The Kogan.com Ltd (ASX: KGN) share price surged yesterday after the e-commerce retailer announced it had acquired NZ-based online retailer Mighty Ape.

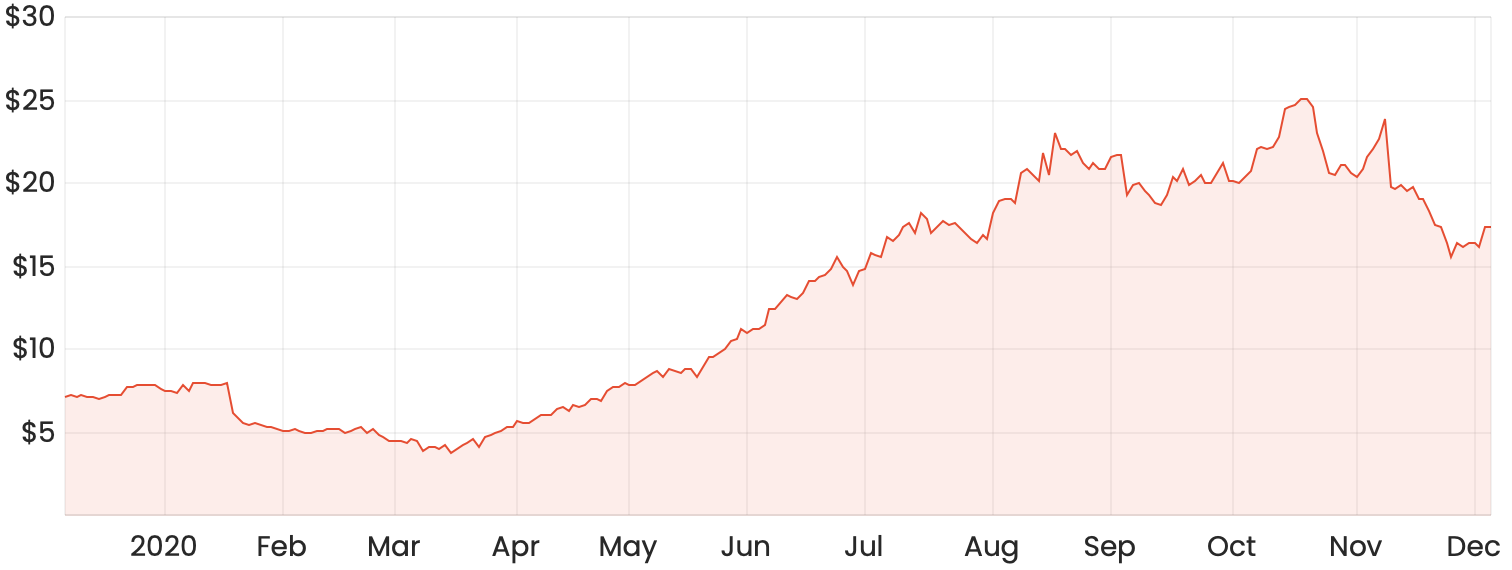

Despite the recent jump, Kogan shares are still languishing at around a 30% discount to where they were a little over a month ago.

The Kogan share price has been hit by a double whammy recently. We’ve seen the rotation into the new recovery beneficiaries while tech and retail have been given a rest. Then there were some corporate governance issues surrounding the remuneration of the founders of the company.

With the Kogan share price looking this beat up, are shares a buy?

KGN share price chart

Acquisition rationale

Mighty Ape is a leading e-commerce retailer in New Zealand with products across electronics, computers, games, books and much more. It’s fairly similar to Kogan, although on a much smaller scale it seems. Mighty Ape is predicted to generate revenue and EBITDA of A$137 million and $14 million, respectively, in FY21.

Kogan has acquired 100% of Mighty Ape’s issued shares for a purchase price of $122.4 million, funded from the company’s cash reserves.

Mighty Ape seems to have experienced that same rapid growth trajectory that Kogan has as a result of COVID-19. Its impressive financial metrics and the potential for cost synergies are the main rationale behind the acquisition.

Are Kogan shares a buy today?

Would I buy shares simply based on this acquisition alone? Probably not, but I can understand the basis for the acquisition and Kogan should see some synergies through combining back-office functions and sourcing for private label products.

Remember that $34 billion worth of superannuation was withdrawn this year, and I dare say some of that ended up on Kogan’s income statement. To support its forward P/E ratio of around 36, there’s a pretty large assumption that Kogan will be able to continue on its current growth trajectory.

For the bull case, I can also see how an attractive private label combined with a growing product range could just be all Kogan needs to achieve these growth rates that its valuation demands.

Personally, I’m holding on Kogan shares for the time being. I’d want to see sales figures well past FY21 to see if there is, in fact, a slow down in sales.

In the meantime, here are 3 ASX shares which I’d happily buy today, not next year!