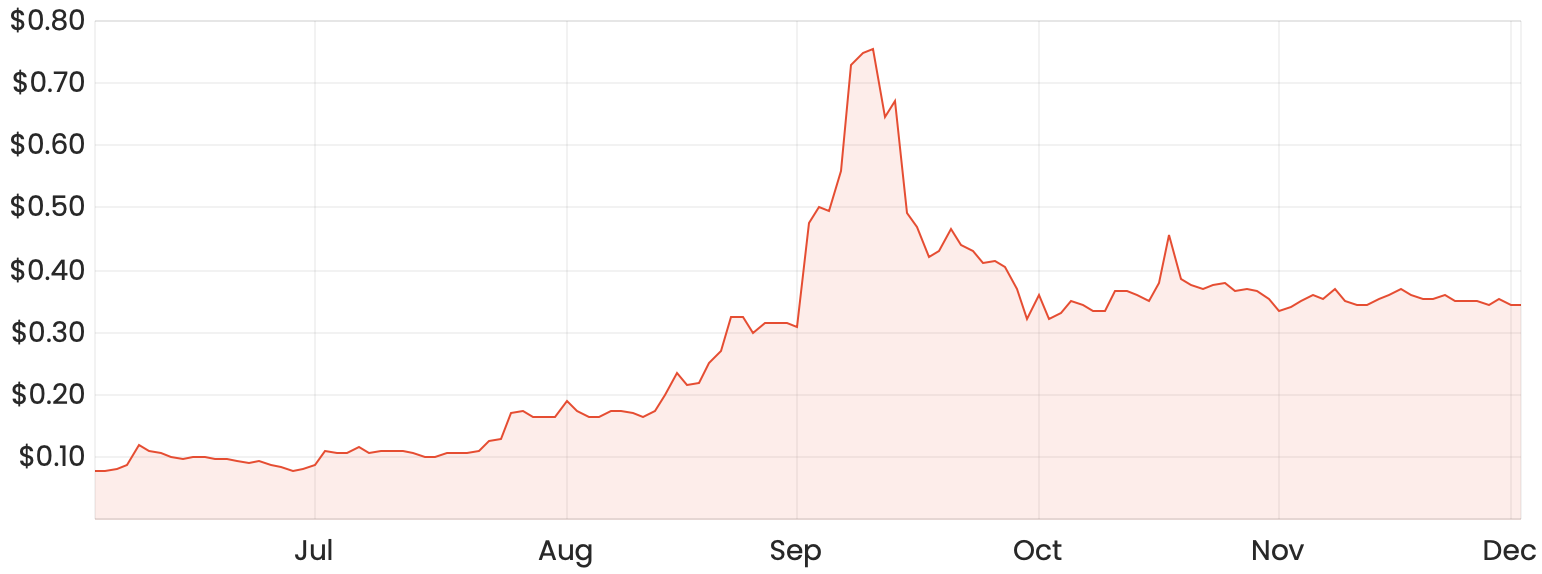

The Brainchip Holdings Ltd (ASX: BRN) share price has halved since September. Are Brainchip shares now cheap?

BRN share price chart

Founded in 2011, BrainChip is developing a spiking neural network chip called Akida.

What is Akida?

Akida, which is also the Greek word for spike, is a neuromorphic neural system on chip (NSoC). According to BrainChip, the chip is “inspired by the spiking nature of the human brain and is implemented in an industry standard digital process”.

Akida is capable of analysing data from sensors at the “edge” rather than transferring data to “the cloud” for processing at a data centre.

BrainChip believes Akida has edge computing applications such as “intelligent environmental controls, driver safety monitoring, vehicle safety and preventative maintenance, medical image classification, wearable health monitors, retail item recognition, access control, the industrial Internet-of-Things (IoT) and acoustic analysis”.

The Akida chip has 1.2 million artificial neurons and 10 billion artificial synapses. BrainChip has expressed this is significantly more than any other neuromorphic chip on the market.

BrainChip believes Akida could be up to 10x more energy efficient than competing chips and up to 1,000x compared to standard data centre architectures.

BrainChip’s Q3 update

At the end of October, BrainChip provided commentary on the quarter ending 30 September 2020.

The company reiterated it had signed multiple parties to its early access program (EAP), including The Ford Motor Company, Valeo, Vorago Technologies and NASA.

The EAP is aimed at validating the Akida chip, with fees charged to members to offset expenses. No specific feedback from EAP members was provided.

For the quarter, BrainChip used US$2.2 million in operating expenses, up from US$1.9 million in the prior quarter. The company ended the quarter with US$12.2 million in cash to fund operations.

Is it time to buy BrainChip shares?

From my perspective, the technology behind the Akida chip sounds like it could be game-changing. In a recent article shared on BrainChip’s corporate website, Anil Mankar, Chief Development Officer and Co-Founder said: “Both IBM and Intel have neuromorphic chips but our chip is more efficient than others and we go one step further, it can convert CNN to SNN or to native SNN”.

The main takeaway I gleaned from this statement was that IBM and Intel are involved in the neuromorphic space, which confirms it is an area to be aware of. Clearly, I will need to become acquainted with the abbreviations CNN and SNN.

I have not yet purchased shares, but I have certainly added BrainChip to my watchlist.