Yesterday, buy now pay later provider Zip Co Ltd (ASX: Z1P) released its November trading update, revealing record results across all regions.

In typical Zip fashion, the share price finished in the red off the back of the positive operational news, with rival Afterpay Ltd (ASX: APT) somehow finishing slightly higher than its previous close with no obvious news or announcements.

ZIP share price chart

Zip’s November update

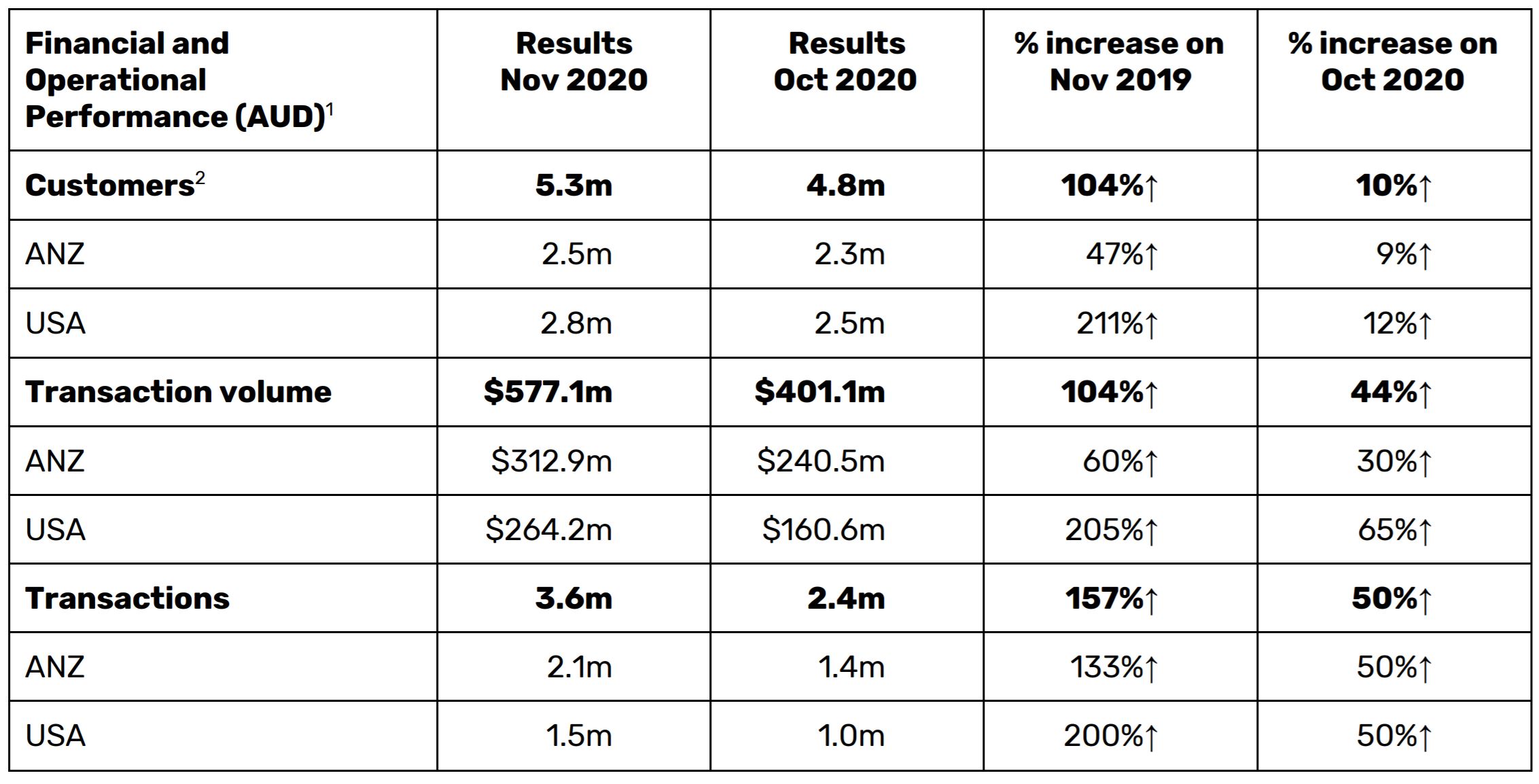

As you can see from the table below, Zip has been able to keep up this year’s momentum with significant growth across transaction volume (up 44%), newly added customers (up 464k), and total transactions (up 50%) from last month.

Despite the severity of the COVID-19 situation in the US, Zip US, under the QuadPay brand, has also seen some incredible growth recently, with transaction volume 65% higher than last month.

Much of this performance has resulted from its popular app, which finished the month rated at #3 in the finance category on the Australian app store and #16 in the shopping category in the US.

Why isn’t the Zip share price moving up?

In my opinion, there might be two possible reasons why the Zip share price doesn’t seem to want to budge from around its current level.

Firstly, there may be many investors who picked up Zip shares months ago when the share price was much higher (around the $8-9 mark). Whenever there seems to be an initial upwards trend in the Zip share price, my guess is that there might be many investors who close out their positions.

In addition to this, Zip is heavily traded among day traders who might be willing to close out positions with smaller returns, adding further pressure on the sell-side.

I think the market has partially realised that Zip still lacks the revenue generation to justify its $3 billion market capitalisation. So the market might expect more growth in order to justify an even higher price tag.

Just a few days ago, Zip announced it was ramping up its entry into the UK market to try and tap into a $600 billion addressable retail market, only for the Zip share price to remain exactly where it was at the open.

How I value Zip shares

I’m going to use a basic P/E ratio to work out the implied earnings that Zip would roughly have to generate in order to justify its current market cap. Please be aware that this model of valuation is not perfect.

Keep in mind that companies in financial services generally trade on a P/E of around 10x. However, I think it’s fair to say that Zip or any other BNPL will not trade on a multiple that low, as BNPL companies seem to carry a loftier tech-like valuation.

Assuming a P/E of 15x sometime after the company matures out, with a market cap of $3 billion, this would imply net income (post-tax) of around $200 million. You could then work out the implied revenue by using a net income margin of a competitor. I am going to use the only profitable listed BNPL provider I could find, Humm Group Ltd (ASX: HUM), which generally achieves a 7% net income margin.

I’ll give Zip an added margin of safety and assume it can achieve a higher margin of 10%. Under this assumption, $200 million in net income would imply $2 billion in revenue. To put that figure into perspective, Zip recorded $161 million of revenue in FY20.

Even if I assume a higher P/E ratio of say, 20x, we get implied earnings and revenue of $150 million and $1.5 billion, respectively.

With a P/E of 30x, we would still be looking at $100 million and $1 billion in implied earnings and revenue.

My point is, even under some pretty stretched valuation assumptions, the company has to earn more than what it’s currently making to justify today’s valuation. It might be able to do this at some point, but how long will this take exactly, I’m not sure. Maybe 5 years or maybe 10. No-one knows for certain.

Are Zip shares a buy?

I find it hard to get excited in a crowded industry where valuations don’t seem to make sense to me.

I ould be wrong but it might be quite some time before these companies are profitable, at which point the valuation process can be slightly easier. Up until that point, there’s an assumption that the company will be able to grow enough to justify the current valuation.

If you’re happy to wait and find out, Zip might be worth the investment today. However, this valuation is just a bit too stretched for my own liking. For some other share ideas that I think represent better value, check out these 3 ASX shares for your watchlist.