The NextDC Ltd (ASX: NXT) share price is the gift that just keeps on giving.

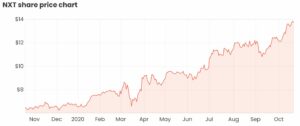

Admittedly, I find it hard to buy shares at all-time highs, which is why I’ve held off on this one. I wish I didn’t – NextDC shares are up over 100% from their March lows and trade at $13.73 at the time of writing.

This has been a real winner from COVID-19 and there is a good reason why it’s been trading at 52-week highs consistently since March. Here are a few ways I analyse this company.

What does NextDC do?

NextDC is a data centre operator with multiple centres across Melbourne, Sydney, Brisbane, Perth and Canberra. Organisations that store critical applications and data “in the cloud” can use NextDC’s facilities to physically store this information securely.

The company’s two key customer segments are retail and wholesale. The retail segment is primarily small-to-medium businesses (SMBs) that can access pre-installed IT infrastructure. The wholesale segment is for larger organisations that can rent the space in the centre but have customised infrastructure of their own.

Although labelled a tech business, this is more of an infrastructure play that requires large amounts of capital expenditure to construct new data centres.

Why the NextDC share price has taken off recently

Last week, NextDC announced it had entered into a new debt agreement through a variety of lenders to underwrite $1.5 billion in debt facilities. The size and structure of this arrangement will allow the company to significantly reduce its borrowing costs, making future expansion a better value proposition.

Having access to this capital will provide the necessary funding to support the further construction of new data centres to keep up with the increased demand.

The company now has around $1.6 billion in liquidity, including a cash balance of $893 million as of FY20. This puts it in an advantageous position moving forward to capitalise on a shift toward cloud-based connectivity.

COVID-accelerated growth

COVID-19 has undoubtedly changed the way individuals and companies behave and transact with each other. To NextDC’s advantage, some of these changes may not return to “normal” for quite some time, and some may be of a more permanent nature. For example:

- Some employees who have worked from home will continue to do so regardless of a vaccine outcome.

- Some businesses that didn’t have an online offering prior to COVID were forced to get one, and now they’re likely to continue using it.

- Consumers who have changed their consumption habits to ones that have been facilitated by online platforms will continue these habits.

These are all examples that will accelerate the shift to using online platforms, which places NextDC in an advantageous position to accommodate the increased demand in cloud-based services.

To me, this is different from sales being “brought on” on a once-off basis from government stimulus and superannuation withdrawals. I think this is more of an accelerated structural shift that is more likely to be ongoing in nature.

1-year NXT share price target

The business is forecasting around $125 million of underlying EBITDA for FY21.

From the FY20 results, NextDC currently trades on a price/EBITDA multiple of around 63x. Assuming the company can maintain this multiple, reaching EBITDA of $125 million will imply a market capitalisation of $7.8 billion.

Dividing $7.8 billion by 456.66 million shares outstanding gives a one-year target price of ~$17 (around 26% upside).

NextDC’s risks

NextDC builds new data centres in advance of customer demand without any sort of pre-sales commitment from customers. The capital intensive nature of new construction adds to the risk that the demand will not generate the required revenues to achieve a sufficient return on investment.

To mitigate this risk, the capabilities of newer centres being built will be scaled over time to meet demand growth, resulting in a lower initial outlay. This, in combination with lower borrowing costs from the recent debt deal, further reduces the risk that these new centres won’t be able to generate returns in excess of their cost of capital.

Potential risk from competition in the Asia Pacific region is moderate, in my opinion. Although there’s nothing preventing another company from building similar infrastructure, this operation is extremely capital intensive and requires a demonstrated track record of creditworthiness before it’s backed by large institutions. For this reason, NextDC has a first-mover advantage and is well diversified across all major regions in Australia.

Final thoughts

NextDC shares are a buy for me for two reasons. The first reason is the company itself – it’s very well managed and the management team has an excellent track record of making smart capital allocation decisions which have led to the company being able to grow its earnings over time.

Secondly, the company is operating in an environment with long-term tailwinds that will hopefully fuel further growth over the coming years. Compared to some of the ASX retailers like JB Hi-Fi Limited (ASX: JBH) who might’ve had earnings “brought on”, this could be an on-going shift that will continue into the future.