ResMed CDI (ASX: RMD) shares have a long history of outperformance and delivering impressive returns for shareholders. Is it too late to buy ResMed shares at current levels?

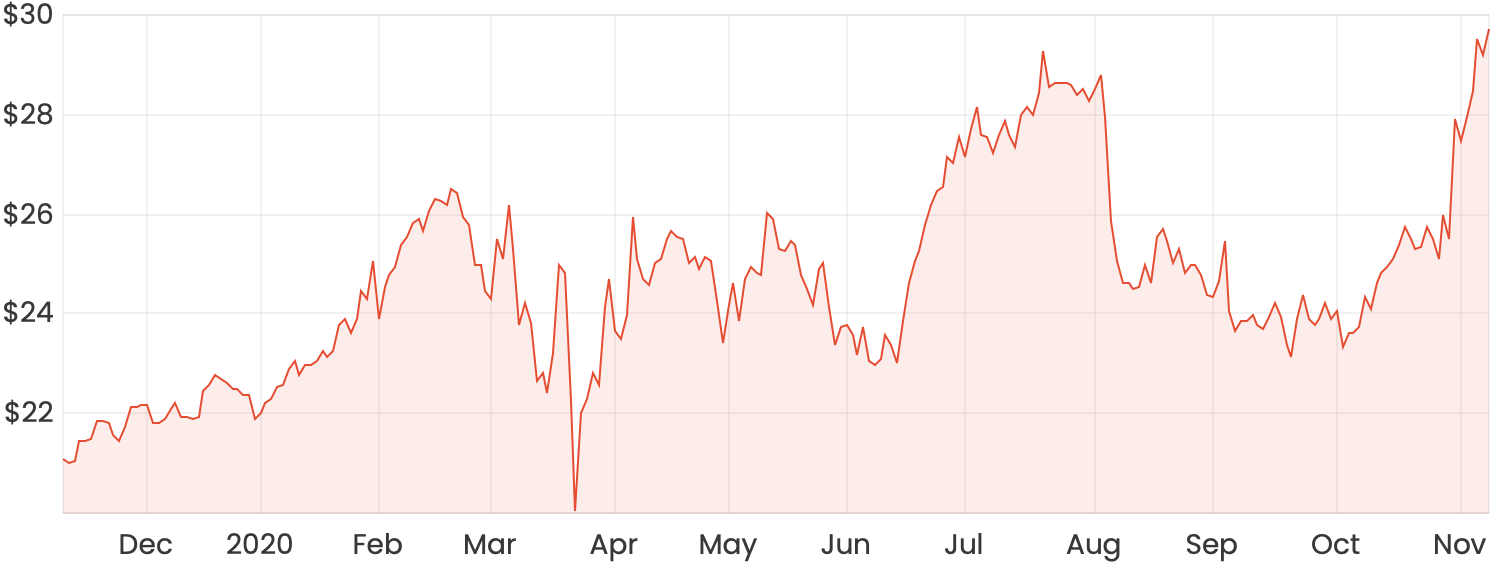

RMD share price chart

ResMed is an American-based company that manufactures and distributes cloud-connectable medical devices for the treatment of sleep apnea, chronic pulmonary disease, and other respiratory diseases.

As the COVID-19 pandemic unfolded, the global demand for ventilators skyrocketed, which resulted in the company reporting an increase of more than $50 million for the quarter. This gain was unfortunately mostly offset by a significant drop in demand for ResMed’s devices that treat sleep apnea and other respiratory diseases due to lower volumes of patients in clinics.

In the same way that some ASX travel shares are expected to recover throughout the gradual reopening of the economy, some investors have pointed out that ResMed shares may also behave in a similar way as patient volumes in clinics throughout the world return to pre-COVID levels.

In addition to a re-opening opportunity, here are a few more reasons as to why even at current levels, ResMed shares are a great long-term growth proposition in my eyes.

ResMed’s first-mover advantage

The current success of ResMed dates all the way back to 1981 when Colin Sullivan from the University of Sydney developed the first continuous positive airway pressure (CPAP) device. This was the first successful, non-invasive treatment used for sleep apnea. In 1989, this technology was commercialised and it’s been successfully distributed globally ever since.

ResMed currently sells directly to sleep apnea patients, as well as to providers of home care who deliver medical treatment in the patient’s home. The provider, therefore, has a significant influence over what brand CPAP device is used on their patients.

It’s not so much that there are high switching costs involved, but it’s more the fact that ResMed’s products are so well-established within the medical community and therefore get recommended to patients over the other competing brands.

ResMed’s macroeconomic tailwind

Unfortunately, the prevalence of sleep apnea and similar illnesses is increasing. Management has recently indicated that there are around 936 million people suffering from sleep apnea around the world. Increasing obesity levels and older populations are said to be contributing factors.

ResMed has developed masks and other devices that are proven to be effective, however, the main issue is that most cases are undiagnosed and the majority of people are unaware of their illness. Therefore, in addition to the initial research and development process, ResMed’s main challenge is to invest in effective marketing campaigns that increase awareness, which will hopefully lead to people buying the company’s products.

To ResMed’s advantage, advancements in medicine mean that doctors are now much better at suspecting sleep apnea and referring solutions for it than they were in the past.

ResMed’s software integration

ResMed’s devices are cloud-connectable and are monitored and controlled through the AirView software solution. The platform collects large amounts of diagnostic information, which can then used to further derive meaningful insights.

Within the last few years, the company has begun to supply out-of-hospital software-as-a-service (SaaS) products which are designed to support patients and caregivers. This segment currently makes up around 12% of annual revenue.

ResMed’s acquisition of Brightree in 2016 provides an integrated procurement and billing platform that’s used by thousands of organisations.

Valuation of ResMed shares

For a company that has consistently outperformed the broader market, ResMed shares have typically always carried a high price tag relative to the company’s earnings.

ResMed shares currently trade on a price-earnings ratio of around 40, however, the company has a strong track record of being able to grow its earnings over time. As a result, I’m sure this price tag is justified to some investors.

I think the valuation now reflects the market’s expectation that the company will continue to be able to outperform and significantly grow its earnings further. The company shows no signs of slowing down and aims to improve 250 million lives by 2025.

Given ResMed’s strong track record, I’d be willing to accept the higher price tag for shares given the future prospects of the company.

Summary

I’d be happy to buy ResMed shares today at current levels. There’s the potential for some medium-term upside through its sleep devices segment as the economy gradually opens up and patient volume levels increase.

That said, given the current state of COVID-19, I’d expect some more volatility in the ResMed share price in the short-term at least.

Regardless of COVID-19, ResMed operates in a growing industry and has effective treatments for debilitating conditions. I like the direction the company is going with its SaaS segment and believe there is still a significant runway for growth ahead.