Are big four ASX bank shares ‘risky’?

Specifically, I am referring to Australia and New Zealand Group Ltd (ASX: ANZ), Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Ltd (ASX: NAB) and Westpac Banking Corp (ASX: WBC).

One way to measure the systematic risk (i.e. market risk) of shares is to calculate and compare their betas (β).

What is ‘beta’?

Beta measures how volatile a share price is relative to the market over a given time period. Beta is an input into the CAPM (capital asset pricing model) formula and is used by many analysts to determine the return they should expect from a share. A higher beta indicates greater volatility, and that investors should expect a greater return.

A beta of 1 means a company’s share price moves in lockstep with the market. For example, an ETF that tracks the S&P/ASX 200 (ASX: XJO) should have a beta of 1 compared to the ASX 200.

A beta of less than 1 indicates the company’s share price tends to be less volatile than the market, while a negative beta indicates the share price moves (on average) in the opposite direction to the market.

Beta is based on historical information. Therefore, a company’s beta will change over time. In my view, it’s important to have an understanding of what beta means, but it’s much more important to try to understand how the fundamentals of a company are evolving.

Show me a high and low beta company

WiseTech Global Ltd (ASX: WTC) has historically had a high beta, while CSL Limited (ASX: CSL) has historically had a low beta.

Levered betas in this article have been sourced from Infront Analytics. A levered beta takes into account the capital structure (debt/equity ratio) of the company.

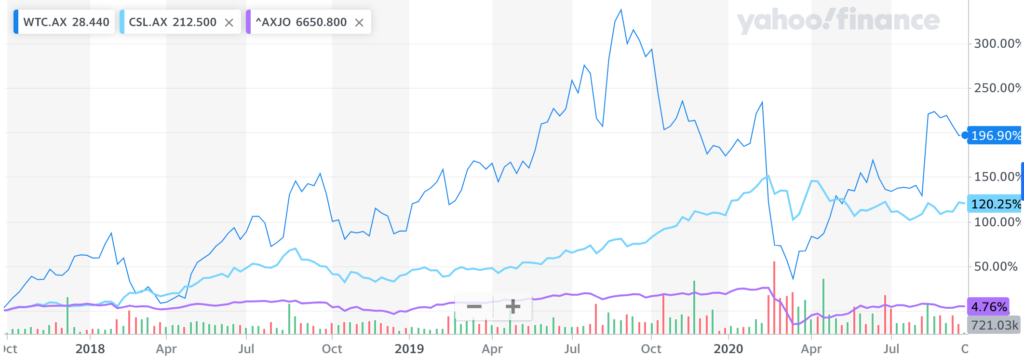

Over the last 3 years, the ASX 200 delivered a return of 4.76% excluding dividends. Two companies which have handily outperformed the market are CSL and WiseTech Global. However, they did so with vastly different betas.

CSL has a 3-year levered beta of 0.87 and has delivered a return (excluding dividends) of 120.25%, comfortably beating the ASX 200’s return of 4.76%. WiseTech has delivered a superior 3-year return of 196.90% (excluding dividends), but with some gut-wrenching moves. WiseTech’s 3-year levered beta is 1.42.

CSL has a lower beta than the market yet managed to outperform the ASX 200. CSL is generally considered a defensive company. In contrast, WiseTech is considered a growth company, and has enjoyed big runs and huge sell-offs. Which would you prefer to own?

Betas of the big 4 ASX banks

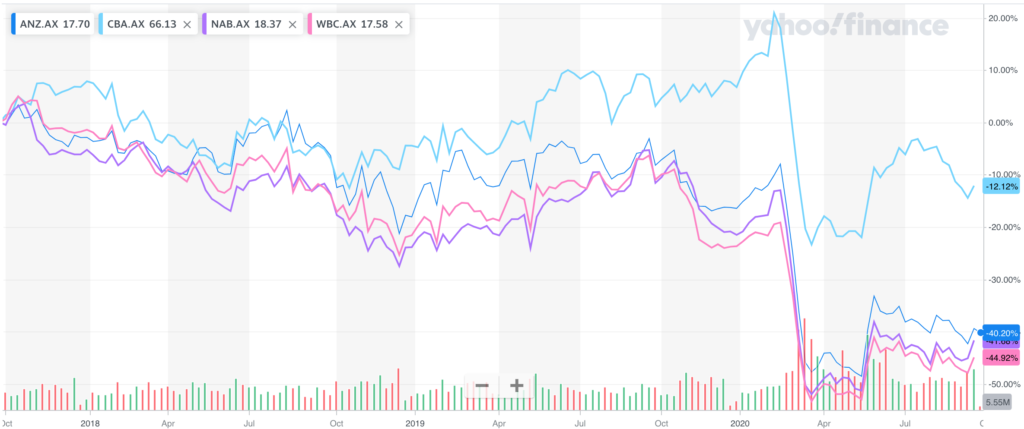

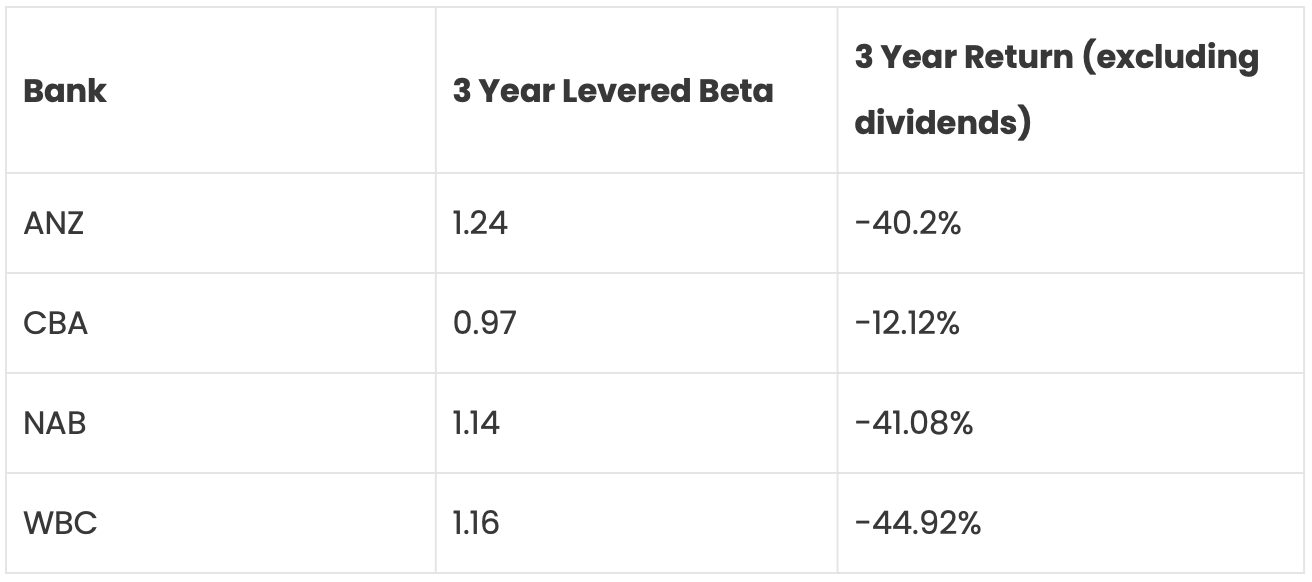

CBA is the only big four bank that has a 3-year levered beta less than the market. It has held up the best, albeit still underwater (excluding dividends), of the big four banks. According to the CAPM theory, CBA has the least systematic risk of the group and therefore, a lower required return.

The remaining big banks were all more volatile than the market over this time period and delivered negative returns (excluding dividends) for shareholders – not a good combination.

The table below is for illustrative purposes and shows the 3-year levered betas and returns of each of the big 4 ASX banks.

Keep in mind that dividends are a major source of returns from ASX bank shares. For the record, I own shares in NAB but I am considering switching to CBA.

In related news, ASX bank shares surged on Friday after Australian lending laws were relaxed.