The Flight Centre Travel Group Ltd (ASX: FLT) share price has fallen recently amidst further uncertainty around the COVID-19 pandemic.

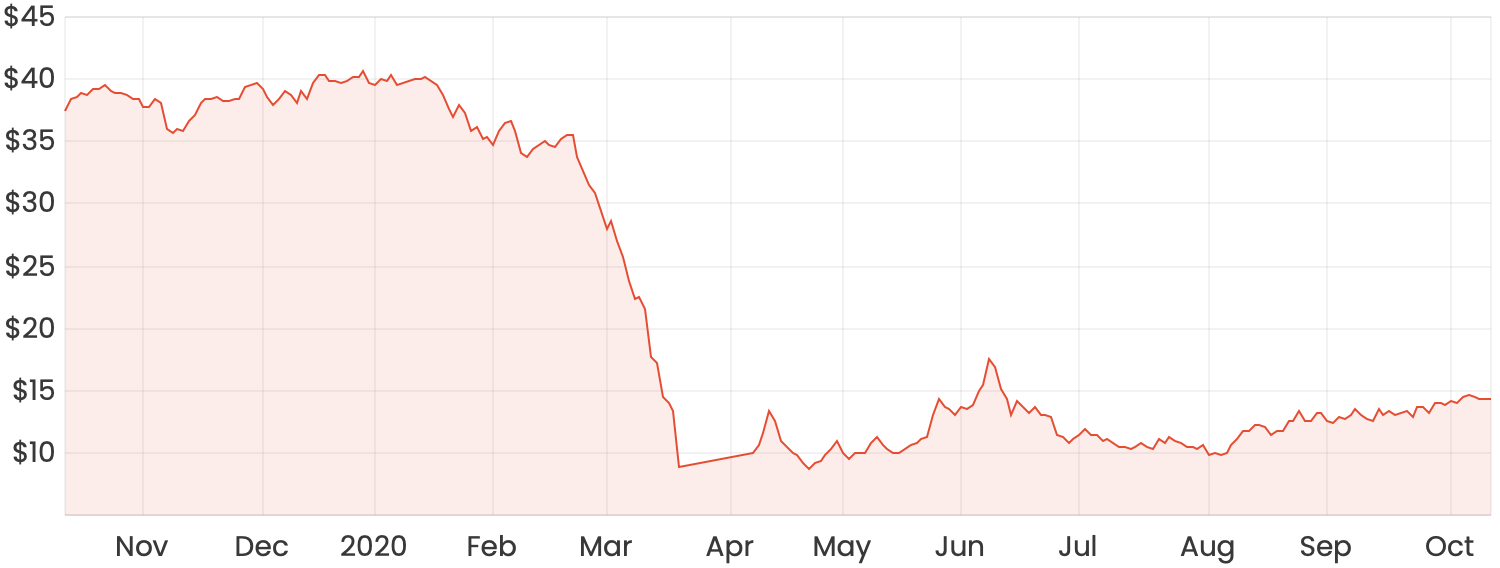

Flight Centre shares currently trade at $14.25, still nearly 65% lower than pre-COVID levels. While some investors are playing this as a turnaround, others are fearful due to the uncertainty on how long the effects of COVID-19 will last, and whether the company has the financial capacity to survive while the pandemic plays out.

Flight Centre’s response to COVID-19

The company has taken significant measures to slash its cost base, including laying off 70% of its 20,000 strong workforce. Around half of its physical stores have been shut, contributing to the company being able to achieve a cost base of around 31% of pre-COVID levels. CEO Graham Turner said that with current operating costs, the company should be able to break even with around 40% of its pre-COVID booking levels.

To help offset the drop in sales, Flight Centre has secured funding from various sources to strengthen its cash position.

In March, the company issued an additional 97 million shares at $7.20 each, raising a net amount of $679 million. In July, the group was granted a debt facility of up to £65 million, with a maturity able to be extended to March 2022.

Flight Centre finished FY20 with a cash balance of $1.9 billion. After adjusting for short-term liabilities, this represents around $1.1 billion in liquidity. The company estimates a monthly cash-burn of around $43 million. Management outlines that its corporate arm is making the strongest recovery, and the overall business should be able to survive in the medium term with its current cash levels.

My thoughts on Flight Centre shares

I don’t think this is the sort of share that will see a v-shaped recovery off the back of a vaccine announcement. Flight Centre generates revenue by collecting a percentage of the total transaction value (TTV) on holiday packages.

Given that we will likely see a staggered approach to resuming international travel, it is going to take a significant amount of time for the company to generate the same level of revenues it was collecting pre-COVID.

Considering the strength of Flight Centre’s balance sheet and its approach to cutting costs, it’s unlikely the business will fail in the near-term. If a vaccine still isn’t available within a year, it’s probable the company will be able to obtain further funding through a mix of debt and equity.

Buy/hold/sell?

Flight Centre shares are a long-term hold for me, and I’d be happy to buy at this point. Having said this, given the long investment horizon there are probably other options that have more upside in the shorter-term.

Most of us have a limited amount we are able to invest, so if you choose to invest now, there is a significant opportunity cost that you will forgo in this case.