Bailador Technology Investments Ltd (ASX: BTI) is an investment business which focuses on companies within the technology sector seeking growth stage investment. Its largest investment is highly leveraged to the beaten-down travel and tourism sector.

Bailador typically targets minority investments alongside highly motivated founders and management who have best-in-class technology or business systems.

Bailador takes a hands-on approach, requiring a member of its investment team to join the board, where they will work with the founder and management team to execute on growth objectives.

Total underlying company revenue of Bailador’s investments grew by 20% in FY2020 to reach $278 million.

SiteMinder – Bailador’s largest investment

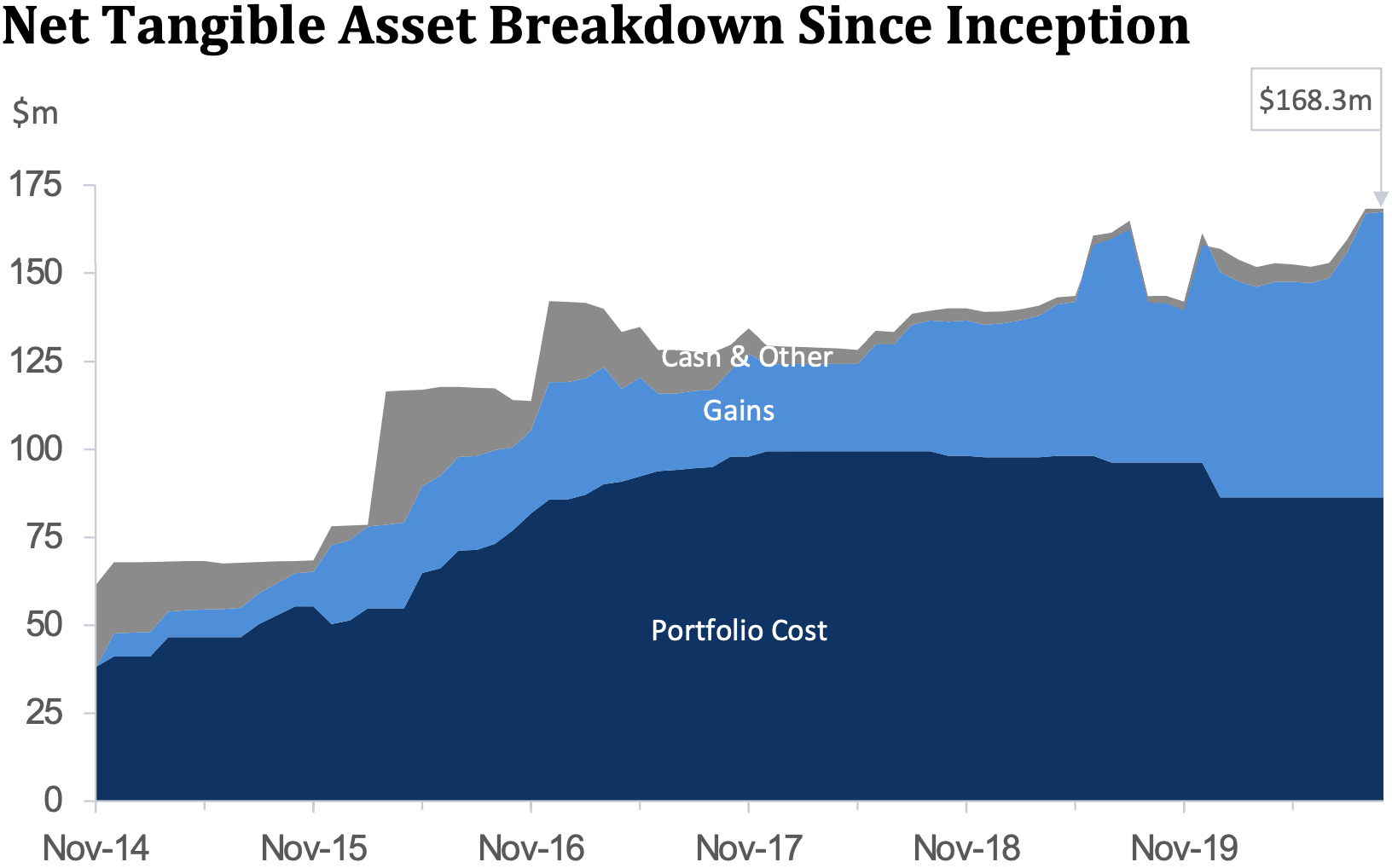

SiteMinder is currently Bailador’s largest investment, representing $82.5 million of the total portfolio asset value of $168.3 million. SiteMinder earned over $100 million in FY20 on the back of its subscription-based service.

SiteMinder is a leading cloud-based hotel guest acquisition platform used by over 35,000 hotels in more than 160 countries. SiteMinder believes it has a huge total addressable market (TAM) of about 1 million hotels.

SiteMinder’s customers typically benefit from increased online revenue, automation of business processes and a lower cost of acquiring bookings. SiteMinder integrates with many online accommodation booking services including Expedia, TripAdvisor, Booking.com and CTrip.

SiteMinder’s CEO is Sankar Narayan, who works alongside co-founder Mike Ford

. Sankar previously held the roles of chief financial officer and chief operating officer at cloud-based accounting powerhouse Xero Limited (ASX: XRO).

In Bailador’s October 2020 Shareholder update, co-founders David Kirk & Paul Wilson commented: “Rather than be hit by significant revenue reduction as many transaction-based travel business have been, SiteMinder has instead demonstrated the characteristics of the Software-as-a-Service business that it is, and warrants its valuation as a Saas business. We continue to be happy to have a company and management team of the calibre of SiteMinder as the cornerstone of the portfolio, and look forward to helping drive and hare in its continued success.”

Skin in the game

According to Bailador’s FY20 annual report, co-founders David Kirk and Paul Wilson have the following significant shareholdings. This is important as they are investing and risking their own capital alongside fellow shareholders.

David Kirk holds 8,651,466 ordinary shares in BTI and has an indirect interest in a further 792,200 ordinary shares.

Paul Wilson holds 3,977,041 ordinary shares in BTI and has an indirect interest in a further 420,146 ordinary shares.

Widely respected largest shareholder

Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) owns 18.86% of Bailador as at 30 June 2020. WHSP is a highly successful investment house and is widely covered by the Rask Media team.

Are Bailador shares a buy?

Bailador provides exposure to a portfolio of rapidly growing companies and has a track record of generating investment gains over time.

In my view, Bailador shares are a buy at current levels ($1.04 at time of writing). Shares currently trade at a significant discount to their net tangible asset (NTA) value of $1.37 pre-tax and $1.24 post-tax as at the end of October.

It is also assuring that Bailador is supported by WHSP and that its co-founders have skin in the game.