TechnologyOne Ltd (ASX: TNE) shares have gained popularity in recent months.

The TechnologyOne share price initially staged a strong comeback post March but has now pulled back significantly since May. Here are a few ways I analyse this ASX tech share and why I’m keeping my eye on it.

Introduction to TechnologyOne

TechnologyOne develops, sells, and implements mission-critical enterprise software on a global scale. Some of its markets include local and federal government, health and community services, and corporates and financial services.

The company offers 14 different licensable products which aim to simplify the user experience and drive underlying efficiencies. TechnologyOne is well-established in the Asia Pacific region and is on track to reach an inflection point on a profitability basis in the UK market soon.

TechnologyOne’s pricing model

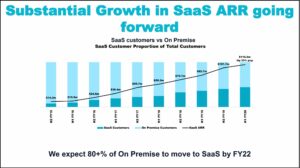

TechnologyOne is currently migrating its customers from an on-premise licence model to a recurring software-as-a-service (SaaS) model. Here’s the difference.

An on-premise model involves a company buying software and hosting it on their own servers. On-premise IT infrastructure can be more costly and pricing models are often inflexible to usage.

In a SaaS model, the software provider is responsible for the operation and maintenance of the infrastructure that is typically housed in a data centre. Users pay a subscription to be able to access the provider’s software remotely. A SaaS model is typically more flexible around its pricing and revenues are often recurring in nature.

A SaaS model is found to be beneficial for both TechnologyOne and its users. TechnologyOne reaps the benefits of recurring revenue streams and doesn’t have to incur further costs to generate future sales. Its customers are able to save costs by freeing up IT resources from managing their on-premise infrastructure.

In TechnologyOne’s case, rather than getting paid upfront, the benefits of the SaaS model will take time to fully realise.

Something important to note is the $127 million in pre-paid subscription revenue shown below. This represents cash received in advance that will be recognised as revenue in future periods. This number has significantly increased since introducing the SaaS pricing model.

As TechnologyOne’s customers transition to the SaaS platform, there is essentially ‘locked-in’ revenue that will be recognised in future financial statements. Keep in mind it will take some time to fully transition over, so I wouldn’t expect a significant jump in earnings in the short-term.

Attractive features of the business

TechnologyOne has a strong balance sheet, with $83.7 million in cash and no debt outstanding. It continues to invest heavily in the development of its service offering, usually spending around 22% of annual revenue on research and development costs.

Its customers have also proved to be extremely sticky, boasting an impressive 99% customer retention rate across all markets.

The company’s long-term focus is on increasing the number of products used per customer, which should result in economies of scale as the business expands. It currently achieves a profit before tax margin of around 19% but is aiming for a margin of 35% in the coming years.

TechnologyOne has set some ambitious targets moving forward. The company aims to have total annual recurring revenue (ARR) of $500 million in FY24 (currently $211 million) and plans to increase ARR by upselling its customer base with more products.

Buy/hold/sell?

TechnologyOne shares are a buy for me. The company has indicated that the UK market is 3x the size of Australia’s addressable enterprise market. With the assumption that the business can successfully continue to implement its offering in the UK market, this represents a large additional runway for growth that should hopefully see earnings rise and the TNE share price move in the same direction.

If you’re looking for more share ideas, make sure to bookmark Rask Media’s ASX share ideas page for all the latest analysis.