As you’ve probably noticed over the last few years, there are many new banks popping up on the scene, aiming to disrupt the traditional model of banking. I’ve talked about a few on past episodes of The Australian Finance Podcast, and recently we had the opportunity to talk to Up bank on the show (see video below).

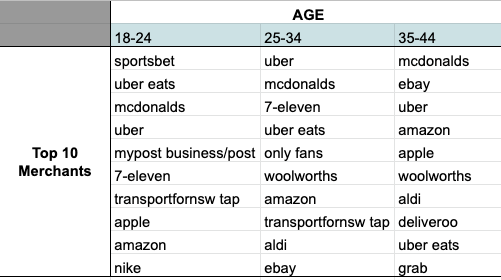

On a slightly related note, Revolut provided me with some spending data for their Aussie customers over the last few months, if you’re interested in what everyone else is spending their discretionary money on during lockdown!

What is a Neobank?

As a fairly new term, a quick Google search will bring up many different descriptions of what constitutes a ‘neobank’. However, there are a few common ideas. Neobanks are generally independent, fully digital and built from the ground up – away from legacy banking infrastructure.

They present a modern brand and encourage consumers to interact and build the company with them. The tech is usually on point, and they come with features and tools not traditionally found in your regular banking apps, including spending insights and instant low-cost currency exchange. The most important part – they keep costs low!

The Rise of Neobanks in Australia

Overseas in the US and the UK, Neobanks are starting to become household names, however, we are a few years behind in Australia. Our banking regular APRA (Australian Prudential Regulation Authority) has pretty strict rules when it comes to starting a bank (and rightly so), and they’ve just started to issue full and restricted banking licenses out in the last few years.

It’s definitely early days for neobanks here in Australia, and we’re starting to hear from the likes of Douugh Ltd (ASX: DOU), Volt Bank, Xinja, Revolut and 86 400. But Up bank (a subsidiary of Bendigo and Adelaide Bank Ltd (ASX: BEN)) has been clearly leading the charge over the last few years in Australia!

It’s also interesting to watch neobanks like Revolut that started in the UK now launching in the Australian market. In Revolut’s model, customer funds in Australia are held within a registered Australian ADI, which enables a much quicker rollout.

Competition in the Australian Banking Sector is Good For You

The best part about all of this is that more competition in the Australian banking sector is actually really great for us, the customers. Like most giant organisations, the banks probably won’t take the rising popularity of neobanks seriously until it’s too late, and half of their retail clients have jumped ship.

It’ll force them to provide better products and superior features and tools if they want to stay relevant, and consumers will demand better controls and transparency (#BankingRoyalCommission). It also gives you more choice and control over your money – because you’ve suddenly got other attractive options to explore and compare to.

How Are Neobanks Regulated in Australia?

It’s probably no surprise to hear that the biggest challenge to launching a neobank in Australia is actually obtaining a banking license from APRA. APRA’s job is to ensure Australian financial institutions are operated in a safe and secure way and promote financial stability and consumer confidence in the system. APRA also aims to reduce the likelihood that a financial institution fails, by putting capital, governance and risk-management standards in place.

The good thing about all this is that Authorised Deposit-taking Institutions (ADIs) in Australia are covered under the Financial Claims Scheme (FCS), which protects the money you hold in an ADI up to $250,000. This means your money is guaranteed, regardless of what happens to the financial institution. Before depositing your funds with any financial institution, it’s important to check this list to ensure they are an ADI in Australia.

If you haven’t already, tune into our conversation with Up Money over here on The Australian Finance Podcast.