Brickworks Limited (ASX: BKW) shares are down after reporting its FY20 result showing a big drop in underlying profit.

Brickworks FY20 result

Brickworks reported that its (continuing) revenue increased by 4% to $953 million.

Underlying EBITDA (click here to learn what EBITDA means) dropped 19% to $281 million and underlying EBIT fell 34% to $206 million.

Underlying net profit plunged 38% to $146 million. However, statutory profit soared 93% to $299 million.

What happened?

The statutory result benefited from the Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) accounting profit from the merger between Vodafone and TPG Telecom Ltd (ASX: TPG). You can read about the WHSP result here.

Australian building products

Brickworks explained that its Australian building products division was resilient with revenue only down 9% to $687 million, but EBIT was $33 million, down 43%.

The company implemented shutdowns across its network in March and April to prevent stock building.

Austral Bricks earnings on the east coast was particularly resilient, with higher earnings in Queensland, SA and Tasmania.

North America

The US division is seeing more disruption than Australia. For Brickworks, it benefited from owning its US acquisitions for a full year.

The North American division delivered EBIT of $10 million, up 63% and EBITDA of $27 million, up 122%. This result was hampered by COVID-19 impacts.

Management still believe these operations provide Brickworks with additional diversification and strong prospects for growth over the long term.

Property Trust

The property trust generated EBIT of $129 million, largely thanks to the joint venture with Goodman Group (ASX: GMG).

All property trust assets were revalued during the year and this resulted in a revaluation profit of $53 million. A development profit of completed facilities at Oakdale South also contributed $25 million in earnings.

The trust’s net rental income rose by 15% to $30 million with rent reviews and new developments.

Brickworks’ share of net assets was $727 million, up $94 million.

Investments

You can read about the full WHSP result here.

WHSP EBIT fell 51% due to the impact of lower coal prices. However, a $244 million after tax profit was recorded by Brickworks in relation to WHSP’s significant items, largely relating to the TPG merger.

Brickworks received $56 million of dividends from WHSP. At 31 July 2020, the WHSP market value was $1.844 billion. Since then, the value has increased by 17% to $2.149 billion.

Dividend

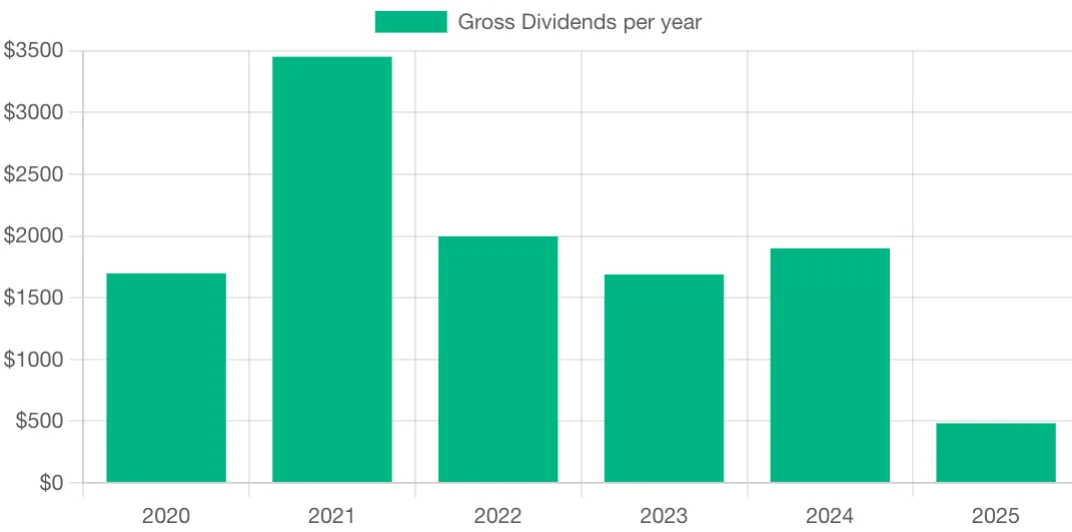

Brickworks declared a final dividend of 39 cents per share, an increase of 3%. That brought the full year dividend to 59 cents per share, an increase of 4%.

This increase means the Brickworks ordinary dividend has been maintained or increased for 44 years – no cuts.

Outlook

COVID-19 has accelerated online shopping and is fueling demand for Brickworks’ prime industry property. Interest from potential new tenants is strong, with discussions underway with several parties.

In the Australian building products division, orders and sales increased in September across most businesses, reflecting the various government stimulus measures in place. Activity is building across the country, however conditions remain tough in Melbourne, and it’s challenging in Sydney because of higher land prices.

In North America, short term demand is still being impacted. Delays are expected for some time. However, improved efficiency and cost reductions along with plat upgrades will help future performance once the pandemic passes.

I think Brickworks is a solid ASX share and could be worth owning for the long term as its various assets continue to grow their earnings potential. The property trust seems particularly compelling for the next few years with Amazon scheduled to be a tenant in a couple of years.

Brickworks is a solid ASX dividend share option, but there are other options like WHSP and APA Group (ASX: APA) which I wrote about here.