Kogan.com Ltd (ASX: KGN) might’ve been one of the biggest beneficiaries of the pandemic this year.

While Kogan shares are trading at a 22% discount from where they were just a month ago, I still question whether this represents good value given the broader macroeconomic outlook in discretionary spending.

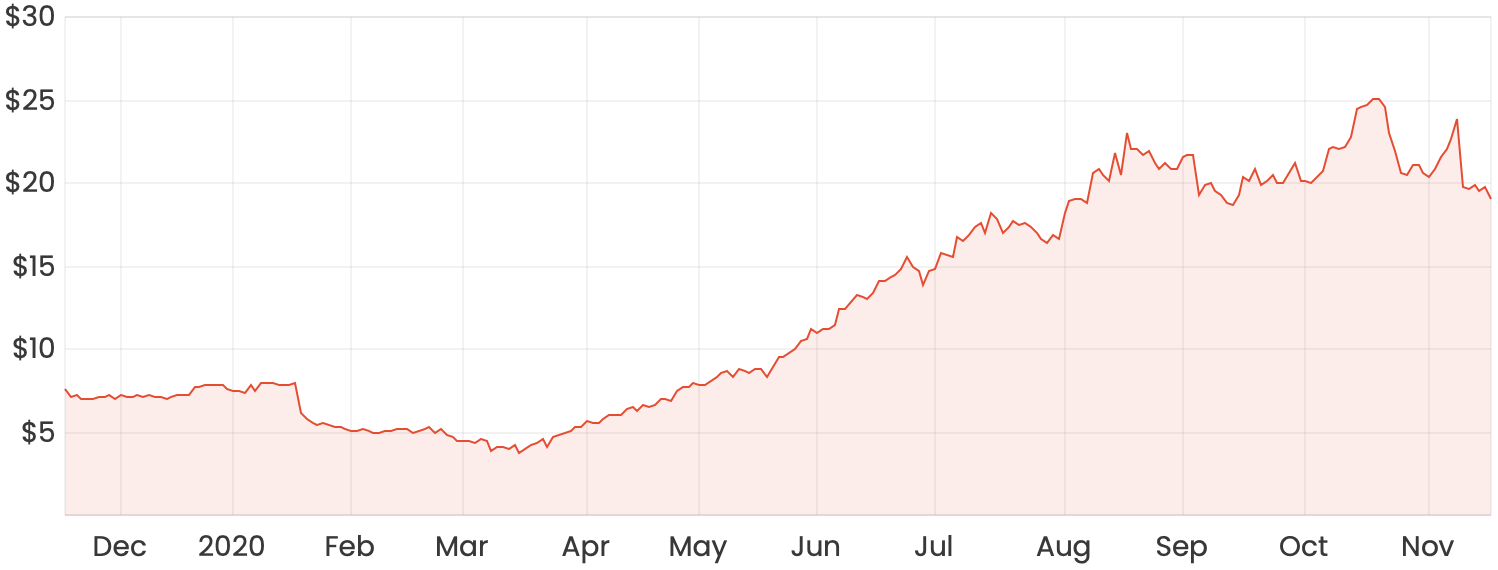

KGN share price chart

A quick recap of Kogan’s COVID-19 tailwind

The online retailer was in a prime position earlier this year to take advantage of the COVID-19 situation. While Kogan did report strong growth in its FY20 results, even more impressive were its figures in the following months, which confirmed the continued acceleration of growth across all its platforms.

In the month of August, gross sales increased by over 117% year-on-year (YoY), which allowed gross profit to grow by more than 165% YoY. Additionally, Kogan had over 2,461,000 active customers by the end of August 2020. The most impressive growth figure was its adjusted EBITDA, which managed to grow by over 466% YoY.

Is the Kogan share price a buy today?

Right now, it’s hard to say. Kogan is going to be releasing its next business update at the company’s AGM this coming Friday. There’s no doubt that its sales figures are going to be impressive relative to the same time last year, but I think what will be important is how the figures stack up compared to last month’s results.

Relative to its earnings, Kogan’s share price is expensive compared to what retailers usually trade at. However, given its recent performance, I would say that this valuation has been relatively justified up until this point.

Remember that the market is forward-looking, and I think in this case the market is expecting Kogan to at the very least maintain these really high levels of growth we’ve seen since March.

Kogan’s upcoming result on Friday might show even more growth on top of what we saw in August, or it might not. I personally try to avoid situations where there are high expectations built into the share price, as there’s more often than not much more potential downside rather than upside.

Take for example what recently happened with Marley Spoon AG (ASX: MMM), which you can read about in my recent article. The meal kit provider’s quarterly results looked fantastic compared to the prior year, but actually showed a slow down of growth compared to the previous quarter. You can guess what has happened to the share price since.

Summary

To buy Kogan shares right before Friday’s announcement would be too speculative for me personally, although it might be fine for others.

If you’re looking for a way to play the COVID-19 recovery, check out my favourite ASX shares right now.