While ASX travel shares seem to be the current favourite for a recovery play, Tyro Payments Ltd (ASX: TYR) could also be a beneficiary from a reopening economy.

The Tyro share price has been relatively stable since June, but has definitely been weighed down by the overall sentiment surrounding consumer spending.

TYR share price chart

What does Tyro do?

Tyro provides payment solutions to merchants as well as business banking products to businesses in Australia. You might not know it, but you’ve more than likely used a Tyro EFTPOS terminal when you’ve used your card to pay for something in-store.

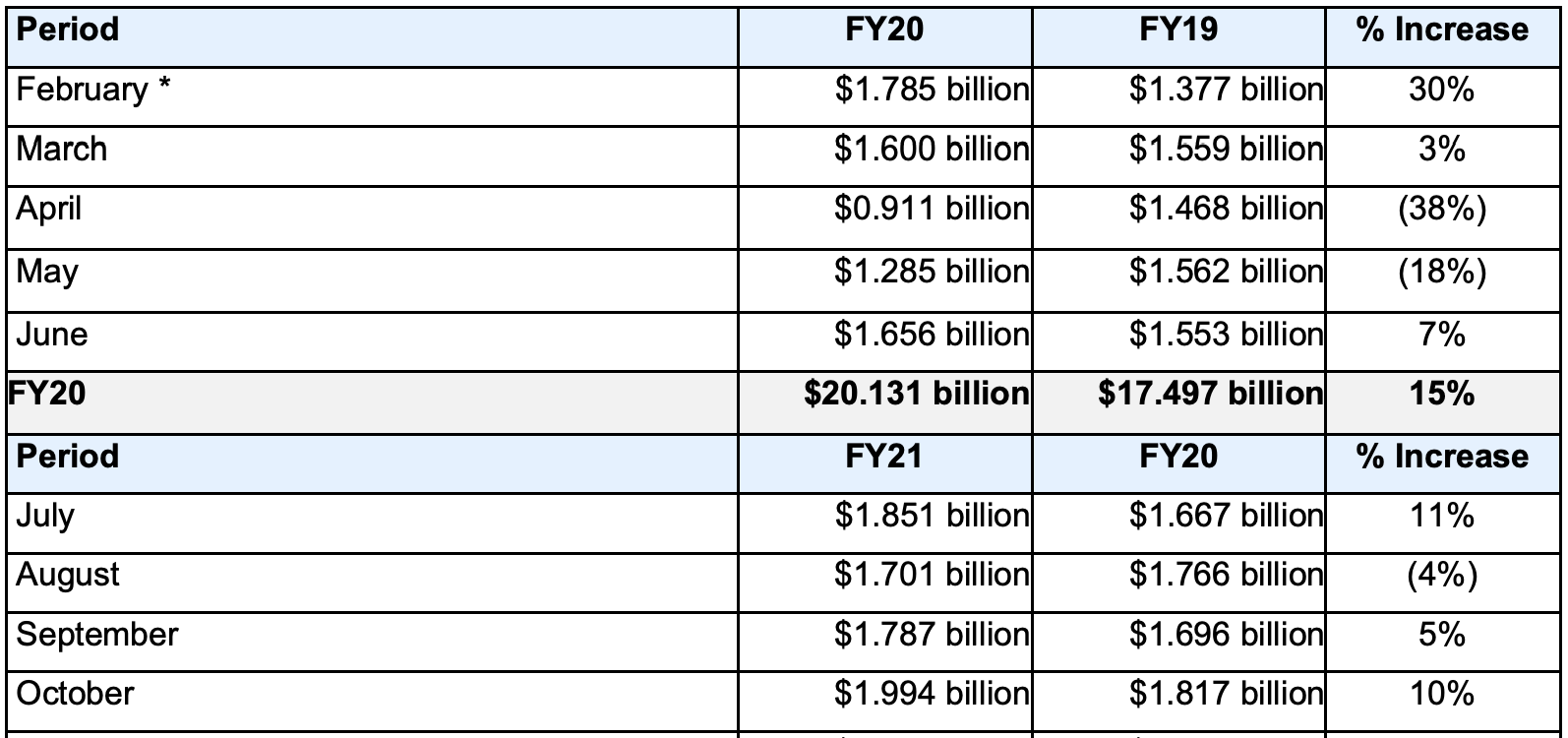

The company was founded in 2003 and has gone from processing just $6 million transactions a year to over $20 billion in FY20.

Tyro essentially performs the basic functions of a bank, meaning it can hold its customers’ money in the form of a deposit, as well as issue businesses loans to manage working capital and investment needs.

Tyro differentiates itself from the big four banks by catering primarily to small and medium-sized enterprises (SMEs). While it has traditionally focused on in-store payments, Tyro has recently expanded into e-commerce.

Has COVID-19 held Tyro back?

Since March this year, Tyro has performed quite well given the circumstances. April was the only month that saw total transaction value (TTV) significantly fall compared to the prior year (-38%), but as you can see from the chart below, TTV has still managed to increase most months up until October.

Monthly transaction volumes

There’s no denying here that Tyro’s done quite well this year considering the circumstances, but it probably would’ve done even better if COVID-19 didn’t happen. So the intuition behind why Tyro has some further recovery upside is relatively simple: as sentiment improves surrounding COVID-19, people will move around a bit more and will likely make more transactions.

The push to cashless transactions, which has been brought forward by COVID, is a fairly significant tailwind that should play to Tyro’s advantage. Tyro charges a percentage fee on EFTPOS transactions using its terminals, so it would make sense that the accelerated shift to a cashless society would provide an ongoing boost in this revenue segment.

Are Tyro shares a buy?

I’d happily buy Tyro shares as a recovery play, and I see them as a safer bet than some of the ASX travel shares at the moment.

It’s not so much leveraged to the state of the rest of world, and given that Australia is handling the pandemic quite well, I think Tyro shares might be a faster recovery play compared to those that are dependent on international travel.