Okay, so if you’re a regular listener of The Australian Finance Podcast, you probably know by now that I’m a bit of a fan of exchange traded funds (ETFs). They’ve given me a way to build my portfolio in a much more streamlined and diversified way, where I can use ETFs at the core and more active investments around the edges.

Core-Satellite Portfolio Approach

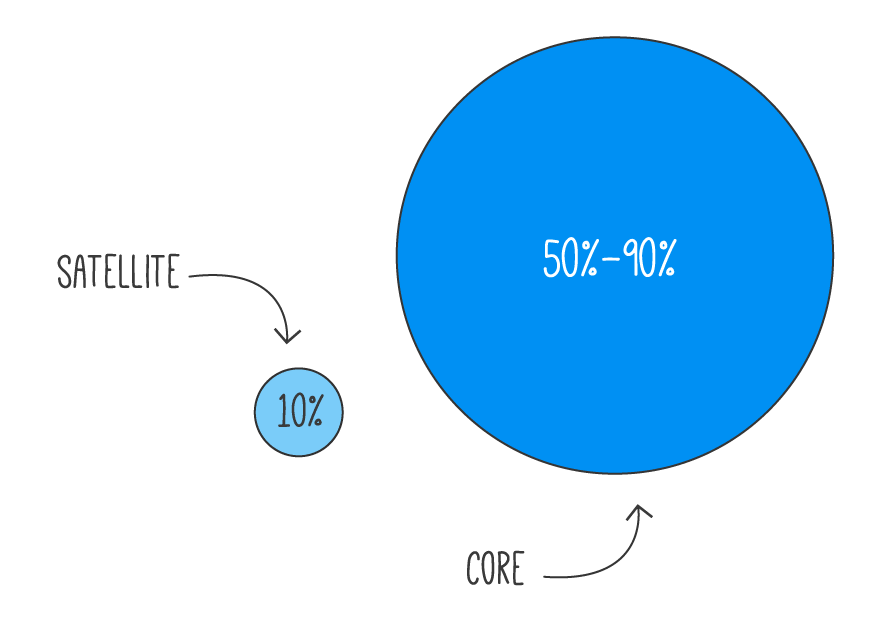

As an aside, my co-host Owen talks a lot about the Core & Satellite portfolio approach, and it looks a little bit like this.

The Core of a portfolio is the centre of every investor’s universe. It’s where most investors should begin (and end) their investment journey. The Satellite or Tactical part of a portfolio is the smaller part (or parts) that investors can reserve for their ‘active’ investing and riskier positions.

What is Thematic Investing?

Thematic investing is a way to invest your money in companies based on specific industry trends or themes, with the idea that that specific sector will outperform over a certain timeframe. The point to differentiate here is whether you’re just jumping onto a popular trend at the time or investing in an industry sector that will revolutionise our world over the next decade. With that said, it’s very important to consider your investment timeframe with thematic ETFs, as it’s certainly not a passive investment strategy.

For me, this is quite a different way of approaching investing, so I hunted through Google on your behalf for some interesting content on this topic.

The power of human ingenuity is at the heart of thematic investing. This ingenuity ignites the innovation which solves imbalances in the world. In turn this creates growth which hasn’t yet been recognised in share prices. By seeking out these opportunities, thematic funds offer a whole new way of investing, with the aim of achieving sustainable, long-term growth.

~What is thematic investing and why should investors care? – David Docherty Investment Director (Thematics) at Schroders Global

Themes are typically about change: perhaps a country evolving from a frontier to an emerging market, a sector undergoing a dramatic transformation, or a new technology seeing widespread adoption. Of course, most investors are only interested in themes that generate enviable returns. Thematic investing isn’t just performance chasing, it’s performance chasing with a narrative. That can be a seductive combination.

~Thematic Investing: Thematically Wrong? – CFA Institute

Adopting a thematic-investing approach can yield three types of benefits for investors.

- First, it allows investors to generate alpha at scale by focusing on investment opportunities in hot spots where a significant amount of capital can be deployed.

- Second, the more systematic investment process and in-depth research required for thematic investing builds a deeper understanding of the underlying drivers of value creation and risk; investors can use this knowledge not just in thematic investing but also in other strategies.

- Third, it provides investors with a dynamic and flexible way to validate and express their hunches by applying a forward-looking lens to investment decisions.

~From indexes to insights: The rise of thematic investing – McKinsey on Investing

What is a Thematic ETF?

Aside from selecting individual shares, there is another way to express your thoughts about where the world is heading by using thematic ETFs. Now, unlike a typical ETF that follows a basic index like the S&P/ASX 200 (ASX: XJO), a thematic ETF is a good way to express an idea, theme or industry trend that you believe is going to change the world over the next 5 to 10 years.

Fidelity has identified a few different approaches that define the world of thematic investing (through managed funds and ETFs) and you can read about each one in detail over here.

- Disruption (cloud computing, media distribution, autonomous vehicles)

- Mega-trends (rise of technology, aging population, resource scarcity)

- Environmental, Social and Governance (ESG) Themes

- Differentiated Insights (large moats, founder led, leverage)

- Outcome Oriented (a specific outcome over the long-term vs short-term returns)

In the US, there has already been a massive surge in popularity for trend-based ETFs, but it’s really just starting warm up over here in Australia. For example, now you can buy ETFs in Australia that track companies in the robotic, biotechnology or lithium mining sectors.

Examples of Thematic ETFs Available in Australia

Let’s explore a few of these thematic ETFs now available in Australia.

ROBO: This ETF invests in robotics, automation and artificial intelligence (RAAI) and aims to track the ROBO Global Robotics and Automation Index. This index includes up to 200 global companies related to the RAAI theme in areas like manufacturing, 3D printing, logistics and security.

DRUG: This ETF invests in a diversified portfolio of the world’s leading healthcare companies and aims to track the Nasdaq Global ex-Australia Healthcare Hedged AUD Index. This index includes companies like Johnson & Johnson, Pfizer and Roche.

ESPO: This ETF invests in the largest and most liquid companies involved in video game development, eSports and related hardware and software globally, and aims to track the MVIS Global Video Gaming and eSports Index. This index includes companies like Nintendo, Activision Blizzard and Zynga.

If you want to investigate the thematic ETFs available in Australia in more detail, have a look at Australian ETF providers like ETF Securities, VanEck, BetaShares or the BestETFs website.

If you haven’t already tuned into our episode on thematic investing with Kanish from ETF Securities, tune in over on The Australian Finance Podcast.

Resources

- Check out previous episode of the Australian Finance Podcast, including Ep. 8. ETFs, Managed Funds & Index Funds, Ep. 21. How To Pick & Choose ASX ETFs & How to build an ETF portfolio, with Kris Walesby of ETF Securities

- Our simple and effective investment rules to build long-term wealth

- How a ‘core satellite’ investment strategy can work for you

- Rask’s 10 rules for investing in the stock market

- What is thematic investing and why should investors care? – Schroders global

- From indexes to insights: The rise of thematic investing

- Thematic Investing: What Is It, and How Should Investors Think About It?