Iron ore producers were the standout on the ASX yesterday, with the Fortescue Metals Group Limited (ASX: FMG) share price surging over 13% by the day’s close.

Some assistance from BHP Group Ltd (ASX: BHP) and Rio Tinto Limited (ASX: RIO) was enough to drag up the overall S&P/ASX 200 (ASX: XJO) index by 35 points. Without these gains, the broader index would’ve had a slightly different outcome for the day and finished in the red.

Fortescue is an Australian iron ore company that was founded in 2003 by business tycoon Andrew ‘Twiggy’ Forrest. It is today one of the largest producers of iron ore in the world behind Australian mining giants BHP and Rio Tinto.

Recent share price movements

There have been a few catalysts behind the recent jump in the share price for these producers. Increased demand from China and a supply shortage from other international producers caused the price of iron ore to surge by around 3% to US$136.75 per tonne.

Keep in mind the last time prices were at this level was back in 2013 and the iron ore price has hovered around the US$50-$70 mark from about 2015 to 2019. It’s only been onwards from 2019 that we’ve seen a significant increase in the iron ore spot price.

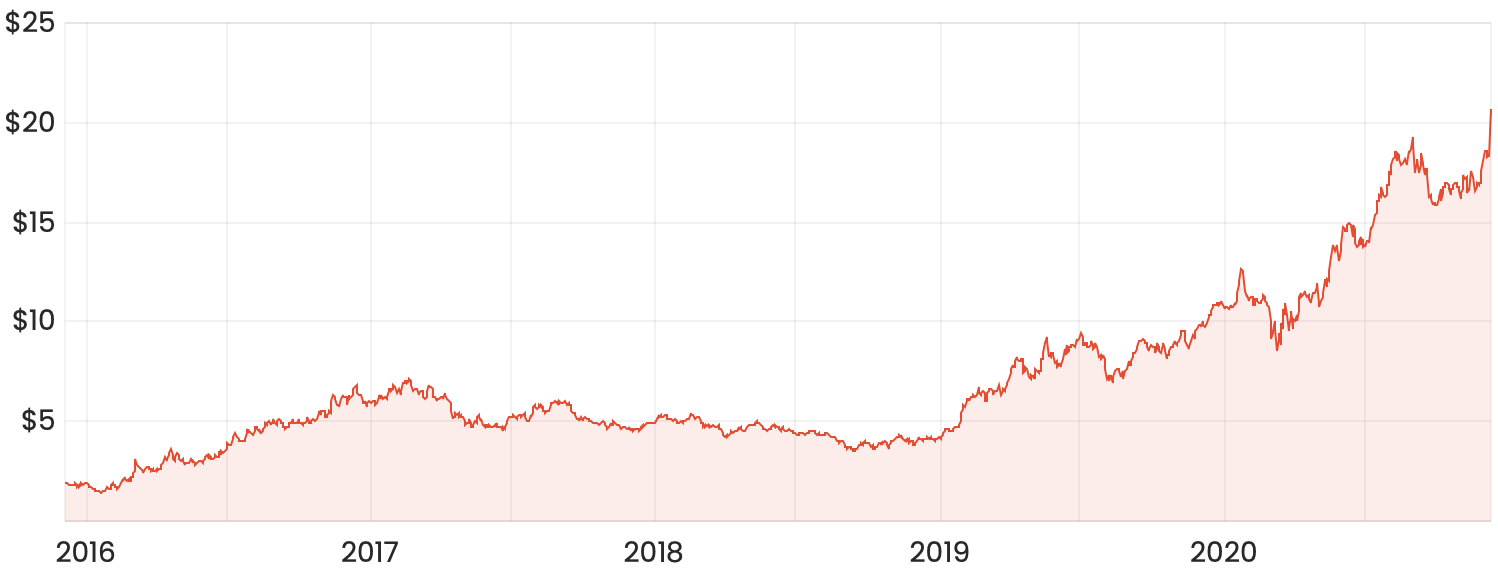

Fortescue is what some analysts describe as a ‘pure-play’ on iron ore, so unsurprisingly, its share price is highly correlated with the spot price for iron ore. As you can see from the 5-year chart below, the Fortescue share price has languished around the $4-5 mark up until 2019, at which point the iron ore price started to rise.

FMG share price chart

Are Fortescue shares a buy today?

Your decision to buy shares in a company like Fortescue would ultimately depend on your own prediction of the underlying commodity price. If the iron ore spot price continues to rise, you could achieve market-beating returns. Quite the opposite will happen if the spot price heads south.

I can only imagine there would be a myriad of factors on both the supply and demand side which ultimately set the price for iron ore. Without extensive research into this, my decision would be a gamble at this point.

I don’t know what direction commodity prices are going, which is why I won’t be buying shares in Fortescue at the moment. I’d rather invest in companies that can outperform in all market conditions.

For more reading, here are 3 ASX shares I believe have secular tailwinds that I’m liking at the moment.