Investors rotating out of the COVID-19 beneficiaries caused some of the big ASX tech names to pull back significantly recently. I can understand the profit-taking, but some of these share price changes seem very irrational, in my opinion.

With that in mind, here are two ASX tech shares that are looking good to me at current prices.

Altium

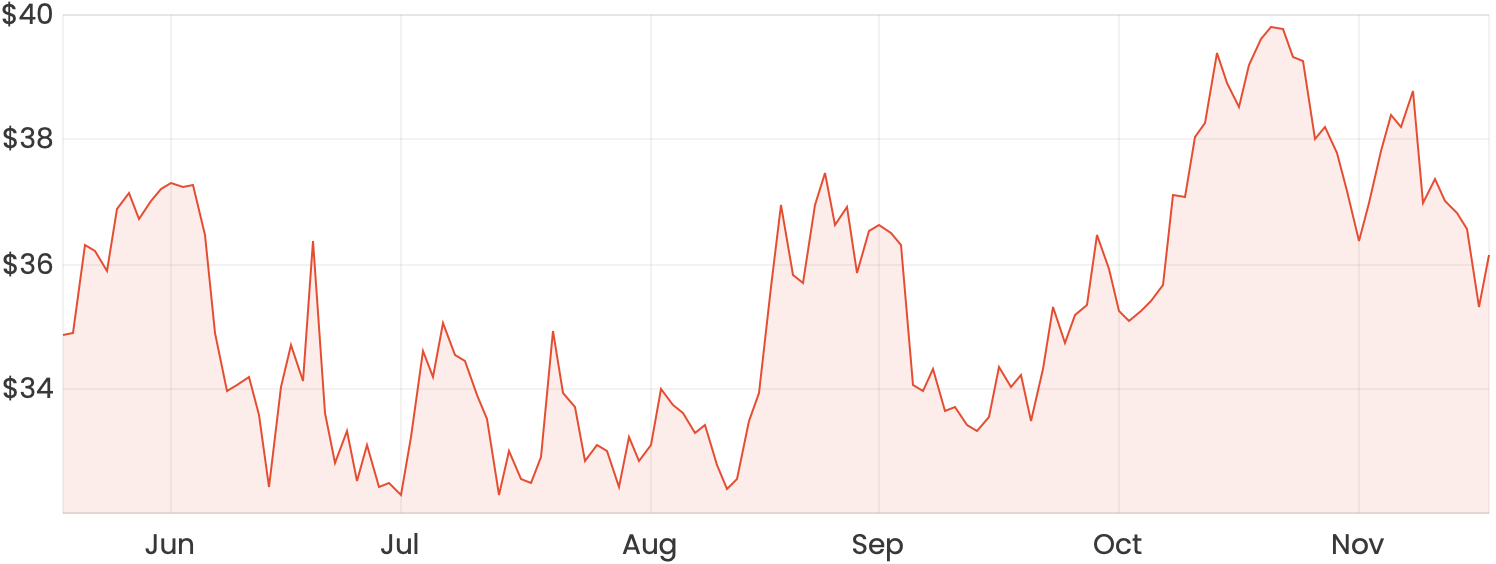

Altium Limited (ASX: ALU) shares were trading at the $40 mark just one month ago, but have now pulled back to around $36 per share.

While the Altium share price has more or less gone sideways for quite some time, I think there are some big things ahead for this company.

ALU share price chart

Altium is in the process of transitioning its customers from a perpetual license model to a recurring Software-as-a-Service (SaaS) pricing model.

We know from looking at companies like Objective Corporation Limited (ASX: OCL) and TechnologyOne Limited (ASX: TNE) who have done the same thing that this presents a pretty significant headwind in the short-term.

This is because SaaS models don’t recognise as much revenue upfront – instead, it will take time for this recurring revenue to be recognised over time. Management has set some pretty ambitious revenue targets over these next few years, but I have faith in their strategy and the new Altium 365

platform.

If you’d like some further reading on Altium, you can read my in-depth article on Altium shares.

Appen

Shares in Appen Ltd (ASX: APX) have also been sold off quite significantly over these last couple of months. Appen is a provider of data labelling services which are used in artificial intelligence (AI) and machine learning systems.

APX share price chart

Investors panicked in late August as a result of insiders selling shares, which was then followed by the company’s HY20 results which failed to regain investor confidence.

Admittedly, insider selling is never a great look, but if your original investment thesis remains intact, I wouldn’t sell out for this reason alone.

Looking ahead, many analysts are anticipating a significant further runway for growth, which I think justifies the slightly stretched forward P/E ratio of 53x FY20 (estimated) earnings.

Some have pointed out that COVID-19 has caused accelerated growth in sectors such as logistics, e-commerce and contactless services. Appen should be well-positioned here to provide its data labelling services, and I see this as a sustainable tailwind moving forward.

I’d be happy to buy shares in Appen today, however with a very long term outlook.

To discover which other ASX shares I think are a buy right now, check out this article: 3 ASX shares I’d be happy to buy today