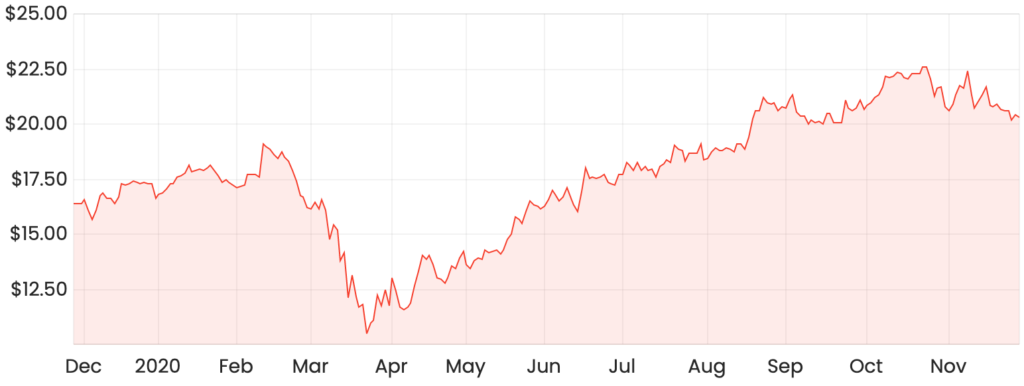

The Carsales.com Ltd (ASX: CAR) share price has been been on fire in 2020, surging almost 24%. This has resulted in Carsales shares greatly outperforming the S&P/ASX 200

(ASX: XJO) over the last 12 months, which in stark contrast has delivered a loss of nearly 5% in the past year.

The Carsales share price is around 10% lower than its all-time high of just under $23. Could this be an opportunity to buy shares in a high-quality business on the dip? Or is the rally over?

Carsales share price chart

What does Carsales do?

Carsales is best known for its dominant Australian online automotive classifieds website. However, over time, Carsales has been expanding its offering into a range of automotive, marine, industry machinery and equipment classified businesses.

Carsales generates the majority of its revenues from charging car dealerships and private vehicle owners fees to advertise new or used vehicles on its websites. Carsales also generates revenues from data, research and associated services.

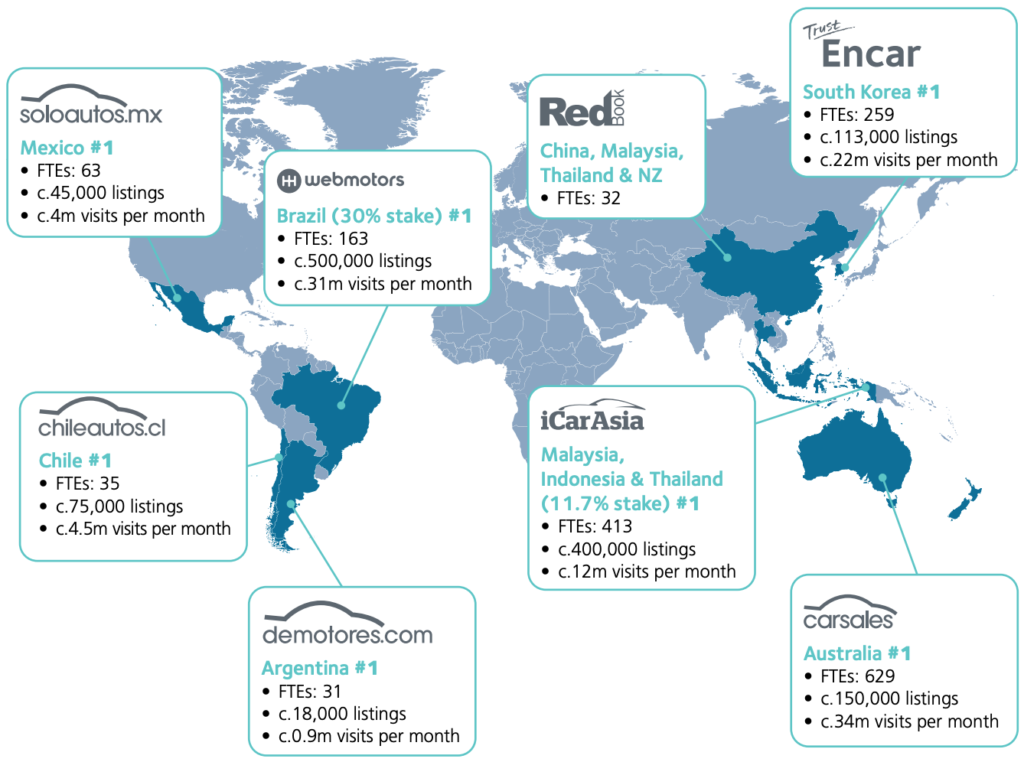

Today, Carsales is a multinational group, operating leading automotive classifieds businesses in Asia and Latin America. Outside Australia, South Korea-based Encar.com is Carsales’ largest classifieds business.

The image below is sourced from Carsales’ FY20 report and gives an idea of the group’s global scale.

Carsales’ FY20 recap

Carsales had a challenging FY20 in the face of the COVID-19 pandemic. The company reported revenue of $395.6 million and NPAT of $119.9 million, down 5% and 9% respectively on FY19.

Carsales’ FY20 annual report explained that the “increasing severity of social distancing measures imposed in Australia across March 2020 significantly impacted the automotive industry and our customers, which translated into a reduction in buying and selling activity on carsales”.

The company elected to offer assistance to car dealers comprising of a 100% rebate in April, a 50% rebate in May and a 100% rebate on new car services in June. Excluding the impact of the dealer rebates, revenue actually increased 1% on the prior year.

Click here a for a full review of Carsales’ FY20 results.

Highly profitable business

Carsales operates a highly profitable business model as characterised by its high return on equity (ROE). According to Morningstar, Carsales earned an ROE of 35.4% in FY20.

In a simplistic sense, this means Carsales achieved a profit of $0.35 for every $1 of shareholders’ equity held on its balance sheet. You can learn about return on equity here.

FY21 outlook

Carsales held its AGM (annual general meeting) on 30 October 2020. While no specific guidance was provided due to the uncertainty created by COVID-19, the company reiterated a focus on controlling costs and investing to maintain and grow its market leadership.

Carsales confirmed it was benefiting from a rapid rebound in used car volumes occurring in line with the easing of COVID-19 restrictions.

Finally, Carsales confirmed its low level of gearing and ability to fund dividends and growth initiatives.

Is the Carsales share price a buy?

In summary, Carsales is a highly profitable business and is well-positioned to capitalise on a return to a post-COVID-19 world. With that said, Carsales shares have been running very hot, seemingly factoring in a complete recovery in operational results.

Personally, I think Carsales shares are worth somewhere between $10-15 a share. In the meantime, check out other ASX growth ideas here.