Objective Corporation Limited (ASX: OCL) shares have gone relatively under-the-radar for many investors this year compared to some of the bigger names on this ASX.

The Objective Corporation share price has had an incredible run since March, but I don’t think it’s comparable to some of the market darlings that have been temporary beneficiaries of COVID-19. Objective Corp shares have returned nearly 100% since June and currently trade for $12.51 at the time of writing.

Here’s some analysis on Objective Corporation and why I think it’s an ASX growth share to look out for.

OCL share price chart

What does Objective Corporation do?

Objective Corporation is a multinational software provider with operations in Australia, the UK, New Zealand, and other countries. It specialises in content management and governance solutions with over 1,000 customers across 60 countries.

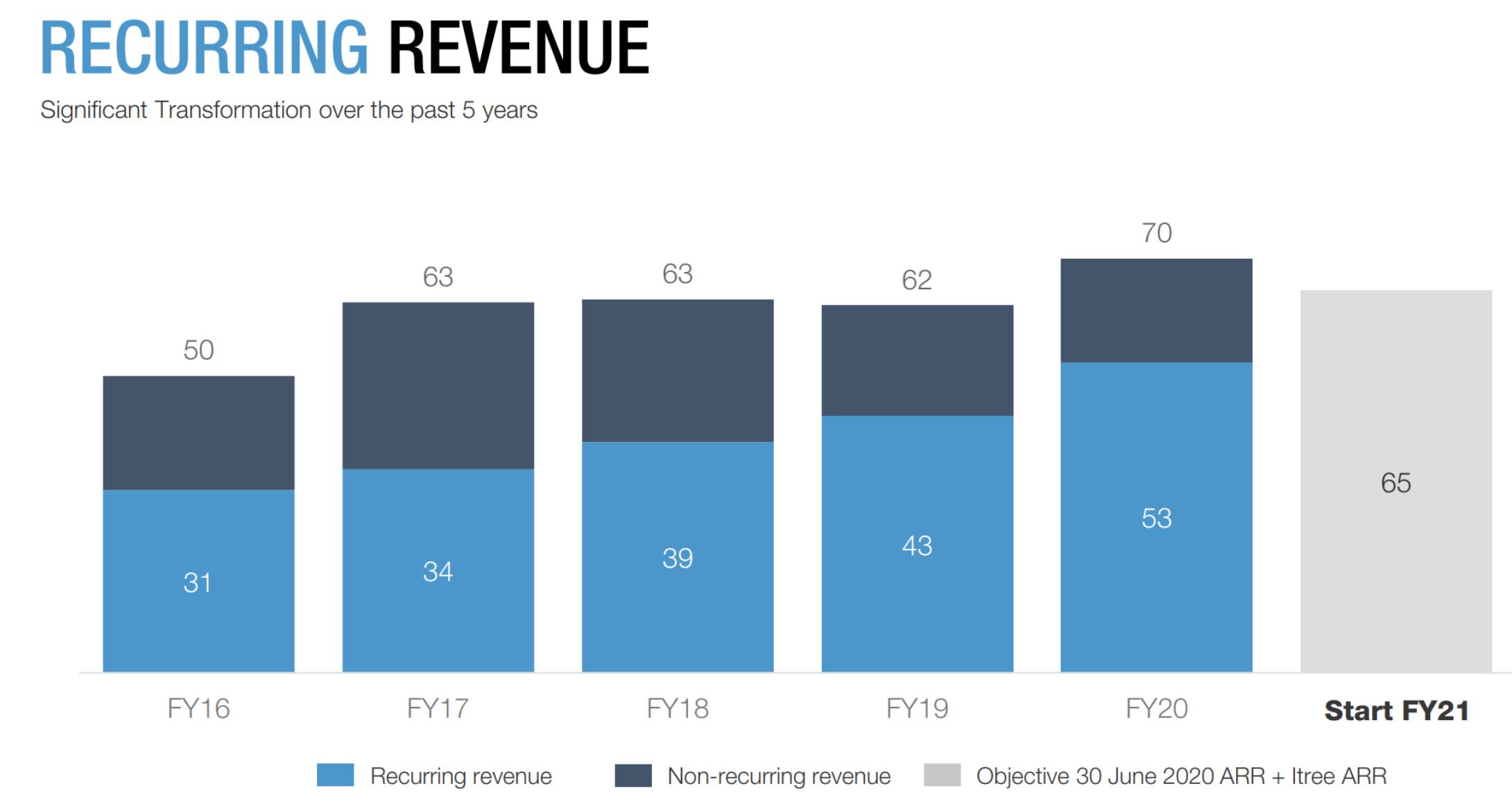

The company has seen some significant changes to its revenue composition within the last five years, with recurring revenue now making up roughly 75% of total revenue.

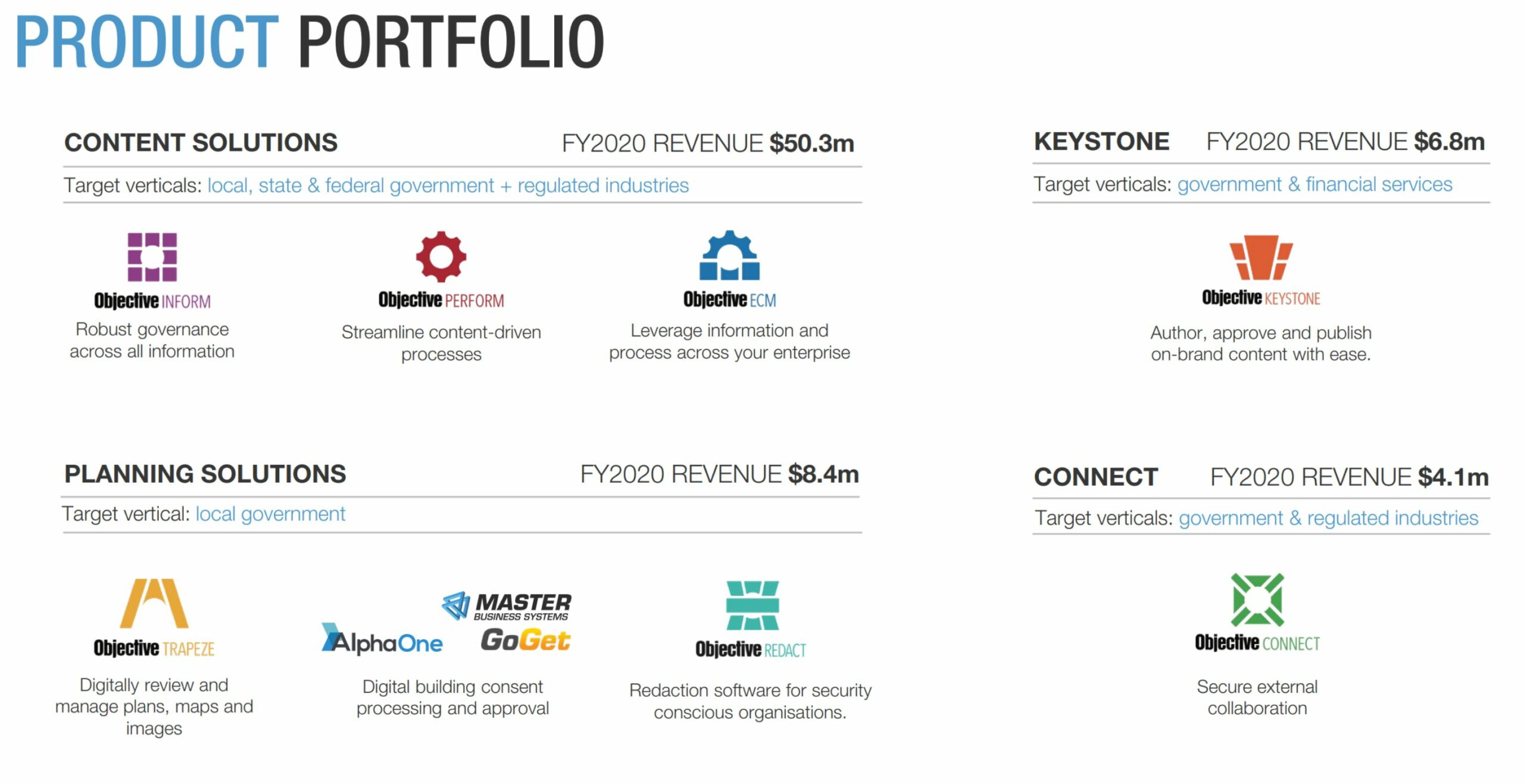

In layman’s terms, Objective Corp has a suite of products that streamlines efficiencies across bureaucratic activities. Its core segment is content solutions, which include Objective ECM (Enterprise Content Management), Objective Inform, and Objective Perform.

These products all assist government bodies in the transition away from inefficient paper-based practices to digital content management. Manual processes are automated, boosting efficiency and delivering better outcomes for all stakeholders.

Just to quickly mention a couple more of its products, Objective Trapeze is used by planners and surveyors to approve and stamp digital plans, which eliminates the need for paper-based measurements and calculations.

One more product that I particularly like is Objective Connect, which allows bureaucrats to securely share sensitive files across other departments and to other parties. How many times have our applications been held up by slow and inefficient government processes that require other departments to “speak to each other”?

Objective Corp’s suite of products serves an incredibly important purpose, and as long as we have government regulation and policies, there are always going to be processes that can be streamlined and done more efficiently. I see this as a huge sustainable tailwind that will provide a constant demand for these sorts of software solutions.

Objective Corp’s pricing model

Within the last few years, Objective Corp has been transitioning its ECM customers from a perpetual licence model to an annually recurring ECMaaS (ECM as a Service) model.

We know from looking at other companies such as TechnologyOne Limited (ASX: TNE) and Altium Limited (ASX: ALU) that a change in the pricing model causes a significant revenue headwind in the short-term. This is because perpetual models deliver more revenue upfront at the time of sale rather than on a recurring basis over time.

In the case of Objective Corp, this phenomenon is no different, but because the company is quite far into the process of the pricing transition, it’s already started to realise the benefits that have come with it. As you can see from the image below, annual recurring revenue (ARR) has been significantly growing over the last 5 years and now makes up over 75% of revenue based on FY20 results.

Skin in the game

CEO Tony Walls has taken a fairly unconventional approach in regard to his remuneration over the years of the business. At just $280,000 a year, he has one of the lowest salaries compared to most CEOs of ASX companies. He hasn’t sold a single share in the company since its inception and still holds around 67% (62 million) of the shares outstanding, valuing his total shareholding at around $780 million on current prices.

This concentration of share ownership actually puts the average retail investor like you and me at an advantage over the larger institutions and fund managers. With only 30 million or so shares available, OCL shares are fairly illiquid and aren’t traded frequently, which means fund managers could struggle to build positions for their clients. Having fewer buyers in the market should relieve some pressure off the selling price.

Buy/hold/sell?

I’m really liking Objective Corp shares at the moment and would be happy to be a buyer at some point. However, the OCL share price has had a staggering run since June and the market may have gotten a bit ahead of itself there.

The valuation is slightly stretched on a P/E basis, but that is to be expected of tech companies that are forecasting a large amount of growth in the coming years.

I’d be happy to look past the valuation at this point and have faith in the management to execute its hybrid strategy of both organic growth and growth by acquisition.

Objective Corp’s management has a solid history of making smart capital allocation decisions through share buy-backs as well as bolt-on acquisitions that expand the current offering. New products then present the opportunity of cross-selling and upscaling, and most of the company’s future revenue growth may well come from existing customers.