ASX travel shares like Webjet Limited (ASX: WEB) and Flight Centre Travel Group Ltd (ASX: FLT) continue to be a hot topic among Australian investors.

The unwinding of international travel restrictions will hopefully be the start of a catalyst which will see both of these companies slowly return to prior levels. However, with no talk from the Australian government regarding international travel, sentiment towards these ASX travel shares remains low.

Here are a few ways I compare Webjet and Flight Centre shares.

What’s the difference between the two?

On an operational level, the main difference between these two ASX travel shares is the range of the service offering and the channels in which they use to engage with their customers.

Flight Centre has the highest price tag due to its much broader service offering and a greater international presence. The company has 689 stores in Australia and a further 550 stores across 10 other countries.

Due to having a large bricks and mortar presence, Flight Centre’s cost base is predominantly rent and wages. Prior to COVID-19, the company had close to 12,000 employees and annual revenues of around $3 billion per year. Flight Centre usually achieves a gross and net margin of 42% and 8.6%, respectively.

Comparatively, Webjet provides an online business-to-consumer (B2C) platform through which customers like you and I can book holiday packages. Its cost base is mainly comprised of wages, which allows the group to achieve a gross and net margin of 70% and 16.4%, respectively.

Although Webjet’s service offering is smaller, one of its key brands is WebBeds, a leading business-to-business (B2B) accommodation provider across 12,000 destinations globally.

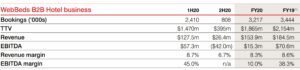

The WebBeds business unit has seen some extremely fast growth just over the last few years alone, and now comprises more than $62 million (60%) of total group EBITDA.

As Webjet’s FY20 results show in the table below, despite the effects of COVID-19, the WebBeds business nearly matched revenues it generated in FY19. This service line is also more profitable than the B2C unit, boasting an impressive 45% EBITDA margin compared to B2C achieving an EBITDA margin of 38.6%.

COVID-19 response and short-term outlook

As a result of the pandemic, both companies took measures to strengthen their financial positions to mitigate the short-term effects of imposed travel restrictions.

In March, Flight Centre raised $769 million through a capital raising and was granted access to a debt facility it could draw down if need be. For now, the company plans to leverage its corporate service line with the gradual reopening of domestic and regional travel. With over $1.1 billion in liquidity, the company hopes to break even until international travel allows the gradual return to normal levels of leisure travel.

Webjet’s variable cost structure allowed the group to quickly cut costs by 78% to that of pre-COVID levels. In April, the company raised $346 million through a capital raising and finished FY20 with total liquidity of $350 million (including undrawn debt facilities).

Similar to Flight Centre, Webjet is currently focusing on the anticipated unwinding of domestic travel restrictions. Given that 85% of Webjet’s online travel agent (OTC) flight bookings are domestic, this places the company in a strong position once these restrictions are gradually lifted.

Long-term outlook

I don’t think there is going to be one clear winner and loser out of these two ASX travel shares. Although the current climate is still uncertain, it’s likely that both will make a steady recovery as international travel restrictions begin to unwind.

Both of these companies are large players backed by institutions. In economic downturns such as these, some smaller players that don’t have easy access to capital will, unfortunately, go out of business.

As travel volume returns to normal, bigger players will use this to their advantage as there is now less competition and some new potential takeover opportunities.

My choice between FLT and WEB shares

My personal choice is Webjet because the WebBeds service line represents a further growth runway that has the potential to bounce back quickly. When it does, its low-cost model will allow the business to scale well as it expands into more regions.

Having said this, I think Webjet’s economic moat is small at best. It has an extensive network effect through its size, but there isn’t a lot stopping someone else from creating a website with similar functions.

Certain customers will always prefer to speak to someone in person. For this reason, it could be said that Flight Centre has an advantage through its physical presence. If a new player came into the game, it would be unlikely to build 700 stores in Australia.

Both of these ASX shares are inherently risky and come with many potential what-ifs. Although it’s likely they will both recover, keep in mind that nothing is certain in this sort of environment.

For some more reading on Flight Centre shares, I recently wrote about whether now is the time to buy.