CSL Limited (ASX: CSL) has continued to be in the top 20 traded shares on the ASX recently.

Mixed announcements have resulted in a volatile share price, with the latest announcement causing the CSL share price to rally on the back of COVID-19 vaccine plans.

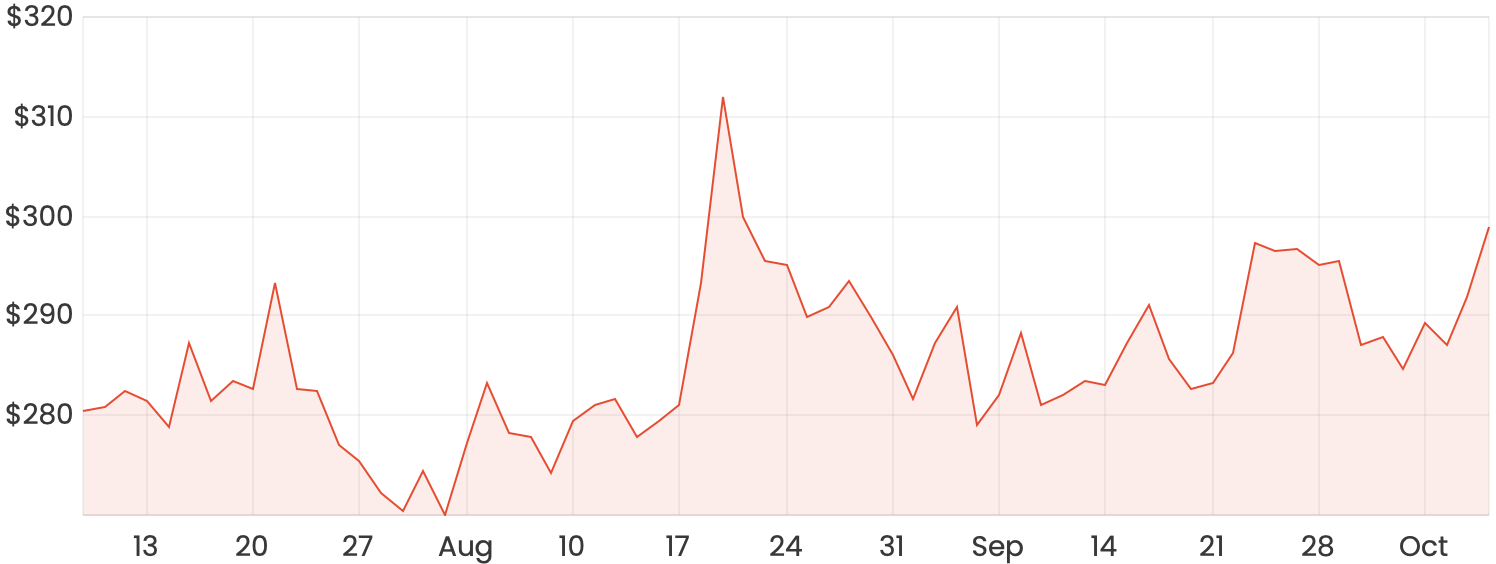

CSL shares are trading at $296 at the time of writing.

CSL share price chart

For an ASX share that is meant to be one of the more defensive picks, CSL has had a volatile journey this year. Initially, worldwide lockdowns threatened to significantly impact blood collection volumes, especially in the US.

There was then some optimism when CSL announced last month it had signed two deals for two separate COVID-19 vaccines. Despite this result, the market found this difficult to price in and the CSL share price remained relatively flat.

The most recent announcement has been good news, but I have some concerns towards the macroeconomic environment that CSL operates within.

What’s caused the recent CSL share price volatility?

Despite strong FY20 results, increasing pressure from competition is now a significant risk facing CSL’s market share.

CSL’s immunoglobulin therapies make up 40% of revenues. Now with rivals such as Roche, Sanofi and Takeda approaching commercialisation with similar therapies, some analysts are saying that CSL may have to increase spending in research and development in order to stay ahead of the competition.

This is interesting because last year, CSL CEO Paul Perreault actually challenged its rivals such as Takeda to “step up” or risk demand greatly outstripping supply in the global immunoglobulin market.

It seems healthy competition in this industry is ideal from an ethical standpoint, as supply can be matched to meet global demand. However, financially this is less than ideal because while some have pointed out that CSL has enjoyed a monopoly in the past, increased competition can only bring market share down, which hurts financial performance.

I don’t doubt that CSL would be a strong, defensive, dividend-paying share that’d still perform quite well in the long-term. However, I’m really interested in companies that still have a large runway for growth and aren’t under as much pressure from competition.

Why I prefer Xero shares

I recently wrote an article on Xero Limited (ASX: XRO), which explains why I think it could be a further wealth winner. Xero doesn’t have a monopoly, which means it can still expand into new markets and not be brought down by the competition as much as in a monopolistic situation.

Xero is well-established in Australia but has only tapped into 20% of the total addressable market in overseas regions. This remaining 80% represents the growth runway I mentioned earlier.

Xero has had a great track record of growing the business and showing disciplined cost management. The cost structure scales extremely well as the business increases its revenues.

Maybe I’m biased towards software-as-a-service (SaaS) businesses, but CSL is a hold for me currently.