The Infomedia Limited (ASX: IFM) share price is up around 4% following the company’s annual general meeting (AGM) held on 11 November. Is it time to buy Infomedia shares?

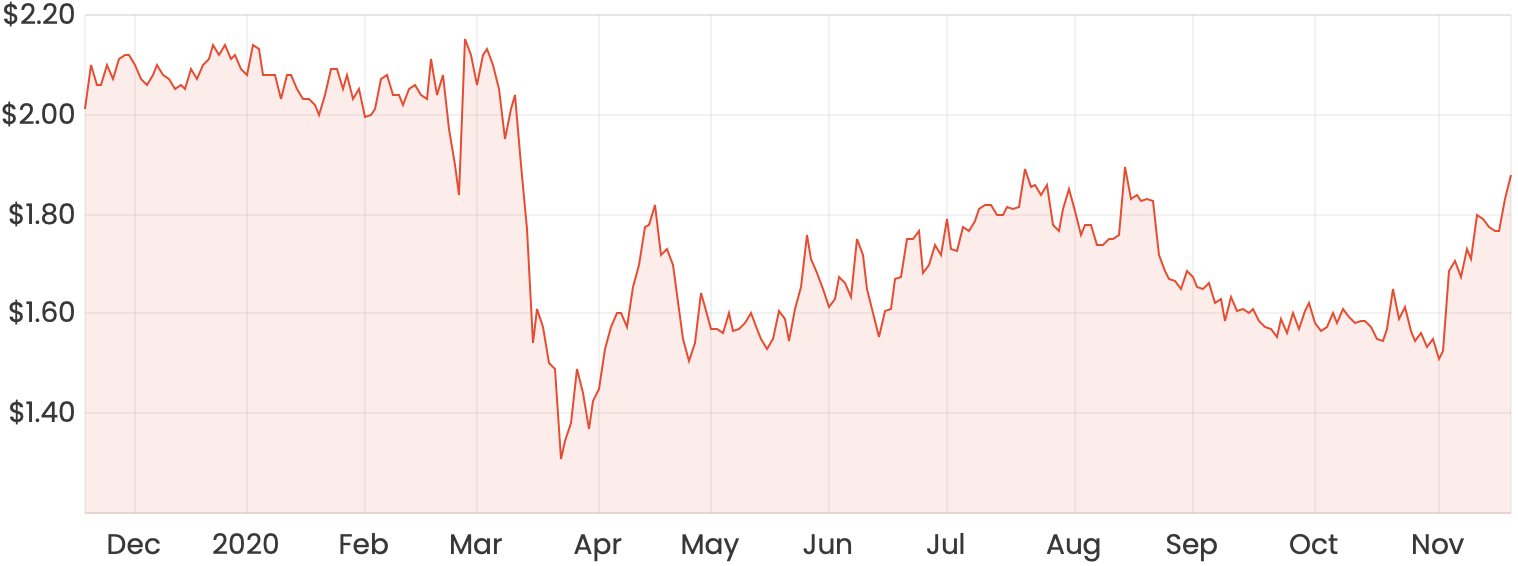

At the time of writing, Infomedia has a share price of $1.865 and a market capitalisation of $705 million.

IFM share price chart

About Infomedia

Infomedia is a global provider of SaaS (Software as a Service) solutions to the parts and services sectors of the automotive market. Infomedia was founded in 1987 and has grown to serve a user base in excess of 170,000 across 186 countries.

Infomedia’s 2020 AGM

Infomedia held its virtual Annual General Meeting (AGM) last week.

Chairman Bart Vogel was pleased to deliver a financial result for FY20 that was in line with expectations, despite incurring delayed revenue stemming from COVID-19 restrictions.

Bart highlighted that this was the fourth successive year of revenue and earnings growth achieved by the current management team and board.

Bart emphasised that Infomedia is in a “solid financial position”, ending FY20 with net current assets of $98.0 million – including cash and cash equivalents of $103.9 million.

Digging into the numbers, Infomedia delivered solid growth in FY20:

- Revenue came in at $94.6 million for the year, an increase of 12% on the prior corresponding period (pcp);

- Net profit after tax (NPAT) was up 15% on the pcp to $18.6 million; and

- Earnings per share (EPS) grew 10% on the pcp to 5.69 cents per share.

FY21 guidance

While specific guidance for FY21 was not provided, investors may have been pleased with Infomedia’s statements alluding to the outlook for FY21.

Bart mentioned that despite COVID-19 impacting the first half of FY21, “recent wins in Europe including our win with Ford Europe announced last week, and other deals in Asia Pacific and the Americas are expected to deliver a stronger second half of the 2021 financial year (FY21)”.

Infomedia CEO Jonathan Rubinsztein added that “we expect growth in calendar 2021 to re-emerge at a faster pace”.

Jonathan pointed out some initiatives Infomedia is undertaking to drive growth:

- The Next Gen platform will be delivered by the end of 2020. Jonathan commented, “our modern Next Gen platform of integrated parts service and data solutions allows Infomedia to drive a much stronger Customer proposition and access a broader addressable market”.

- Focus on acquiring assets that may enhance functionality, add customers and allow Infomedia to enter new geographies.

Is the Infomedia share price a buy?

I think Infomedia is certainly well poised to continue to grow earnings over time. However, Infomedia shares are currently trading on a price/earnings ratio of 31.

I feel investors have expressed confidence in Infomedia’s growth story playing out, and are therefore willing to pay a premium to acquire shares. I would be looking to pick up shares in Infomedia well below the current share price.

In the meantime, check out other ASX growth share ideas here.