The Suncorp Group Ltd (ASX: SUN) share price has rallied more than 26% this month off the back of more vaccine excitement.

Tech and retail are off the menu and have now been replaced by recovery shares that have brought down the broader index for much of the year.

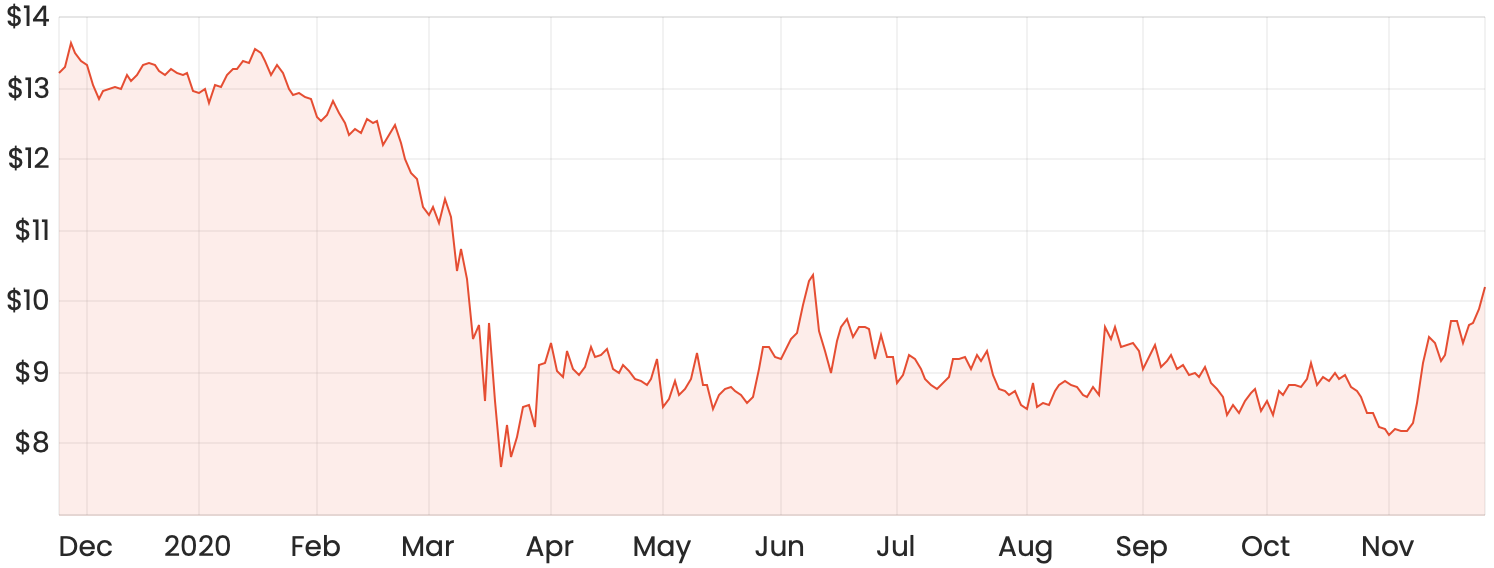

SUN share price chart

Suncorp is broadly split between traditional banking services as well as insurance. These two industries on their own are both very tough spaces to be in, so I think this is going to make things extra difficult for Suncorp for at least the next few years.

Why the insurance industry is a tough space

I recently wrote an article about Insurance Australia Group Ltd (ASX: IAG) regarding its recent $865 million capital raising. IAG has run into trouble with potentially having to pay out claims associated with losses that have arisen from COVID-19 business interruptions.

I’m using IAG as an example because I think it could be entirely possible that these sorts of situations occur more frequently for insurance companies, especially while the COVID-19 situation plays out. Insurance is also a heavily regulated industry, with providers usually having little pricing power compared to other less-regulated industries.

Another important factor to keep in mind is the record-low interest rate that is likely to remain for at least the next few years. Interestingly enough, insurance companies don’t just make their money through collecting premiums and paying out less in claims. Insurance companies take your premium and put this money into interest-bearing investments. Therefore, low interest rates make it even tougher to generate substantial returns.

Why the banking industry is also challenging

I’ve written about the ASX banking sector a few times as well, which you can read here. Unfortunately, the banking sector suffers the same headwind from a low-interest-rate environment.

Banks currently pay very little amounts of interest on their deposits, so a further decrease in interest rates does little to reduce the amount of interest they pay on these deposits. However, because banks will collect less interest on their interest-bearing assets such as loans, this will inevitably compress their margins and make them less profitable.

You’ve then got the additional pressure of buy now, pay later (BNPL) companies and other fintechs trying to disrupt traditional banking practices that could put more pressure on margins.

What’s the verdict?

I wouldn’t be a buyer of Suncorp shares at the moment. The current macro environment isn’t working in its favour in my opinion, and I’d rather invest in companies with secular trends moving it forward.

For more reading, here are 3 ASX dividend shares I’d buy today.