Diversification is important when investing in Australian real estate investment trusts (A-REITs). Different subsectors of the A-REIT market perform differently. This has been particularly borne out since March this year when COVID-19 hit.

Before we delve into the detail, let’s take a look at the main A-REIT subsectors.

Retail – typically refers to shopping centres, in both capital cities and regional areas. It also includes freestanding shops like Bunnings.

Office – as the name indicates, these A-REITs own properties used as offices and include CBD office towers as well as suburban and regional office parks.

Industrial – includes warehouses, manufacturing buildings, industrial parks and multi-use buildings.

Residential – includes the development and ownership of land and apartments. There are no major A-REITs in Australia that are dedicated to residential. However, A-REITs like Mirvac Group (ASX: MGR) derive a large proportion of their income from residential.

Diversified A-REITs – as the name suggests, diversified A-REITs own and manage a mix of property types; they do business in two or more of the A-REIT subsectors.

How have A-REITs performed this year?

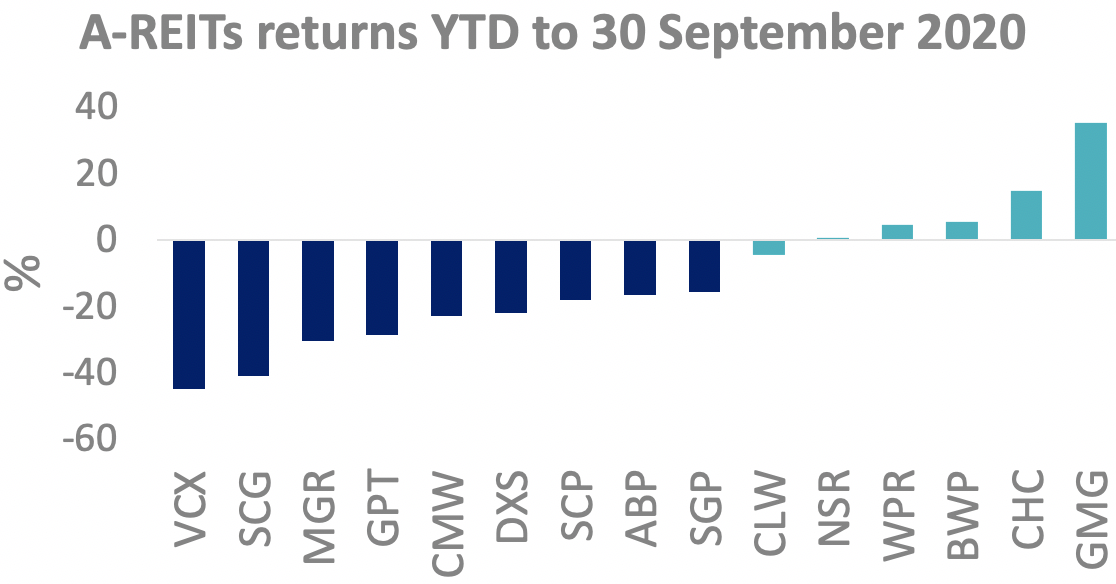

The graph below shows the returns of 15 A-REITs this year. There has been an exceptionally wide dispersion of returns between the subsectors.

Retail was one of the hardest-hit sectors by COVID-19, with rent collections for shopping centres down for the six months to 30 June ranging from 65% to 90%. In addition, rents are expected to drop by 20% as a result of increasing vacancy rates, retailers reducing their footprint and minimal new long term leases.

Vicinity Centres (ASX: VCX) is one of Australia’s largest REITs and is focused on ownership, management and development of shopping centres and outlets. VCX was the poorest performer, losing 45% in value over the period.

On the other hand, Goodman Group (ASX: GMG), which is a vertically integrated, internally-managed global property group specialising in industrial property ownership, funds management, and property development, achieved stellar performance of 36%.

Industrial property was a bright spot, being the key beneficiary of the shift to e-commerce as supply chains adapt and logistics operators adjust to changing consumer behaviour. E-commerce penetration for grocery is expected to reach 10% by 2024 (currently 3%) and ex grocery to 17% (9% in FY19).

What does this mean for ASX investors?

In this current environment, it is more difficult than ever to determine which REIT subsector is going to perform the best, with a lot riding on when a COVID-19 vaccine will end the lockdowns and restrictions. This is why it is more important than ever to be diversified.

One way to access the A-REIT sector in a diversified way is via an ETF. However, most ETFs are dominated by the largest A-REITs, which is why ‘capping’ may provide a better diversified exposure to the sector. The MVIS Australia A-REIT Index caps stocks at 10%.

VanEck Vectors Australian Property ETF (ASX: MVA) tracks the MVIS Australia A-REIT Index and is a simple way to gain a diversified exposure to all the A-REIT sub-sectors in Australia including retail, office, industrial, residential and specialised sectors.

This report was written by Russel Chesler, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.