The PolyNovo Ltd (ASX: PNV) share price shot up 8.73% yesterday after announcing Taiwan FDA approval.

PolyNovo is a medical device company specialising in the development of dermal regeneration products.

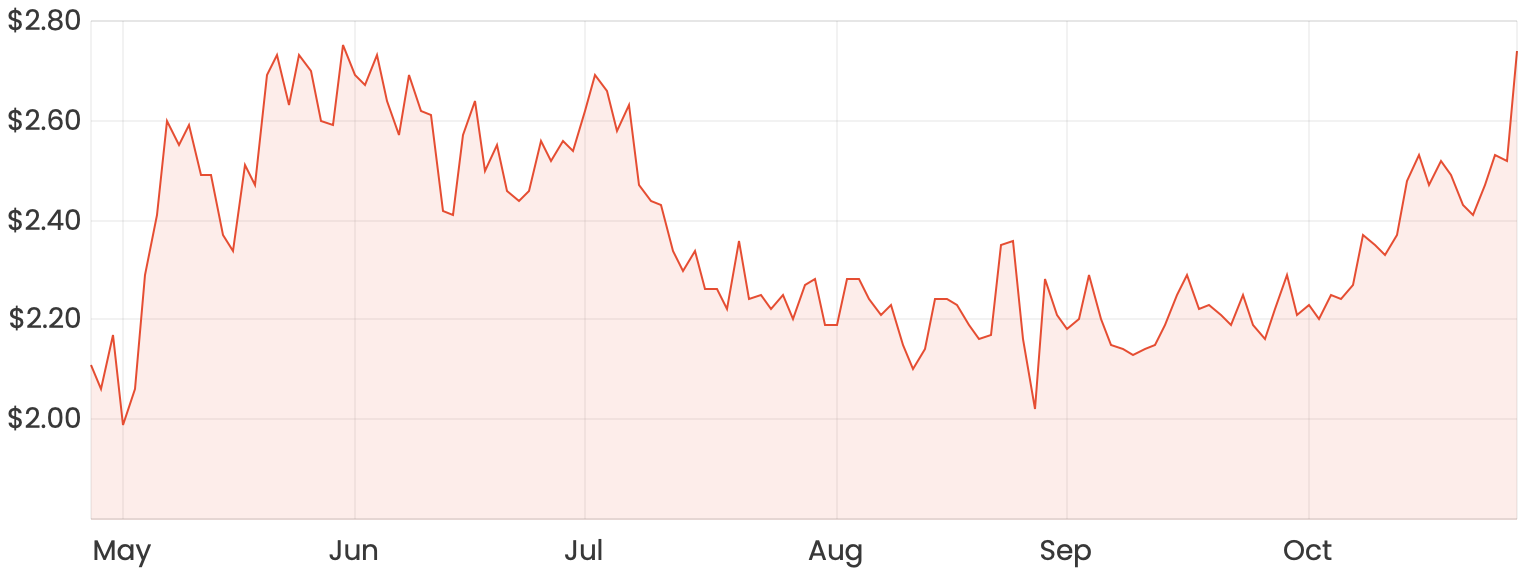

PNV share price

What was announced?

PolyNovo announced it had received approval from the Taiwan Food and Drug Administration to sell its NovoSorb BTM (Biodegradable Temporizing Matrix) product in the Taiwanese market.

Also announced was that PolyNovo had reached an agreement with Taiwan-based distributor Evermed to sell NovoSorb BTM.

PolyNovo Managing Director Paul Brennan stated: “This is an exciting development for PolyNovo. Taiwan has an advanced health system and has a population of circa 23 million concentrated in three regions. The dermal matrix market in Taiwan has good potential for us in reconstructive surgery, trauma and burns.”

Paul also remarked that Evermed “has well established relationships with hospitals and key opinion leaders throughout Taiwan.”

PolyNovo expects sales of its BTM product in Taiwan will commence in around March next year.

What is NovoSorb BTM?

NovoSorb’s website describes BTM as a man-made synthetic polymer which can be used to close wounds and assist the body in generating new tissue. Specifically, BTM supports the regeneration of the dermis skin layer, which may be lost through circumstances including surgery, burns or road trauma.

Other advantages of BTM are that it’s biodegradable and bio-compatible (meaning compatible with living tissue).

Reasons PolyNovo shares could rise further

PolyNovo announced in its FY20 results a number of possible developments that could play out in FY21. If any of the below events were to eventuate, the PolyNovo share price could get another boost:

- Completion of commercial manufacturing process for Syntrel – a NovoSorb-based hernia device

- Development of NovoSorb-based breast reconstruction products

- Launch of NovoSorb BTM into European markets such as Scandanvia, France, Italy, Greece and Benelux

- Regulatory approval for sale of NovoSorb BTM in the Korean market

Summary

I can see why the market is excited with this announcement, and reasons the PolyNovo share price could rise in the near term.

However, from a valuation perspective, PolyNovo has a market capitalisation of $1.8 billion and FY20 sales of just $22.19 million.

Trading on a price-sales ratio of 81x, a lot of growth is expected, and any setback could lead to a significant selloff. For this reason, I will sit on the sidelines for the time being.