One thing we’ve seen from COVID-19 is that many of the ASX shares that have done extremely well are those that could introduce a robust hybrid offering to their customers. By this, I simply mean offering an online marketplace as well as physical stores, as an example.

Gaming machine provider Aristocrat Leisure Limited (ASX: ALL) has experienced some rapid growth in its digital arm in FY20, which was still unfortunately not enough to offset the drop in sales in its land-based segment.

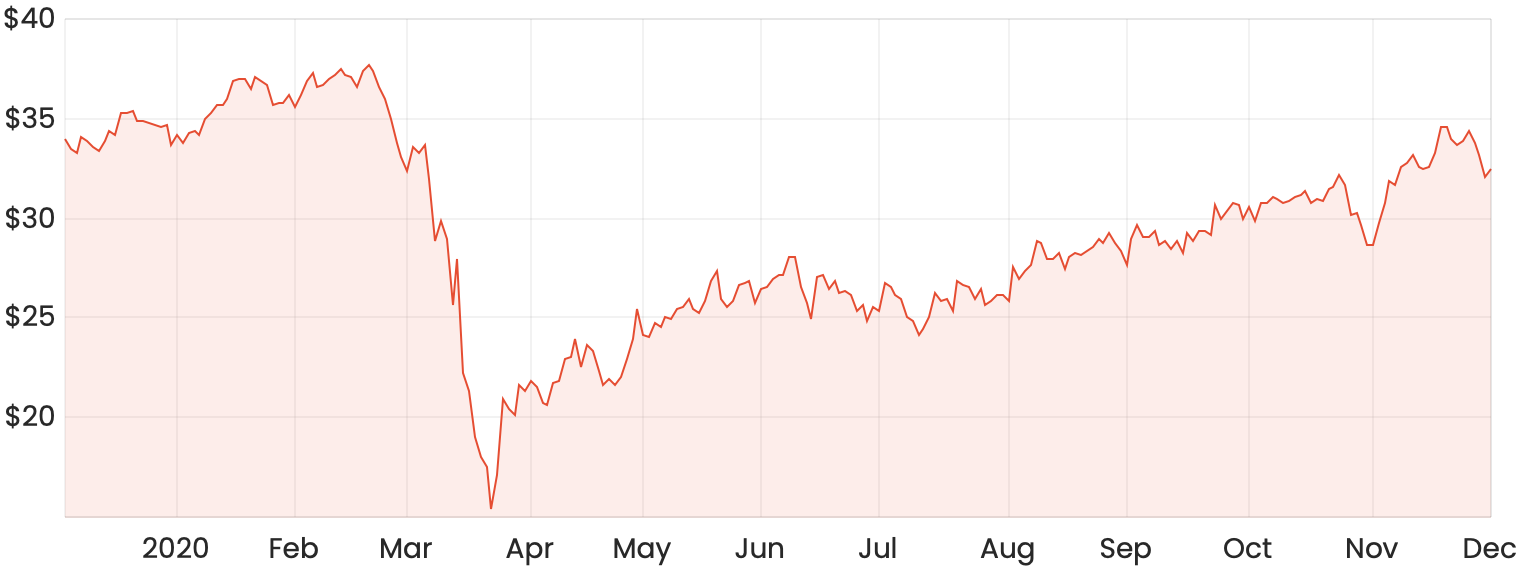

As such, Aristocrat shares are currently trading at a 13% discount to their pre-COVID levels.

ALL share price chart

Are Aristocrat shares a buy today?

I would preface this by saying that there are definitely some ethical considerations you should make as an investor that should help guide your investment decision. Some people might have different beliefs as to how ethical a business like this may be, so I don’t think it’s easy to label it as right or wrong.

Rask Australia’s Owen Raszkiewicz and Max Wagner recently discussed ethical and sustainable investing on a recent episode of The Australian Investors Podcast.

Ethical considerations aside, I think Aristocrat is well-positioned to be in the crosshairs of the accelerated online shift we’ve seen as a result of COVID-19.

Aristocrat recently released its FY20 results, which were pretty much in line with expectations. Its land-based segment did underperform due to the effects of COVID-19. However, the company saw strong growth in its digital segment, with bookings growth and profit up 31% and 34%, respectively.

The company remains confident that gambling as a whole will continue to be extremely popular with its audience. As such, many analysts are predicting its land-based segment to recover over time as the COVID-19 situation improves.

While no one knows for sure when this will be, Aristocrat at least has its strong digital arm with brands such as Big Fish Games and Plarium to keep its land-based segment afloat for the time being.

Valuation

At the time of writing, Aristocrat shares trade on a forward P/E ratio of 28.9 based on FY21 consensus earnings estimates.

Provided the estimates are indeed relatively accurate, this valuation is on the cheaper side considering expected earnings per share (EPS) growth of 49% next year.

The verdict

I would happily buy Aristocrat shares today for a couple of key reasons. Firstly, the Aristocrat share price appears to be decent value considering the potential for some significant earnings growth.

Secondly, I would be fairly confident that gambling in-person will recover at some point. Like some of the ASX travel shares, this recovery might take some time, so you’d definitely have to have some patience.

In the meantime, however, the digital arm of the business looks extremely promising and I view it as a significant growth runway in the coming years.

For more share ideas, here are 3 ASX shares with secular tailwinds that I’m liking at the moment.