The Elders Ltd (ASX: ELD) share price has had a remarkable run this year, outperforming the broader S&P/ASX 200 (ASX: XJO) significantly.

Cyclical companies such as Elders are often unloved during times at the bottom of the cycle, but its performance has definitely attracted some attention recently.

What does Elders do?

Elders is a diversified agribusiness that provides agricultural goods and services to primary producers in Australia and New Zealand. The majority of its operations are domestic, however, it does have some exposure to overseas markets through its Fine Foods and Killara Feedlot segments which I will touch more on throughout this article.

The two main segments that contribute the most to Elders’ gross margin are rural products and agency services.

Rural products are things like seeds, fertilisers, agricultural chemicals, animal health products and general rural merchandise that are available to both retail and wholesale markets. Elders also offers a consulting service that specialises in production and cropping advice. The latest addition to its rural segment was through its acquisition of Australian Independent Rural Retailers (AIRR), which supplies independent rural merchandise and pet & produce stores with its products.

Elders’ agency segment essentially facilitates the buying and selling of livestock, wool and grain between parties. It offers auction services, marketing and a commodities platform for grain to maximise choice for growers.

The group also has a real estate segment that assists with the marketing of rural properties, as well as a financial services segment which offers banking and general insurance.

Featured video: how does short selling work?

Why have Elders shares outperformed this year?

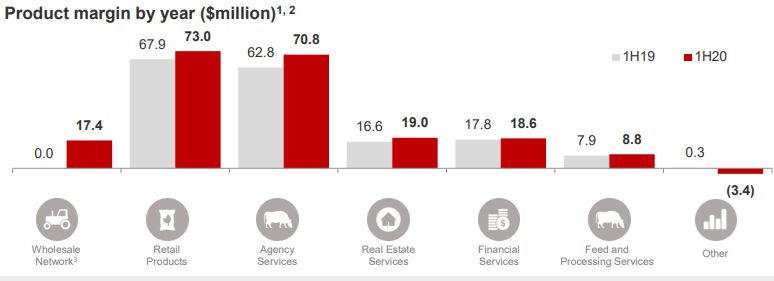

Elders reported 1H20 profit of $52 million back in May, up 90% on the prior corresponding period. The majority of the additional earnings were a result of the AIRR acquisition, which added $17.4 million to the group’s gross margin. However, there was organic growth in most other areas of the business as well.

Some of this organic growth was the result of significant rainfall across drought-affected areas across the eastern states, which increased the demand for crop protection products and lifted farmer confidence for the winter crop which has just passed. While this is fantastic to see, it outlines the cyclical nature of these types of businesses and how sensitive earnings are to environmental conditions.

The agency segment has benefited from historically-low cattle supplies and strong restocking demand. This has reduced slaughter numbers and exports, which has driven cattle prices up – a trend that management expects to continue at least through the short-term.

Elders Fine Foods exports premium Australian beef, lamb and veal throughout mainland China. The ongoing trade war between Australian exporters and Chinese authorities is clearly a worry, but this segment contributes such a small percentage of overall gross margin (<4%), therefore, I believe the risk associated with this segment is low.

Source: Elders Half Year Results Presentation 2020 | Elders segment growth 1H19 vs. 1H20

Why I like Elders shares

Elders has extremely broad diversification by product, service, market segment, geography and channel. For this reason, I believe that holding Elders shares would be a relatively secure proposition.

If its rural products segment were to go through a hypothetical downturn due to weather conditions, it still has its agency segment going through a tailwind of historically-low cattle supplies which will ideally drive prices further up. The remaining segments don’t seem too positively correlated with each other, further minimising risk if one segment were to underperform.

The company does have around $117 million net debt. However, relative to EBTIDA of $60 million, this is actually a relatively conservative amount of gearing.

Are Elders shares a buy?

I’ve got a hold on Elders shares for now. I like the fundamentals of this business and how it’s been able to grow its earnings recently. But due to the cyclical nature, there’s always the possibility that one underperforming segment will bring down the overall earnings and the share price with it.

For this reason, I would keep my eyes on the Elders share price for now and see if I can pick up shares closer to the bottom of their cycle. This would pretty hard to pick, but the Elders share price definitely doesn’t appear to be close to the bottom of its cycle currently – quite the opposite.

Check out this article to find out which three other shares I’m watching closely at the moment: 3 ‘buy the dip’ ASX shares I’ve got my eyes on