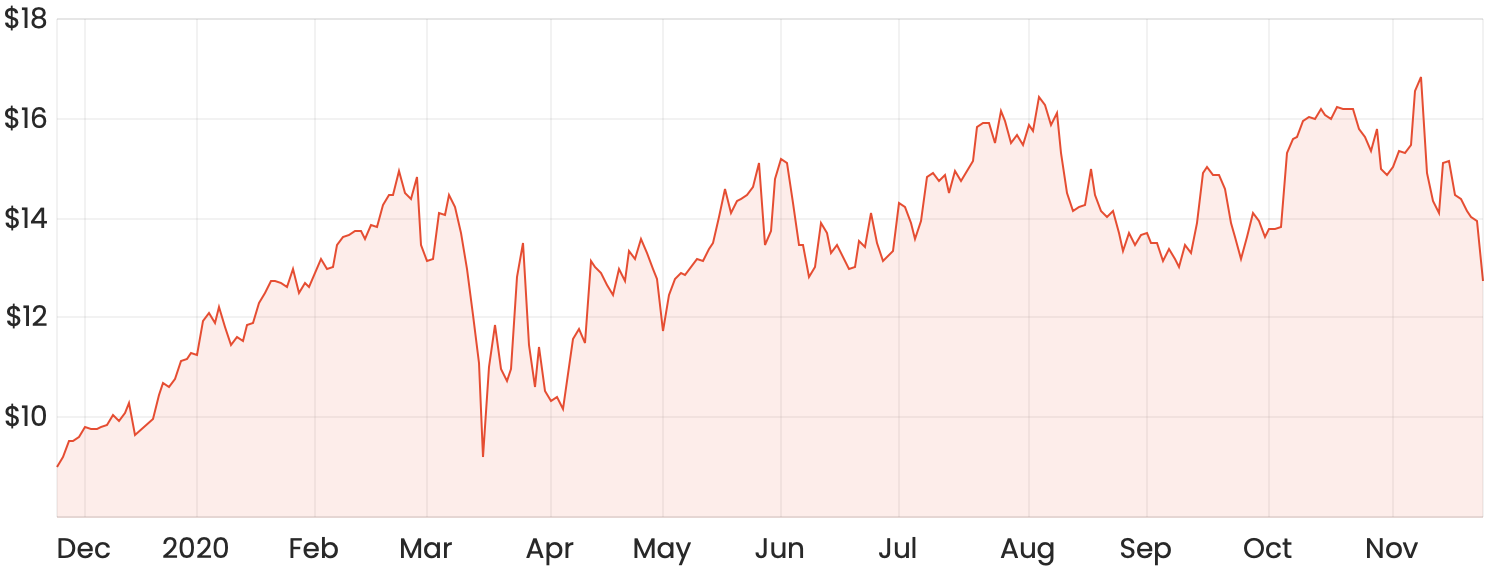

One standout performer this year has been the Northern Star Resources Ltd (ASX: NST) share price. Northern Star shares had returned nearly 100% since March – that was until multiple potential vaccine announcements caused the recent sell-off of many of the big ASX gold miners.

NST share price chart

While the recent string of positive vaccine announcements has thrown a much-needed lifeline to ASX travel shares, the gold price has moved in the opposite direction, causing investors to hit the sell button on ASX gold shares.

The price of gold is generally negatively correlated with the broader market. As Northern Star is a price taker, a falling gold price will have a negative impact on the revenue it’s able to generate.

Is now a good time to invest in gold?

It’s important here to differentiate between investing in physical gold (bullion) and investing in a gold-producing company such as Northern Star.

Investing in physical gold would definitely require some more active management and can be used as a contrarian investment based on what you think lies ahead for the general market. With everyone having a different opinion on what the future holds, there’s no right or wrong answer here.

I probably wouldn’t buy physical gold now because I think it’s likely that the broader market will continue to trend upwards off the back of more positive vaccine announcements.

Is the Northern Star share price a buy?

If I had to play gold as an investment, I’d definitely be choosing a gold-producing company rather than physical gold. Producers are like any other normal company with operations, earnings and potential dividend distributions. While they are price takers based on the price of gold, they can still outperform the broader market even when the market is trending upwards.

Northern Star is a great example of this, with the NST share price returning more than 4,792% over the last 10 years. In FY20, the company announced record underlying net profit of $291 million (up 69%). It declared a final dividend of 9.5 cents plus a special dividend of 10 cents, both fully franked.

Northern Star’s gold production is forecast to rise consistently over the next three years. A falling gold price will have an impact on its revenues, but given its past performance, this might not prevent the company from continuing to grow its earnings.

A merger with fellow ASX gold miner Saracen Mineral Holdings Limited (ASX: SAR) is also on the cards.

The verdict

Buying shares in Northern Start could be a relatively safe investment. However, if gold prices are expected to fall further, this will be an ongoing headwind. I’d rather invest in companies where macroeconomic factors work for the company rather than against it.

For some share ideas outside of mining, here are 3 ASX shares I’m watching closely right now.