Some sectors of the ASX are looking pretty beat up at the moment. While some investors have rotated out of the bigger tech and retail names, I think this has created some buying opportunities.

Here are three ASX shares I’d happily add to my portfolio today.

NextDC

Shares in data centre operator NextDC Ltd (ASX: NXT) are looking good to me at current prices, with the share price still down 7% since being sold off at the beginning of last week.

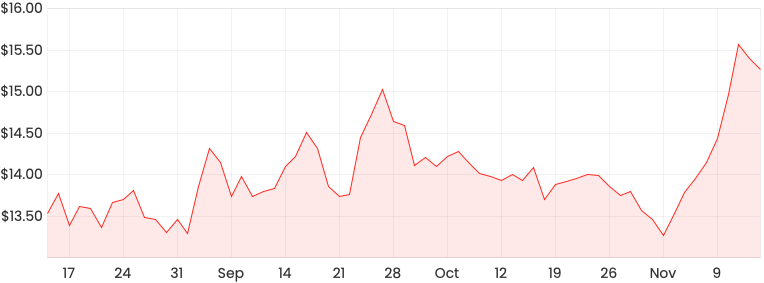

NXT share price chart

I think while some companies have been temporary beneficiaries out of the COVID-19 pandemic, such as Marley Spoon AG (ASX: MMM) which I recently wrote about here, I’m of the opinion that NextDC will be able to continue to perform well over the long-run, even with a vaccine and an open economy.

If you want to read more about why I think this company could be a further wealth winner, click here to read my in-depth analysis of NextDC shares.

Aristocrat Leisure

The Aristocrat Leisure Limited (ASX: ALL) share price wasn’t affected too much last week compared to some others. However, the company is set to release its full-year results this Wednesday, and some brokers are anticipating significant growth in its digital segment.

While there may be some short-term upside off the back of this week’s upcoming announcement, I still like Aristocrat as a long-term play because I think there are some macro factors that play to its advantage.

Regardless of whether venues are shut or open, it remains likely that consumers will continue to gamble, be it online or in casinos. For this reason, I think Aristocrat is well-positioned to take advantage of the gradual unwinding of restrictions due to its broad hybrid offering across the world.

You can read more about Aristocrat Leisure in this article: How I analyse Aristocrat Leisure shares

Transurban Group

Transurban Group (ASX: TCL) shares also weren’t too affected after last week’s sell-off. Even at current levels, there are still quite a few reasons as to why I’d happily add Transurban shares to my portfolio.

TCL share price chart

Transurban is a road operator that develops, manages and maintains toll road networks. It operates 21 toll roads across Sydney, Melbourne, Brisbane and North America.

One thing that’s really attractive about this company is its pricing power. Most of its toll fees can be increased by either the annual inflation rate or 4% per year (whichever is higher).

In addition to this, there’s most likely going to be some more upside when international travel resumes because many of its road networks service international airports.

If you’d like to know more, click here to read my recent article on Transurban Group shares.