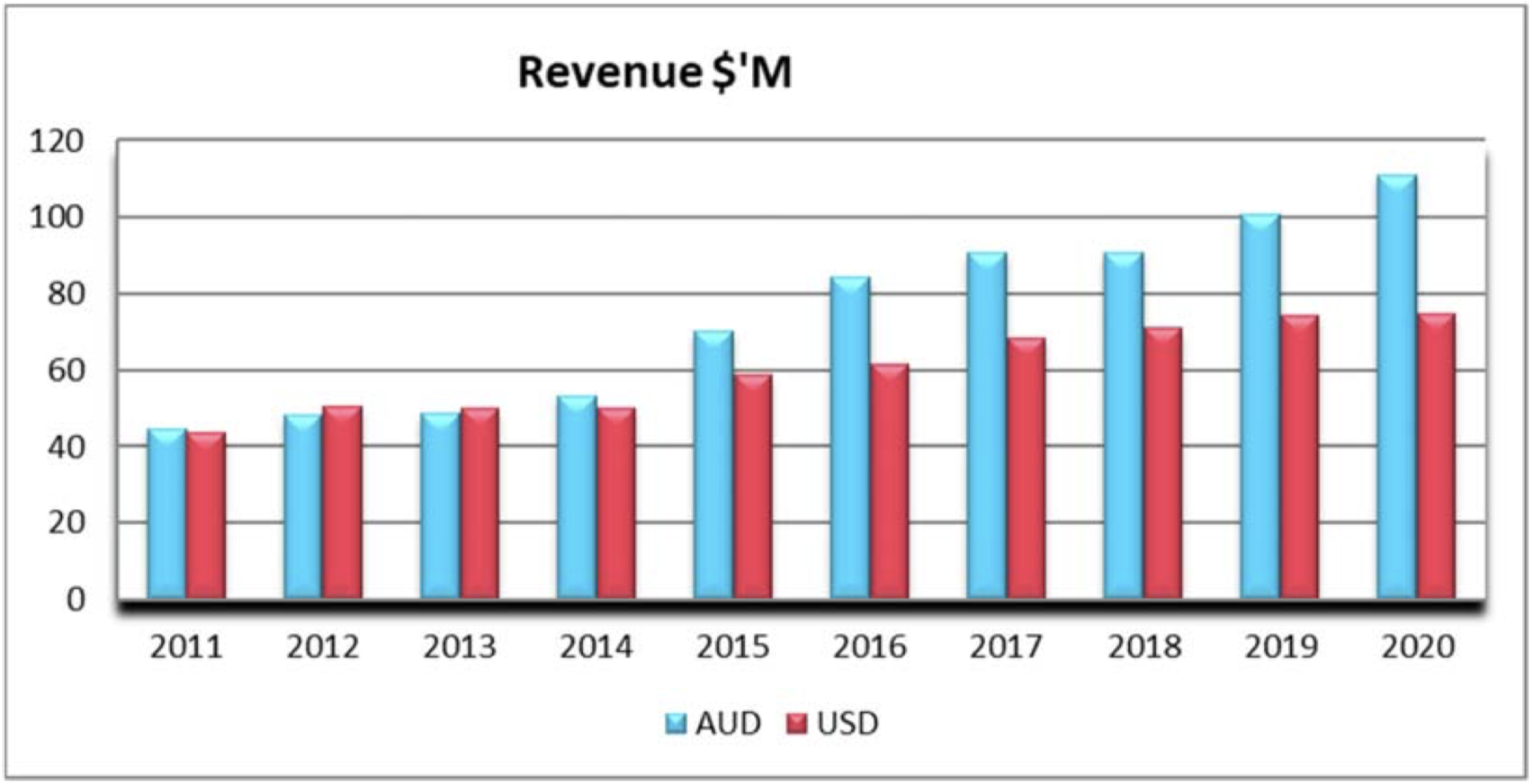

This shouldn’t have come as a surprise though. In July this year, the company released profit guidance anticipating approximately a 10% increase in both revenue and net profit after tax (NPAT). Sure enough, management followed through with its guidance and reported its seventh consecutive year of annual profit growth of $24.1 million, up 10% from FY19. Total revenue came in at $110.9 million, also up 10%.

Why I like the fundamentals of Integrated Research

I don’t think the recent sell-off is a reflection of the underlying quality of Integrated Research. In fact, I think it has a lot of attractive features that should allow it to continue to grow into the future.

1. Sticky customers

90% of Integrated Research’s revenue comes from multi-year contracts. In March this year, IR signed its biggest deal with JP Morgan, a five-year contract with a value of US$10 million. Its customer base isn’t too concentrated as well, adding 38 new customers in FY20.

2. Strong, consistent results delivered by management

Past performance isn’t indicative of future results, but it’s easier to trust the management team if they have a great track record of growing the numbers. IR has been able to deliver a stable and consistent level of growth in both revenue and NPAT.

3. Strong balance sheet

FY20 cash position of $9.7 million with $5 million of debt which was drawn from its credit facility to fund working capital requirements. This appears to be the first time IR has had debt on its balance sheet for several years. This is a strong example of its ability to make smart capital allocation decisions mainly from equity funding.

Buy/hold/sell?

I see Integrated Research as a company operating on really strong fundamentals that has gone through a significant pull-back recently. For a company that pays a dividend and has a great track record, IR would be a buy for me. Given the latest US technology sell-off, I’d probably wait and see if I could get it at a slightly bigger discount though.